(Source: Shutterstock)

The price of Brent crude ended the week at $84.48 after closing the previous week at $84.80. The price movement aligned with our expectations that the price of Brent crude would be under pressure. The price of WTI ended the week at $79.83 after closing the previous week at $81.28. The price of DME Oman ended the week at $86.65 after closing the previous week at $86.03.

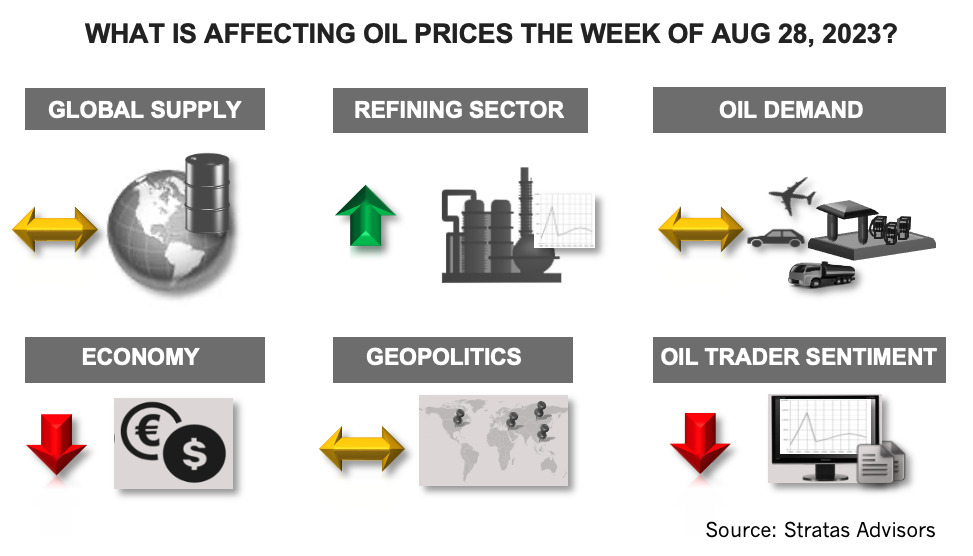

Prices rebounded in the second half of the week with the crude inventories in the U.S. decreasing by 6.13 MMbbl according to the EIA. Crude inventories in the U.S., however, remain above the level of the previous year and essentially on par with the level of 2019.

Concerns about the major economies continue to weigh on the oil market. At the end of last week, the U.S. Federal Reserve Chairman (Jerome Powell) stated that inflation is still too high and future rate increases could be required. Core inflation (excluding food and energy) is currently running more than twice the stated inflation target of 2.0%. While the Federal Reserve may feel the need to increase interest rates, the risk of doing so is increasing. Consumers are being squeezed by declining purchasing power, which is translating into increased debt levels. Credit card balances exceed $1.0 trillion dollars at the end of the second quarter while the average interest rate is running around 21%. Overall household debt now stands around $17.0 trillion and has increased by $2.9 trillion since the end of 2019. The resulting stress on the consumer is exhibited by the increasing delinquency rates on credit cards and auto loan debt. Defaults on auto loans are now exceeding 2.0%, which is higher than pre-pandemic levels. The situation is not helped by food prices, which have increased by nearly 20% over the course of the last two years. The fiscal situation of the U.S. federal government is also deteriorating with the cumulative 2023 fiscal deficit through July at $1.7 trillion (the fiscal year for the U.S. federal government runs from Oct. 1 through Sept. 30). Additionally, interest payments as a percentage of revenue are running at nearly 20%. In comparison, during the 2008-2009 recession, interest payments as a percentage of revenue peaked at around 17%.

China’s economy continues to disappoint, not just because of the hangover from the COVID-related sanctions, but also from structural factors, which China has struggled to resolve for years. These structural factors include an overreliance on manufacturing, exports and real estate coupled with a declining population and declining work force.

Europe’s economy showed further slowdown according to the latest Purchasing Manager’s Index (PMI). The composite PMI for the Eurozone decreased to 47.0 from 48.6 in July. The service PMI decreased to 48.3, which is the lowest level since February 2021. The manufacturing PMI increased to 43.7 from 42.7 but is still indicating that the manufacturing sector is contracting.

The negative economic news has also affected the sentiment of oil traders. The net long positions of traders of WTI decreased for the second consecutive week. The decrease stemmed from long positions decreasing while short positions increased. The net long positions of traders of Brent also decreased last week with long positions decreasing while short positions increased.

For the upcoming week, we are expecting that the price of Brent crude oil will drift sideways and remain below $86.00.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

From Restructuring to Reinvention, Weatherford Upbeat on Upcycle

2024-02-11 - Weatherford CEO Girish Saligram charts course for growth as the company looks to enter the third year of what appears to be a long upcycle.

TechnipFMC Eyes $30B in Subsea Orders by 2025

2024-02-23 - TechnipFMC is capitalizing on an industry shift in spending to offshore projects from land projects.

Patterson-UTI Braces for Activity ‘Pause’ After E&P Consolidations

2024-02-19 - Patterson-UTI saw net income rebound from 2022 and CEO Andy Hendricks says the company is well positioned following a wave of E&P consolidations that may slow activity.

ProPetro Reports Material Weakness in Financial Reporting Controls

2024-03-14 - ProPetro identified a material weakness in internal controls over financial reporting, the oilfield services firm said in a filing.

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions