The price of Brent crude ended the week at $82.78 after closing the previous week at $85.83. (Source: Shutterstock)

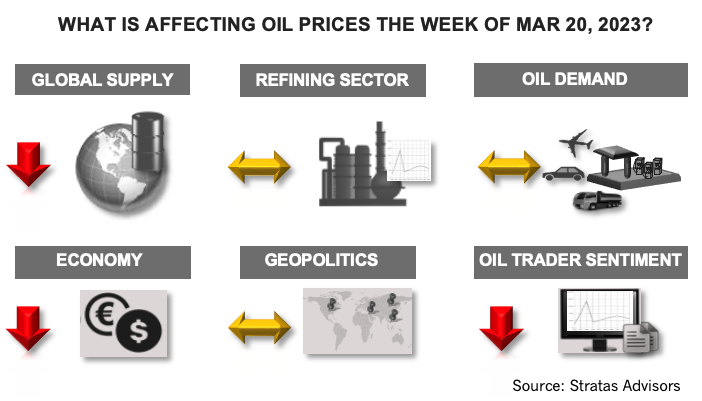

The price of Brent crude ended the week at $72.97 after closing the previous week at $82.78. The price of WTI ended the week at $66.74 after closing the previous week at $76.68. The significant decline in crude prices was the reaction to the collapse of Silicon Valley Bank (SVB) and the concerns about the stability of the financial sector.

Last week, we reiterated one of our long-held concerns pertaining to the Federal Reserve being too aggressive in shifting to a tightening monetary policy and subsequently pushing the economy into a recession either through demand destruction or through a breakdown somewhere within the financial sector, which would then undermine the real economy. This concern stems from our view that the Federal Reserve has limited ability to address the root causes of the current inflation, which is not being driven by wage growth, but more so from supply-side factors. The recent collapse of the Silicon Valley Bank (SVB) is indirectly related to aggressive rate increases that have been implemented by the Federal Reserve. The bank was caught holding a portfolio of long-term Treasury bonds, which diminished in value because of the rate increases, at the same time the rate increases were negatively impacting the bank’s client base. While the Federal Reserve, the U.S. Treasury and the FDIC came up with a solution to protect the funds of the depositors and to keep the bank operating, the concerns about the financial sector are spreading. Over the weekend Credit Suisse had to be taken over by UBS with Credit Suisse facing significant withdrawals by depositors.

The Federal Reserve (and to a less extend the ECB) has gotten into a jam by raising interest rates very quickly in an attempt to squelch inflation after running with accommodating monetary policies for an extended period of time. Now the Federal Reserve is facing a dilemma:

- Increase rates so as to remain consistent with stated views that higher interest rates are the solution to inflation and placing further stress on the financial sector (including the smaller, regional banks, which provide a material amount of lending to businesses, commercial and residential real estate and consumers), which will ultimately affect the overall U.S. economy along with putting further pressure on emerging markets.

- Changing course and pausing the rate increases and risking the loss of credibility, which will result in heightened concerns about the U.S. inflation outlook and the resulting impact on the overall U.S. economy. We were expecting that the Federal Reserve at its next meeting scheduled for March 21-22 will raise rates by 0.25% in an attempt to take the middle ground and give something to the inflation hawks, as well as those worried about the stability of the financial sector and the U.S. economy slipping into a recession.

Additionally, we are expecting that OPEC+ will monitor the banking issues in the west along with China’s economy now that it has moved away from its zero-COVID policies and the impact on oil demand before making any changes to their supply strategy. However, we also expect OPEC+ will make additional cuts, when warranted, to support oil prices.

Given the remaining concerns about the financial sector and the overall economy, we are expecting that oil prices will be under further pressure this week, but the price of Brent has support around $70.00 and the price of WTI has support around $65.00. As such, we think it will take some other unexpected bad news to break below these levels.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

NOG Closes Utica Shale, Delaware Basin Acquisitions

2024-02-05 - Northern Oil and Gas’ Utica deal marks the entry of the non-op E&P in the shale play while it’s Delaware Basin acquisition extends its footprint in the Permian.

Vital Energy Again Ups Interest in Acquired Permian Assets

2024-02-06 - Vital Energy added even more working interests in Permian Basin assets acquired from Henry Energy LP last year at a purchase price discounted versus recent deals, an analyst said.

California Resources Corp., Aera Energy to Combine in $2.1B Merger

2024-02-07 - The announced combination between California Resources and Aera Energy comes one year after Exxon and Shell closed the sale of Aera to a German asset manager for $4 billion.

DXP Enterprises Buys Water Service Company Kappe Associates

2024-02-06 - DXP Enterprise’s purchase of Kappe, a water and wastewater company, adds scale to DXP’s national water management profile.

Tellurian Exploring Sale of Upstream Haynesville Shale Assets

2024-02-06 - Tellurian, which in November raised doubts about its ability to continue as a going concern, said cash from a divestiture would be used to pay off debt and finance the company’s Driftwood LNG project.