(Source: Yalcin Sonat / Shutterstock.com)

The price of Brent crude ended the week at $86.66 after closing the previous week at $87.63. The price of WTI ended the week at $79.68 after closing the previous week at $81.64.

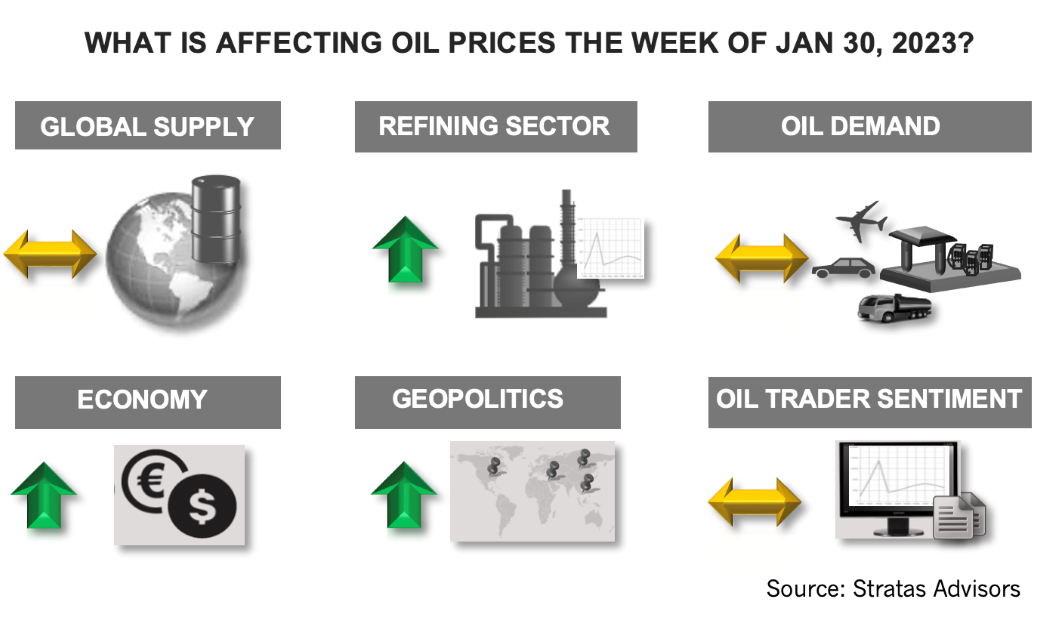

We are expecting that, for the most part, the price of Brent crude will remain in a channel between $80 and $90, given that supply/demand will be relatively balanced. The concerns about the global economy and the major economies will establish a ceiling on oil prices, while OPEC+ will place a floor under prices. The Joint Ministerial Monitoring Committee of OPEC+ is scheduled to meet on Feb. 1. We do not expect any changes in OPEC+ policy from this meeting, given the current supply/demand situation and price levels. Furthermore, this is not a full OPEC+ meeting (the next such meeting not scheduled until June).

Additionally, geopolitics will affect the oil market. The next milestone will be the imposition of the sanctions on Russian exports of oil products, which are scheduled to take effect on Feb. 5. The biggest concern associated with the sanctions pertains to the diesel market, given that Europe is dependent on imports of diesel fuel, including significant imports from Russia.

Additionally, the diesel demand has remained relatively robust, even during much of the COVID-19 pandemic. Coupled with the diesel demand, the supply of diesel was reduced because of refining rationalization, including closures in the U.S. and the reduction of diesel exports from China. The result was a significant drawdown in diesel inventories. The dynamic, however, started changing at the end of 2022 with China’s exports ramping up in the November and December (more than doubling the exports of October), in part from the increased utilization associated with China’s independent refineries along with China increasing the export quotas at the beginning of the 4Q. The export quotas were increased again at the beginning of 2023.

During the same period, Europe has been rebuilding its diesel inventories with increased imports, including at Amsterdam-Rotterdam-Antwerp region where diesel/gasoil inventories have reach16.5 MMbbl, which is the highest level since the first half of 2021. The increase stems from imports from other destinations but also because imports from Russia have remained substantial.

We do not expect any major disruptions to the oil product market because of the sanctions, given the rigorousness and flexibility of the global supply chain associated with crude oil and oil products. This view is reinforced by the path of the Russian oil exports within context of the G7 price cap that was imposed on Dec. 5. During December, Russia’s crude exports only decreased by 200,000 bbl/d and still averaged 7.8 MMbbl/d.

There remains, however, the risk of the Russia – Ukraine conflict escalating and expanding beyond the borders of Ukraine. The longer the conflict goes on the greater the risk and the greater the range of outcomes and implications.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

US Using More, Storing Less NatGas in Summer 2024—EIA

2024-07-24 - Gas storage levels remain high, thanks to record production levels in 2023 and a warmer-than-typical winter.

NatGas Purgatory: US Gas Spot Prices Hit Record Lows in 1H24—EIA

2024-07-22 - Facing record-low commodity prices, U.S. dry gas producers have curtailed production and deferred new completions in the first half of 2024.

NatGas Inventories Hold Back Price Despite Summer’s Demand Boost

2024-06-21 - The U.S. Energy Information Administration’s storage report shows storage levels drifting back down to normal.

Segrist: Gassed Up, Waiting to Go: Producers Aim to Remedy Gas Prices

2024-07-31 - The countdown clock for a surge in natural gas demand is ticking. Is the U.S. finally at the turning point?

EIA NatGas Storage Report Comes in at 10 Bcf Above Forecast

2024-08-22 - Most of the additional gas in storage came from the Appalachian Basin. The Midwest added 19 Bcf and the East added 12 Bcf, according to the EIA.