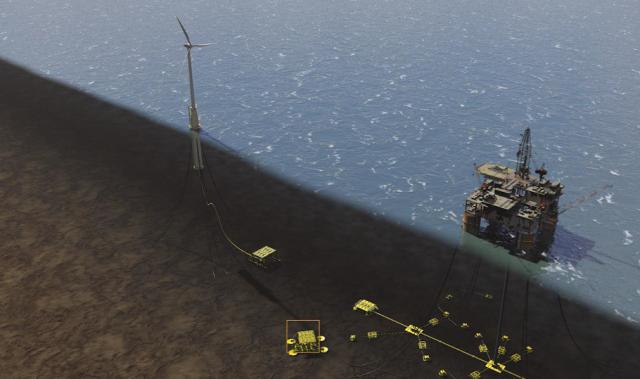

DNV GL is testing the use of floating wind turbines to power injection pumps, water treatment systems and related control and safety systems. (Source: DNV GL)

When wind energy and oil production team up offshore, a lower cost power source for subsea pumps could result.

At least that is what researchers working with a group of energy companies led by DNV GL hope to prove.

The joint industry project (JIP) called “Win Win” is testing the use of floating wind turbines to power injection pumps, water treatment systems and related control and safety systems. The process would be used to inject water into an oil or gas reservoir to increase pressure, improving the flow of hydrocarbons.

The concept is gaining interest nowadays as unfavorable market conditions push operators to spend less money and regulatory scrutiny moves emission reductions efforts higher on some agendas.

“Initial estimates done by DNV GL prior to project start-up suggest that the concept has the potential to be cost-competitive with conventional solutions for certain cases, typically marginal developments with long step-out distance from the host, or where water injection capacity is limited on the existing asset,” Johan Sandberg, segment leader for floating wind turbines at DNV GL and the project sponsor, told Hart Energy in a statement.

Traditionally, a subsea cable is connected to a host platform where the power is generated for the subsea injection pump. Instead, wind turbines can be placed closer to the manifold to provide power.

“The reduced costs of this solution are enabled by the shorter subsea power cable, the elimination of incremental power generation on the host platform and, in the case of Norway, reduced taxes related to the incremental emissions of natural-gas turbine power generation for the subsea injection pump,” DNV GL said.

Initial results appear promising, the Norway-based risk management company said without disclosing details.

“The project focuses on utilizing existing technology to the extent possible. The innovation lies primarily in a new combination of existing technologies,” Sandberg said.

Technical focus areas could hold challenges:

- Reservoir and equipment response to the fluctuating injection rates;

- Operation of a wind-turbine system without connection to the grid or other back-up power sources; and

- Operations and maintenance strategy for the system.

“Once the technical hurdles are cleared, the concept’s economic viability will be analyzed using relevant and realistic cases provided by the JIP partners,” Sandberg said in a separate statement. “With the operators on board we are able to test the concept on real cases.”

DNV GL has been working with ExxonMobil (NYSE: XOM), ENI Norge, Nexen Petroleum UK Ltd, Statoil (NYSE: STO), VNG, PG Flow Solutions and ORE Catapult on the JIP, which started at the beginning of 2015.

“We are very satisfied that DNV GL has taken the initiative to form a JIP, and brought on board several of our peers from the oil and gas industry,” said Hanne Wigum, manager for Statoil’s renewables research group. But “the overall concept needs maturing up to a point where it can be considered a viable option in field development studies.”

Cian Conroy, offshore wind sector lead for ORE Catapult, a JIP participant, added: “Recent advancements and trialing of offshore floating wind prototypes, backed by strong research, suggest there is scope for cost effective floating wind power sooner than many people may have previously thought. This project will help to further accelerate the development and commercialization of floating wind turbines as a viable technology.”

Currently, the project is a “desktop study,” DNV GL said. Project participants are developing the technical concept and assessing feasibility, including economics, in detail. Results from the assessment are scheduled to be published by the end of first-quarter 2016, Sandberg said.

“In parallel with finalizing the initial technical and economic assessment of the concept, we are now thinking about the next steps, both looking for other relevant applications of the system and making sure the Win Win concept moves from the drawing board to a prototype and actual realization in a project,” he said.

And, technically, there is no reason why the concept could not be tailored for onshore use, he added.

If deemed viable, the concept could in principle be available in the market within a few years because it utilizes existing technologies, according to Sandberg.

“But a successful demonstration project as well as industrial and political commitment would be required for realization and a broader penetration in the market,” he said.

Contact the author, Velda Addison, at vaddison@hartenergy.com.

Recommended Reading

Sangomar FPSO Arrives Offshore Senegal

2024-02-13 - Woodside’s Sangomar Field on track to start production in mid-2024.

Deepwater Roundup 2024: Offshore Africa

2024-04-02 - Offshore Africa, new projects are progressing, with a number of high-reserve offshore developments being planned in countries not typically known for deepwater activity, such as Phase 2 of the Baleine project on the Ivory Coast.

E&P Highlights: April 1, 2024

2024-04-01 - Here’s a roundup of the latest E&P headlines, including new contract awards.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

The OGInterview: How do Woodside's Growth Projects Fit into its Portfolio?

2024-04-01 - Woodside Energy CEO Meg O'Neill discusses the company's current growth projects across the globe and the impact they will have on the company's future with Hart Energy's Pietro Pitts.