The price of Brent crude ended the week at $87.00 after closing the previous week at $85.43. The price of WTI ended the week at $80.63 after closing the previous week at $80.63. The price of DME Oman crude ended the week at $87.28 after closing the previous week at $85.07.

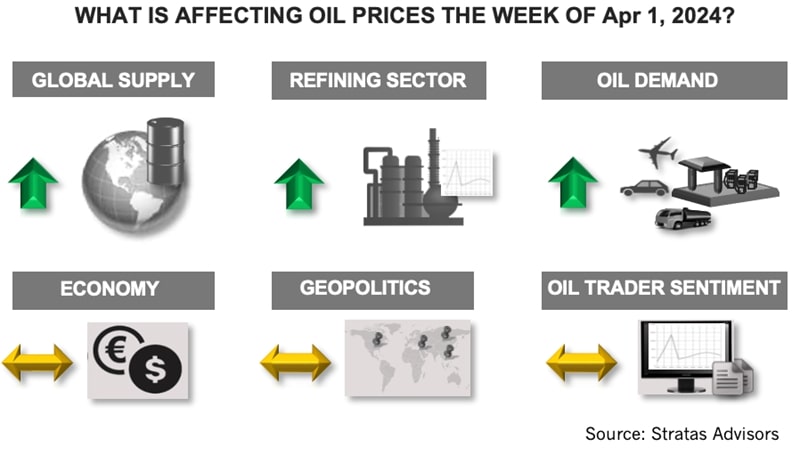

We have been forecasting that oil prices would increase with tightening supply/demand conditions coupled with increasing geopolitical risks. With last week’s increase, oil prices have reached the highest level since late October 2023.

Last week, we updated our short-term outlook (through 2025) for the crude oil markets. We are expecting that the fundamentals will remain supportive of oil prices with oil demand increasing during this period. We are also expecting that OPEC+ will continue to manage supply in a proactive manner, which will help establish a floor under oil prices. At the same time, we are expecting non-OPEC supply growth to be more modest during 2024 and 2025 than seen in 2023. There are risks to the forecast – especially with respect to the macro-level factors, including the possibility of an economic downturn, as well as geopolitical developments that could spin out of control.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Well Logging Could Get a Makeover

2024-02-27 - Aramco’s KASHF robot, expected to deploy in 2025, will be able to operate in both vertical and horizontal segments of wellbores.

E&P Highlights: April 29, 2024

2024-04-29 - Here’s a roundup of the latest E&P headlines, including a new contract award and drilling technology.

Tech Trends: Halliburton’s Carbon Capturing Cement Solution

2024-02-20 - Halliburton’s new CorrosaLock cement solution provides chemical resistance to CO2 and minimizes the impact of cyclic loading on the cement barrier.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.