The price of Brent crude ended the week at $92.20 after closing the previous week at $93.27 and the price of WTI ended the week at $90.79 after closing the previous week at $90.03. (Source: Shutterstock)

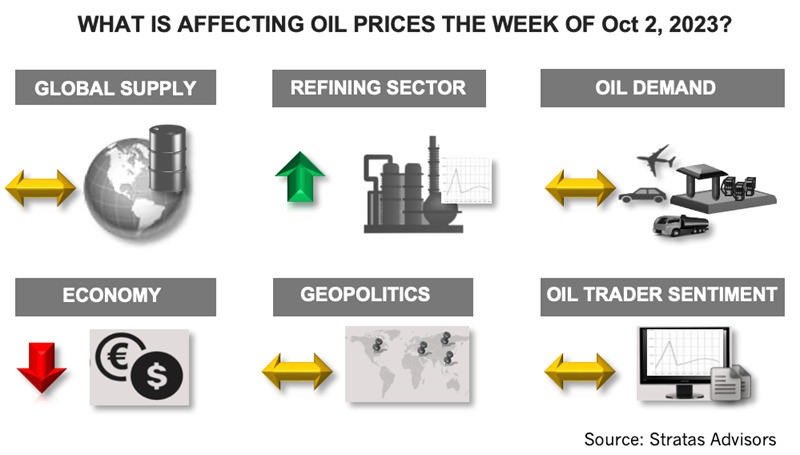

The price of Brent crude ended the week at $92.20 after closing the previous week at $93.27. The price of WTI ended the week at $90.79 after closing the previous week at $90.03. The price of DME Oman ended the week at $92.29 after closing the previous week at $94.08. The price movement aligned with our expectations that oil prices would be under pressure and that the price of Brent could test $90 again.

During the upcoming week the Joint Ministerial Monitoring Committee of OPEC+ is scheduled to meet on Oct. 4. We are expecting that no change will be announced with respect to the current production cuts. During the first week of September, Saudi Arabia and Russia agreed to keep their supply cuts through the end of the year, which combined are around 1.30 MMbbl/d. However, that is more positive news about oil producers outside of the OPEC+ agreement.

Venezuela has the goal of increasing its production to at least 1.0 MMbbl/d, which compares to average production of around 800,000 bbl/d in 2023. Chevron is planning to add 65,000 bbl/d of production by the end of 2024 (and total production to 200,000 bbl/d) with a new drilling program.

Iran’s oil production increased to 3.15 MMbbl/d in August, which is the highest level since 2018, when additional sanctions were imposed on Iran by the U.S. Prior to the sanctions, Iran’s oil production was 3.8 MMbbl/d, so Iran has further upside potential and Iran’s oil minister has stated that Iran’s oil production reached 3.4 MMbbl/d in September. So far, in 2023, Iran’s total crude oil exports are more than twice the level of 2022 when exports were around 800,000 bbl/d. Nigeria’s crude oil production reached nearly 1.20 MMbbl/d in August, which is an increase of around 92,000 bbl/d in comparison with July. Brazil’s oil production has exceeded 3.50 MMbbl/d, which is an increase of around 550,000 bbl/d in comparison to production last year. U.S. production is around 900,000 bbl/d higher than one year ago, and about 500,000 bbl/d higher than in 2019. With respect to the robustness of oil demand and the global economy, the economies of the U.S. and Europe continue to show signs of being on the edge.

The latest data released by the U.S. Bureau of Economic Analysis indicate that the core (excludes food and energy costs) Personal Consumption Expenditures (PCE) index decreased in August to 3.9% from 4.3% in July, which is the first reading below 4.0% since September 2021. The headline PCE (includes food and energy) increased 0.4% in August and on an annual basis increased 3.5%. Consumer spending increased by only 0.4% after increasing by 0.9% in July. Other signs of consumer weakness, include the following:

Consumer spending is shifting towards essentials – housing, utilities, transportation and medical-related expenses. The personal savings rate decreased to 3.9%, which is the lowest level in a year. Real disposable income has decreased for three consecutive months. Wage growth decreased to 4.6%, which is the lowest since May of this year.

Similar to the U.S., Europe’s latest inflation readings are decreasing with consumer prices increasing by 4.3% in September, which is the lowest rate since October of 2021. Core inflation decreased to 4.5% in comparison to 5.3% in August. The favorable news about inflation is offset by signs that Germany’s economy is moving towards negative growth with increasing unemployment coupled with deteriorating business sentiment about the current and future situation. The sentiment in all business sectors (manufacturing, services, trade and construction) is moving downwards.

In contrast to the slowdown in Germany, China’s economy is showing some strengthening, with the latest official readings from the Purchasing Managers Indexes (PMIs) increasing. The manufacturing PMI increased to 50.2 in September from 49.7% in August, non-manufacturing PMI increased to 52.0 from 51.3 and the composite PMI increased to 52.0 from 51.3. The data from the “Golden Week” which lasts through Oct. 6 will provide insights about the current strength and sentiment of the Chinese consumers.

For the upcoming week, we are expecting that oil prices will have a downward bias, in part because of concerns about economic growth and oil demand, which is not helped by the strength of the U.S. dollar, with the U.S. Dollar Index ending last week at 106.17, in comparison to 99.91 in early July of this year.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Santos’ Pikka Phase 1 in Alaska to Deliver First Oil by 2026

2024-04-18 - Australia's Santos expects first oil to flow from the 80,000 bbl/d Pikka Phase 1 project in Alaska by 2026, diversifying Santos' portfolio and reducing geographic concentration risk.

SilverBow Makes Horseshoe Lateral in Austin Chalk

2024-05-01 - SilverBow Resources’ 8,900-foot lateral was drilled in Live Oak County at the intersection of South Texas’ oil and condensate phases. It's a first in the Chalk.

New Permian Math: Vital Energy and 42 Horseshoe Wells

2024-05-10 - Vital Energy anticipates making 42 double-long, horseshoe-shaped wells where straight lines would have made 84 wells. The estimated savings: $140 million.

Exclusive: Carbo Sees Strong Future Amid Changing Energy Landscape

2024-03-15 - As Carbo Ceramics celebrates its 45th anniversary as a solutions provider, Senior Vice President Max Nikolaev details the company's five year plan and how it is handling the changing energy landscape in this Hart Energy Exclusive.

The OGInterview: How do Woodside's Growth Projects Fit into its Portfolio?

2024-04-01 - Woodside Energy CEO Meg O'Neill discusses the company's current growth projects across the globe and the impact they will have on the company's future with Hart Energy's Pietro Pitts.