The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

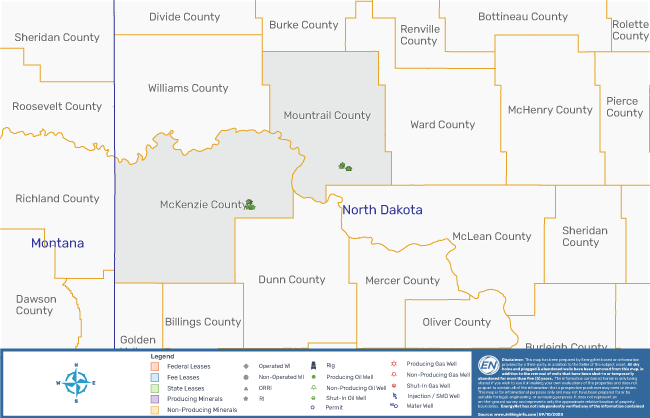

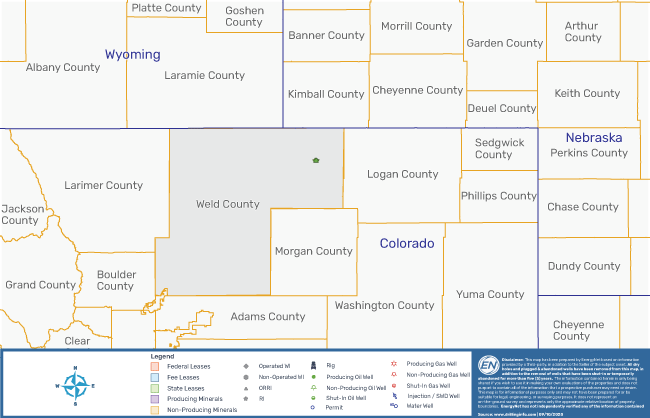

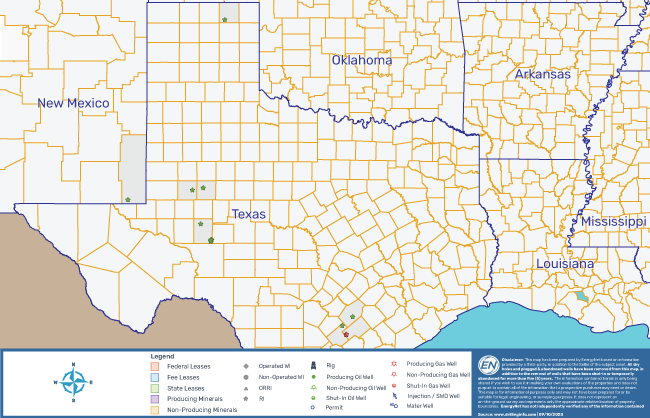

Strategic Pipeline Income Fund retained EnergyNet for the sale of a 143 well package that includes nonoperated working interest, overriding royalty interest (ORRI) and royalty interest in Colorado, New Mexico, North Dakota and Texas.

Highlights:

- Nonoperated Working Interests, ORRI and Royalty Interests in 99 Properties (143 Wells - Six Wells WBO)

- 0.2568% to 0.021204% Working Interest / 0.592703% to 0.015691% Net Revenue Interest

- 0.099834% to 0.033126% ORRI

- 0.634796% to 0.042069% Royalty Interest

- 80 Producing Properties | 15 Non-Producing Properties | Four Confidential

- Six-Month Average 8/8ths Production: 10,402 bbl/d of Oil and 46,154 Mcf/d of Gas

- 11-Month Average Net Income: $18,872 per Month

- Select Operators include ConocoPhillips Co., Devon Energy Corp., EOG Resources Inc., Sable Permian Resources LLC and Whiting Petroleum Corp.

- Weld County properties in Colorado are further subject to Documentary Stamp fees

Bids are due by 1:40 p.m. CST Feb. 10. For complete due diligence information on either package visit energynet.com or email Zachary Muroff, vice president of business development, at Zachary.Muroff@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

Solar Sector Awaits Feds’ Next Move on Tariffs

2024-04-25 - A group of solar manufacturers want the U.S. to impose tariffs to ensure panels and modules imported from four Southeast Asian countries are priced at fair market value.

Solar Panel Tariff, AD/CVD Speculation No Concern for NextEra

2024-04-24 - NextEra Energy CEO John Ketchum addressed speculation regarding solar panel tariffs and antidumping and countervailing duties on its latest earnings call.

NextEra Energy Dials Up Solar as Power Demand Grows

2024-04-23 - NextEra’s renewable energy arm added about 2,765 megawatts to its backlog in first-quarter 2024, marking its second-best quarter for renewables — and the best for solar and storage origination.

BCCK, Vision RNG Enter Clean Energy Partnership

2024-04-23 - BCCK will deliver two of its NiTech Single Tower Nitrogen Rejection Units (NRU) and amine systems to Vision RNG’s landfill gas processing sites in Seneca and Perry counties, Ohio.

Clean Energy Begins Operations at South Dakota RNG Facility

2024-04-23 - Clean Energy Fuels’ $26 million South Dakota RNG facility will supply fuel to commercial users such as UPS and Amazon.