Latest From Hart Energy

Highlights, Field Development, Discoveries, Deepwater, Acquisitions & Divestitures, Drilling, Subsea

E&P Highlights: May 20, 2024

Here’s a roundup of the latest E&P headlines, including development of the Belinda Field in the North Sea to new contract awards and service company acquisitions.

Under Siege: Industry Cuts Emissions Despite Biden's ‘Attack’ on E&Ps

IPAA Chairman and Elevation Resources CEO Steve Pruett shared insight on industry’s concerns over regulations carried out by an “alphabet soup” of agencies from the Environmental Protection Agency to the Federal Trade Commission.

Saltchuk Resources to Acquire OSG for $950MM

Following the transaction’s close, Overseas Shipholding Group Inc. will operate as a standalone business unit within Saltchuk.

Matador CEO: Portfolio ‘Rationalization’ to Yield Permian M&A Opportunities

Joe Foran built the Matador Resources brand from friends-and-family financing into an $8 billion company. Foran, Matador’s chairman and CEO, still sees a long runway for growth in the Delaware Basin.

APA Corp. Sells $700MM in Non-core Permian, Eagle Ford Assets

APA Corp. and subsidiary Apache are selling more than $700 million in non-core assets in the Permian Basin and Eagle Ford Shale—part of a plan to reduce debt after a $4.5 billion acquisition of Callon Petroleum.

Permian Recycling Facility Passes 50 MMbbl of Water Recycling

Occidental Petroleum and Select Water Solutions have collaborated on water treatment and recycling at the site since 2021.

ADNOC Buys 11.7% Stake in NextDecade’s Rio Grande LNG Project

The United Arab Emirates’ ADNOC will acquire a 11.7% equity stake in Phase 1 of NextDecade Corp.’s Rio Grande LNG (RGLNG) project from Global Infrastructure Partners (GIP), while also entering an offtake agreement for 1.9 mtpa from the Texas export facility.

What's Affecting Oil Prices This Week? (May 20, 2024)

U.S. economic activity, geopolitical uncertainty in the Middle East and the U.S.' recent hike in Chinese EV import duties all have a hand in the sway of oil prices this week.

Akin Energy Practice Adds Midstream Specialist as Partner

Trent Bridges, who served as vice president and assistant general counsel for Magellan Midstream Partners, has represented clients in a range of energy transactions, infrastructure development projects and investments, with a particular emphasis on the midstream industry.

Key Energy Buys Endeavors’ Well Servicing Business

Key Energy Services’ deal comes as Endeavor Energy Resources is selling its upstream assets to Diamondback Energy.

AI Highs: Corva Predictive Drilling Powers Oilfield Efficiency

The energy sector is buzzing with talk of artificial intelligence, and Corva is capitalizing on its ability to synthesize complex data to optimize drilling operations with predictive drilling software.

Iberdrola Scoops Up Rest of US Renewables Firm Avangrid in $2.6B Deal

Iberdrola said its acquisition of the remaining stake in Avangrid Inc. is intended to increase its exposure in the U.S.

Bakshani: Midstream Exhibiting M&A Fever Symptoms

East Daley Analytics identified several market factors in the midstream sector that point to further consolidation ahead.

Seatrium Awarded Contract for FPSO Bound for Guyana’s Stabroek

The topsides fabrication and integration contract will be for the FPSO Jaguar, bound for the Whiptail Field in the Stabroek block offshore Guyana for Exxon Mobil.

Seadrill Sells Three Jackups for $338MM to Gulf Drilling International

Seadrill Ltd. is also selling its 50% equity interest in the joint venture that operates the rigs offshore Qatar.

Third Suriname Find for Petronas, Exxon Could Support 100,000 bbl/d FPSO

A recent find offshore Suriname in Block 52 by Petronas and Exxon Mobil could support a 100,000 bbl/d FPSO development, according to Wood Mackenzie.

Adkins: Attacks on Fossil Fuels, Overregulation Poised to Backfire

Raymond James’ J. Marshall Adkins tells Hart Energy’s SUPER DUG conference attendees demonizing oil and gas, strenuous regulations and continued inflation are bound to have unexpected consequences for E&P opponents.

US NatGas Flows to Freeport LNG in Texas Seen at Five-month High, LSEG Data Shows

The startup and shutdown of Freeport and other U.S. LNG export plants often has a major impact on global gas prices.

US Drillers Add Oil, Gas Rigs for First Time in Four Weeks: Baker Hughes

The oil and gas rig count rose by one to 604 in the week to May 17.

Energy Transition in Motion (Week of May 17, 2024)

Here is a look at some of this week’s renewable energy news, including more moves by the U.S. to strengthen and protect the U.S. solar panel manufacturing sector from China.

CGG to Change Name to Viridien

The company’s new ticker symbol will be “VIRI” and listed on Euronext Paris, effective May 21.

Apache CEO: Longer Laterals Expected as Permian Enters New Era

With more than a decade of development in the Midland and Delaware basins, there are more limitations that operators will have to work around, said Apache Corp. CEO John Christmann at Hart Energy's SUPER DUG Conference & Expo.

Sector’s Appetite for Capital Remains Amid Consolidation Frenzy, Panelists Say

There’s still an appetite for capital in the oil and gas sector—companies just need to think creatively to find it, a number of panelists said during SUPER DUG in Fort Worth, Texas.

Could Crescent, SilverBow Buy More in South Texas After $2.1B Deal?

The combination of Crescent Energy and SilverBow Resources will yield one of the Eagle Ford’s top producers—and the pro forma E&P could look to gobble up more acreage in South Texas after closing.

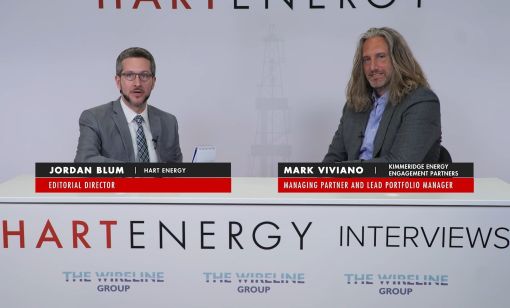

Kimmeridge’s Mark Viviano on Reshaping the Energy Sector, SilverBow-Crescent Deal

Kimmeridge Energy Engagement Partners’ Mark Viviano says the company is evaluating the Crescent Energy and SilverBow Acquisition and how Kimmeridge played a key role in transforming the shale sector in this Hart Energy Exclusive interview.

Oil, Gas Groups Sue BLM to Block Increased Federal Drilling Fees

Under new U.S. Bureau of Land Management rules, royalty rates will jump to 16.67% from 12.5% and minimum lease bonds will increase to $150,000 from $10,000, which industry groups say will deter future oil and gas development.

SilverBow Resets Shareholder Meeting After $2.1B Crescent Deal

SilverBow Resources said it will adjourn its May 21 shareholders’ meeting until May 29 following Crescent Energy’s agreement to buy the Eagle Ford operator.

SUPER DUG: Shale 4.0 Era about Building Scale- Rystad

The Shale 3.0 era or capital discipline era will be followed by the Shale 4.0 era, which will see companies focused on building scale, according to Rystad Energy Senior Shale Analyst Matthew Bernstein.

IndustryVoice: Hydrogen Blending in Natural Gas Pipelines - Meter Compatibility, Challenges, and Industry Solution

Companies around the world are using hydrogen blended with natural gas to reduce the amount of carbon output or the greenhouse gas emissions that come from the combustion of hydrogen. The question this brings is: Can the current flow meters handle this without the need to redo the whole pipelines’ infrastructure and their measurement stations?

BPX Looks to Ramp US Production Over 60% by 2030

BPX Energy is looking to boost its U.S. production over 60% by 2030 as it considers bringing online a fourth processing facility in the Permian by mid-year 2025, Clark Edwards, the company’s vice president of development, said during SUPER DUG in Fort Worth.