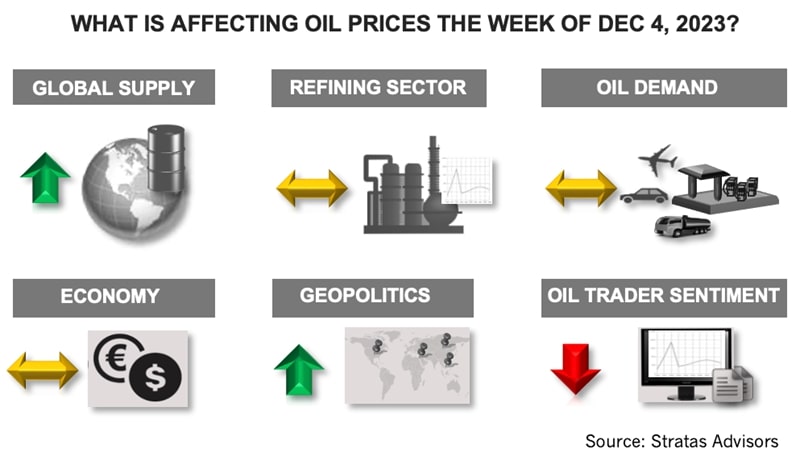

The price of Brent crude ended the week at $79.56 after closing the previous week at $80.658. The price of WTI ended the week at $74.38 after closing the previous week at $75.54. The price of DME Oman ended the week at $79.21 after closing the previous week at $81.98.

Similar to the prior week, oil prices moved upwards in the first part of the week with the price of Brent crude reaching $84.30 and the price of WTI reaching $77.86. Prices then fell back, in part, because of another week of inventory builds in the U.S.

- The EIA report indicated that U.S. crude inventories increased by 1.60 MMbbl. Crude inventories are higher than last year previous year (450 MMbbl vs. 419 MMbbl) and are approaching the level of 2019 (452 MMbbl); and

- Product inventories also increased with gasoline inventories increasing by 76 MMbbl and diesel inventories increasing by 5.22 MMbbl.

Members of OPEC+ finally held their meeting originally scheduled for Nov. 26 on Nov. 30. At the meeting OPEC+ agreed to reduce its oil production by another 700,000 bbl/d – which will come from Iraq, UAE, Kuwait, Kazakhstan, Algeria and Oman. Additionally, Saudi Arabia agreed to extend its voluntary cut of 1.0 MMbbl/d and Russia agreed to reduce its exports of refined products by 200,000 bbl/d in addition to its current reduction of 300,000 bbl/d. The additional production cuts will start at the beginning of 2024.

Also announced at the meeting was that Brazil is intending to join OPEC+ in 2024, which will further strengthen OPEC+ since Brazil is the largest oil producer in Latin America at around 3.30 MMbbl/d with its oil production increasing from 2.94 MMbbl/d in 2020 – and with further potential to increase production.

The announced production cuts did not have much of an immediate impact on the oil market, in part, because the market was expecting additional cuts. Also, the cuts were announced as being voluntary, which suggests that the full extent of the cuts will not take place. Our view is that the production cuts will ultimately provide support for oil prices. Prior to the announcement of the additional cuts, we were forecasting that oil demand would outstrip oil supply by around 600,000 bbl/d during 1Q and 2Q of 2024. As such, any additional cuts by OPEC+ will result in further supply deficits – even with our forecasted increase in non-OPEC supply.

The geopolitical environment continues to be a source of risk, which is currently be dismissed by the oil market:

- The ceasefire between Israel and Hamas that lasted a week has ended with negotiations falling apart with still around 140 hostages still be held in Gaza. On Sunday, three commercial ships in the Red Sea were attacked by missiles fired by Houthi forces from Yemen, which are backed by Iran. Another sign of potential escalation is the Iranian Foreign Minister Hossein recently stating that if the Israel-Hamas conflict continues, the conflict will be entering a new phase;

- With respect to Russia -- the U.S. Treasury Department has recently imposed sanctions on three UAE shipping companies that allegedly shipped Russian oil that was priced above the $60 cap. In response to increased attention on enforcing the sanctions, four major Greek shipping firms have stopped shipping Russia oil. Additionally, the U.S. Assistant Secretary of State for Energy Resources announced intentions to reduce Russia’s revenue from oil and gas by 50% by 2030, which indicates that the U.S. is considering more sanctions on Russian entities and other entities that have been doing business with Russia; and

- Another geopolitical development that could affect oil prices involves Venezuela and Guyana. Venezuela is voting on a referendum that will ask voters their views on creating a new state that would consist of disputed territory that is currently controlled by Guyana. The territory provides access to Guyana’s offshore oil.

For the upcoming week, we are expecting that the price of Brent will struggle to break above its 200-day moving average to move higher than $82.00.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Keeping it Tight: Diversified Energy Clamps Down on Methane Emissions

2024-04-24 - Diversified Energy wants to educate on emission reduction successes while debunking junk science.

Darbonne: The ESG Sword: BlackRock's Life, Death by ESG

2024-04-17 - BlackRock, the $10 trillion investment manager, is getting heat for too much ESG investing, while shareholders are complaining it’s doing too little.

Fire Closes Atlas Energy’s Kermit, Texas Mining Facility

2024-04-15 - Atlas Energy Solutions said no injuries were reported and the closing of the mine would not affect services to the company’s Permian Basin customers.

Coalition Launches Decarbonization Program in Major US Cities, Counties

2024-04-11 - A national coalition will start decarbonization efforts in nine U.S. cities and counties following a federal award of $20 billion “green bank” grants.

Exclusive: Scepter CEO: Methane Emissions Detection Saves on Cost

2024-04-08 - Methane emissions detection saves on cost and "can pay for itself," Scepter CEO Phillip Father says in this Hart Energy exclusive interview.