Oil prices recovered in the second half of the week after dropping sharply on March 31. (Source: Shutterstock)

The price of Brent crude ended the week at $76.40 after closing the previous week at $76.98. The price of WTI ended the week at $71.87 after closing the previous week at $72.67. Oil prices recovered in the second half of the week after dropping sharply on March 31 (the price of Brent crude fell to $72.60 and the price of WTI fell to $68.04).

The resolution of the debt limit eliminated one source of uncertainty about the economy. Further support was provided on June 2 by the jobs report for May, which indicated that the U.S. added 339,000 jobs according to the payroll survey.

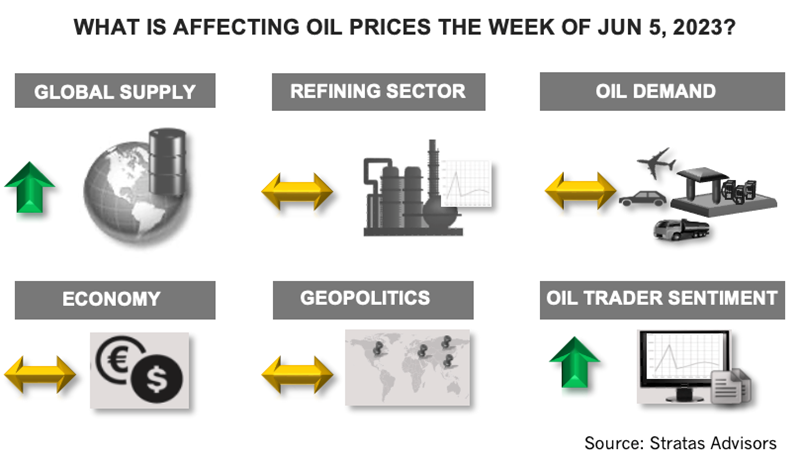

On June 4, OPEC+ announced its members agreed to extend the production cuts until the end of the year. Additionally, Saudi Arabia will reduce production by another 1.0 MMbbl/d in July. The move will provide some upward support for oil prices, in part, because traders will move to cover some of their short positions. The net long positions of traders of WTI decreased last week for the fourth consecutive week with a significant increase in short positions. Since mid-April, net long positions have been cut in half and now are approaching the level of the previous time that OPEC+ announced supply cuts.

It has been our view that supply will be supportive of crude prices, with OPEC+ being in position to reduce supply, if needed, to align with demand, given that OPEC+ does not need to worry about losing market share in the current environment. Last week, the number of operating oil rigs in the U.S. decreased by 15 and now stands at 555 rigs, which compares to the pre-COVID level of 683 that occurred during the week of March 13, 2020 (and 574 at the same period in 2022). It is worth noting, however, that the level of inventories in the Strategic Petroleum Reserve (SPR) decreased by 2.52 million. Last week’s drawdown was the ninth consecutive week of drawdown, and we are expecting the weekly draws will last for another 11 weeks.

The major uncertainty continues to reside on the demand side of the equation because of concerns about overall economic growth. However, not all the economic signs are bad.

Despite the strong jobs report, many economists are expecting the U.S. to fall into a recession during the second half of this year. So far, however, the U.S. economy continues to show signs of economic growth. Real GDP growth has been estimated to be 1.1% in the first quarter and was 2.6% in fourth quarter 2023. The “nowcast” from the Atlanta Fed is indicating a growth rate of 2.0% for 2Q of this year. U.S. oil demand, while still less than in 2019, is running above last year’s demand. Based on the 4-week average, current gasoline demand is greater than last year’s demand by 310,000 bbl/d. Diesel demand has been about the same as demand of the previous year for the last four weeks. Jet fuel demand is running ahead of last year’s demand for the last four weeks by 47,000 bbl/d.

China’s economy continues to struggle since the lifting of COVID-related restrictions. The official manufacturing purchasing managers’ index (PMI) decreased to 48.8 from 49.2 and is now at a five-month low (readings below 50 indicate contraction). The PMI for the service sector also decreased in comparison to April (54.5 to 56.4). The Chinese economy is being hampered by weak domestic demand and weak demand from its export markets. While growth has been sputtering, China has the benefit of not having to deal with an inflation issue, which allows China to employ a more accommodating monetary policy in the future.

The weakness in the EU economy was highlighted last week by Germany’s GDP decreasing by 0.3% during the first quarter of this year after decreasing by 0.5% in the fourth quarter of 2022. Germany’s economy continues to be hampered by elevated inflation and high energy prices. One good piece of news for the EU is that the inflation rate has slowed to the lowest rate since February 2022. In May, the inflation rate for the Eurozone was 6.1%, which compares to 7.0% in April. Additionally, core inflation (excluding food and energy) decreased to 5.3%, which is a four-month low.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

US Expected to Supply 30% of LNG Demand by 2030

2024-02-23 - Shell expects the U.S. to meet around 30% of total global LNG demand by 2030, although reliance on four key basins could create midstream constraints, the energy giant revealed in its “Shell LNG Outlook 2024.”

Silver Linings in Biden’s LNG Policy

2024-03-12 - In the near term, the pause on new non-FTA approvals could lift some pressure of an already strained supply chain, lower both equipment and labor expenses and ease some cost inflation.

Permian Gas Finds Another Way to Asia

2024-04-30 - A crop of Mexican LNG facilities in development will connect U.S. producers to high-demand markets while avoiding the Panama Canal.

CERAWeek: LNG to Play Critical Role in Shell's Future, CEO Says

2024-03-19 - Sawan said LNG will continue to play a critical role adding that LNG currently makes up around 13% of gas sales but was expected to grow to around 20% in the coming 15 to 20 years.

Antero Poised to Benefit from Second Wave of LNG

2024-02-20 - Despite the U.S. Department of Energy’s recent pause on LNG export permits, Antero foresees LNG market growth for the rest of the decade—and plans to deliver.