The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

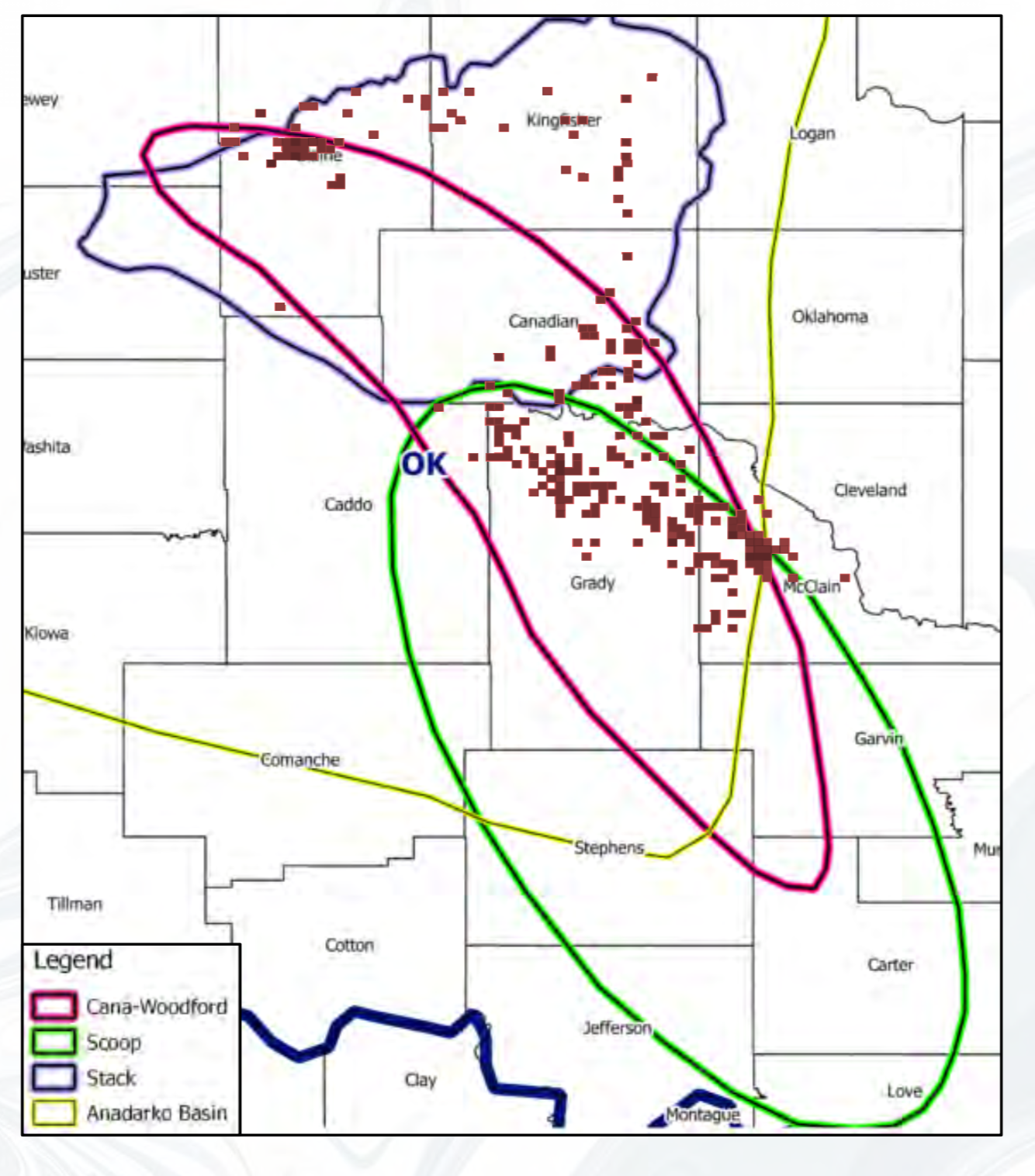

An undisclosed company retained EnergyNet for the sale of a package of assets in Oklahoma's SCOOP and STACK shale plays through a sealed-bid offering closing May 7.

The offering includes overriding royalty interest (ORRI), royalty interest and nonoperated working interest in a 308-well package plus leasehold and minerals in Blaine, Canadian, Grady, Kingfisher and McClain counties, Okla.

The package is listed on the firm's new EnergyNet Indigo platform, which is tailor-made for higher valued assets. The platform features asset deals valued from $20 million to more than $250 million, according to EnergyNet.

Highlights:

- Overview:

- 11,756.28 Net ORRI Acres

- 1,230.39 Net Mineral Acres

- 646.14 Net Leasehold Acres

- Current Average 8/8ths Production: 215.877 MMcf/d of Gas and 27,300 bbl/d of Oil

- Four-Month Average Net Cash Flow: $101,308 per Month

- ORRI in 216 Producing Wells:

- 6.210475% to 0.000026% ORRI

- An Additional Royalty Interest Only in Four Wells

- Select operators include Cimarex Energy Co., Continental Resources Inc., EOG Resources Inc., Marathon Oil Co. and Ovintiv Inc.

- Royalty Interest in 56 Producing Wells:

- 6.255% to 0.001467% Royalty Interest

- Select operators include EOG Resources Inc., Marathon Oil Co. and Ovintiv Inc.

- Nonoperated Working Interest in 26 Producing Wells:

- 12.963242% Working Interest to 0.039169% Working Interest/ 10.476892% to 0.03016% Net Revenue Interest in Horizontal Wells

- An Additional ORRI Only in Seven Wells

- An Additional ORRI and Royalty Interest in One Well

- Select operators include Continental Resources Inc. and Ovintiv Inc.

Bids are due at 4 p.m. CT May 7. For complete due diligence information visit indigo.energynet.com or email Emily McGinley, manager of business development, at Emily.McGinley@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

Oilfield Service Companies Dril-Quip, Innovex to Merge

2024-03-18 - Dril-Quip Inc. and Innovex Downhole Solutions Inc. will emerge as a new company, Innovex International, with expanded reach in global markets.

Talos Energy Sells CCS Business to TotalEnergies

2024-03-18 - TotalEnergies’ acquisition targets Talos Energy’s Bayou Bend project, and the French company plans to sell off the remainder of Talos’ carbon capture and sequestration portfolio in Texas and Louisiana.

EQT, Equitrans to Merge in $5.45B Deal, Continuing Industry Consolidation

2024-03-11 - The deal reunites Equitrans Midstream Corp. with EQT in an all-stock deal that pays a roughly 12% premium for the infrastructure company.

Continental Resources Makes $1B in M&A Moves—But Where?

2024-02-26 - Continental Resources added acreage in Oklahoma’s Anadarko Basin, but precisely where else it bought and sold is a little more complicated.

Permian Activity in ‘Low-to-no-growth’ Mode for First Half

2024-02-22 - After multiple M&A moves in 2023 and continued E&P adherence to capital discipline, Permian Basin service company ProPetro sees the play holding steady.