Oil and gas companies are operating in increasingly dynamic and competitive environments, with growing demands for new ways to add value, reduce costs, improve performance and ultimately increase profitability.

Having to consider closing assets in the high-hazard industries, or a part of assets, due to a company’s competitive position is a reality of the current economy. Operators, proficient at managing and maintaining their assets for production, are entering into the new domain of decommissioning and potentially demolition of their facilities. For many, this is a first-time experience.

A major misconception in regard to demolition and decommissioning is that it is akin to the upfront construction process. This is far from the truth. Before installation, the number of known variables is low, as each critical issue is assessed, reviewed and tested. When it comes to the deconstruction process, however, there are a number of unknown variables, based around the condition of assets and lifespan of the plant. Therefore, a demolition planning process is essential to move from a potentially unknown state to a known state.

There are many factors that can influence demolition outcomes: poor-quality information, low-quality decommissioning, contract type, unrealistic timescales, inadequate funding, and ecological and environmental restrictions.

Demolition, as its name suggests, is a destructive process. There has been a perception in the past that demolition could be undertaken by unskilled workers and, as a result, routinely it would be. Today the industry is much more savvy to the fact that demolition, especially where hazardous substances are concerned, must be carried out by specialist engineers that have the appropriate skills and extensive industry experience.

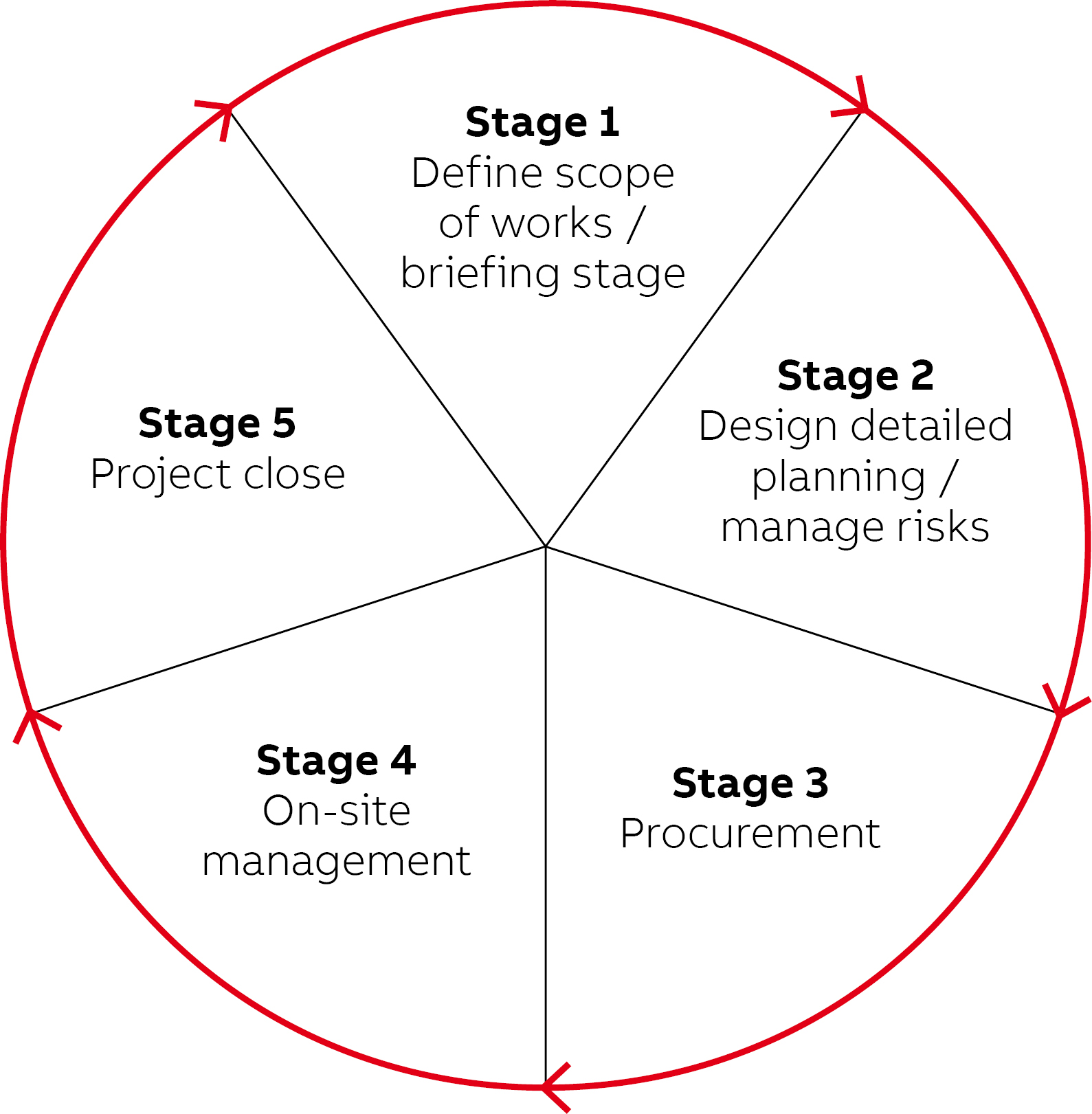

Taking all this into account, it is critical that operators mark upon a robust decommissioning and demolition planning process (Figure 1) before embarking on the physical breakdown of plants, assets and equipment.

It’s all in the planning

When an asset is no longer required, the biggest mistake most operators make is to decommission and isolate still protecting the asset value—by using existing operating procedures. In many cases, this can unnecessarily put people at risk. The demolition process and methodology are very different from that of manufacturing operations aimed at producing highest and most efficient yields. To achieve the highest standards of demolition, manage occupational safety and minimize incident risk, demolition experts should be employed early in the project to help plan, design and manage the process.

Importance of having a demolition mindset

The only way to effectively reduce risk is to combine an operator’s unprecedented knowledge of the process, systems and materials, as well as day-to-day risks and hazards, with an expert demolition team’s strategic know how of how best to isolate individual or multiple plant controls, equipment or assets.

Collaboration and sharing of this essential knowledge from both parties only serve to support effective and efficient decision-making regarding demolition risks, which include dealing with explosive remote detonation; working at heights; managing exposure to vibration, noise, pressure and hazardous materials; and enabling appropriate levels of equipment decontamination. By working together in this early demolition design stage, appropriate approaches can be prepared for every scenario to reduce project risk for everybody involved.

Case studies

Despite more awareness of the importance of planning and adopting a strategic and expert approach to demolition, the industry is still within a step change of understanding and committing to spend a little more on the process to get a better result.

In one case study, a process condenser when originally installed was constructed of titanium with a mild steel outer jacket. During operational issues, this was changed to stainless steel to enable easier cleaning. When it came to decommissioning and demolition, the as-built drawings did not reflect this change, as no one had foreseen the need to update and detail it.

The change to stainless steel was not a good one, as the material could not handle the corrosive nature of the product it was holding. As a result, the old titanium condenser was re-installed with some modifications during operations. Once again, the blueprints were not adapted or even noted. Luckily, this was not an issue during operation, but it quickly became a major one during the demolition.

Many operators look to recoup demolition costs by selling on the material recovered at the end of decommissioning. This case was no different from the company in question looking to sell on its scrap metal. To achieve this, however, the different composite metals needed to be separated. Air tests are generally carried out alongside hot work to separate, for example, titanium from steel.

In this case, what was believed to be steel versus stainless was inaccurate. As a result, a metal fire, which was very hard to extinguish, occurred. The operator acted quickly and with guidance, and as the condenser was in a remote area, it was agreed to bury the condenser under 40 tons of sand and let the fire burn out.

Clearly, this was a serious and potentially deadly incident with high risks had it not been successfully and quickly controlled. The loss of potentially sellable material was estimated at about £50,000, which could have been avoided with careful and insightful planning. Unfortunately, this was not the only, or end of, incidents that occurred during this plant demolition.

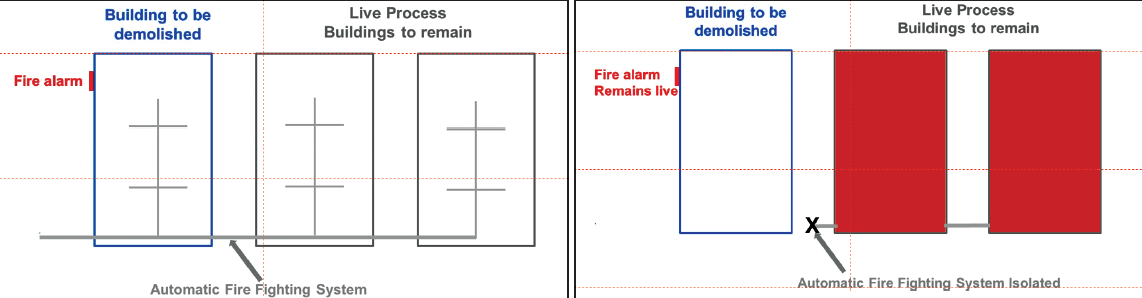

In another case study, the plant to be demolished was one of three facilities, and the other two were to remain live and operational. Despite preparation and receipt of a handover document and work control permits confirming that all of Plant 1’s (i.e., the one to be decommissioned and demolished) equipment had been de-energized, isolated and decontaminated, it came to light after the event that the fire alarm system of the three plants was interconnected (Figure 2). The automatic fire fighting response system was deployed in the two operational plants when the alarm was set off within the plant being decommissioned. In failing to identify this issue upfront, the two neighboring live plants were quickly filled to the brim with firefighting foam. As a result, both plants incurred significant downtime and costly cleanups.

Experience delivers good decisions

These use cases show how the smallest factors can create the biggest issues. It takes expert support to understand and foresee how potential pitfalls can have risky and expensive fallouts. It is not a process easily shortcut, nor should it be.

With so many potential hazards at play, the same level of importance should and must be placed on decommissioning as is for installation to ensure the best possible outcome of reduced hazards, lower risk and, where applicable, little to zero counter effect on any ongoing operations.

Recommended Reading

NOG Closes Utica Shale, Delaware Basin Acquisitions

2024-02-05 - Northern Oil and Gas’ Utica deal marks the entry of the non-op E&P in the shale play while it’s Delaware Basin acquisition extends its footprint in the Permian.

Vital Energy Again Ups Interest in Acquired Permian Assets

2024-02-06 - Vital Energy added even more working interests in Permian Basin assets acquired from Henry Energy LP last year at a purchase price discounted versus recent deals, an analyst said.

California Resources Corp., Aera Energy to Combine in $2.1B Merger

2024-02-07 - The announced combination between California Resources and Aera Energy comes one year after Exxon and Shell closed the sale of Aera to a German asset manager for $4 billion.

DXP Enterprises Buys Water Service Company Kappe Associates

2024-02-06 - DXP Enterprise’s purchase of Kappe, a water and wastewater company, adds scale to DXP’s national water management profile.

Tellurian Exploring Sale of Upstream Haynesville Shale Assets

2024-02-06 - Tellurian, which in November raised doubts about its ability to continue as a going concern, said cash from a divestiture would be used to pay off debt and finance the company’s Driftwood LNG project.