The price of Brent crude ended the week at $85.43 after reaching $86.62 on March 19 and closing the previous week at $85.34. We expected that the price of Brent crude would test $86, and while not staying at that level, the price of Brent crude remained above its 200-day moving average. The price of WTI ended the week at $80.63 after reaching $82.73 on March 19 and closing the previous week at $81.04. The price of DME Oman crude ended the week at $85.07 after closing the previous week at $85.00.

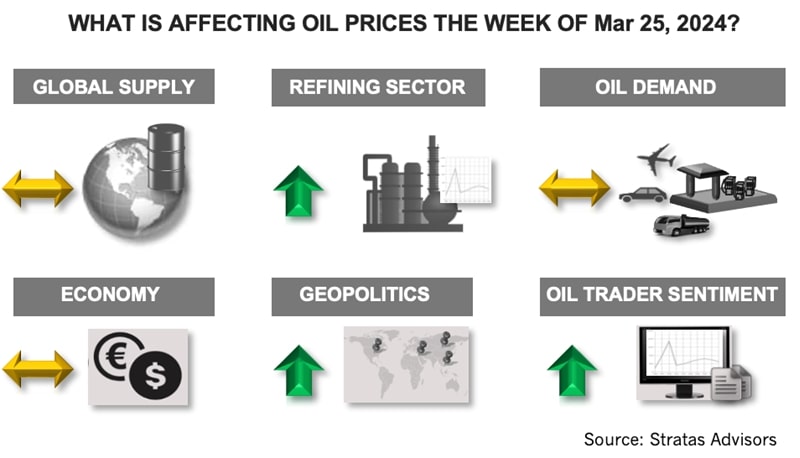

The oil market appears to be realizing that oil supply will be constrained this year with the additional supply cuts by OPEC+ and less robust supply increase this year from non-OPEC producers, including the U.S. On average, we are forecasting that supply will be at a deficit of 840,000 bbl/d in 2024. The net long positions of WTI traders increased significantly last week with traders increasing their long positions while reducing their short positions. Net long positions are now at the highest level since Oct. 24, 2023, but still 30% below the level of Sep. 26, 2023. Brent traders also increased their net long positions significantly with traders increasing their long positions while reducing their short positions.

Oil prices continue to get a boost from geopolitical developments. It is becoming increasingly clear that the conflict between Russia and Ukraine is moving toward a full-fledged war with all the inherent risks of expanding into a regional war – and even beyond. Ukraine is launching attacks on the interior of Russia, including attacks on oil refineries, which have affected about 10% of Russia’s refining capacity. The impact can be mitigated somewhat because the Russian refining sector is operating at around a 70% utilization rate, which means that Russia has the flexibility to increase crude thruputs at refineries that have not been attacked. In response, however, Russia is launching attacks on Ukraine’s infrastructure in western Ukraine and on Kyiv with the recent attacks being the most substantial in the last two years. The conflict has been made more complicated by the recent terrorist attack on a Moscow concert hall resulting in a death toll approaching 150 people. While there are reports that the attack was undertaken by ISIS, Russia is linking the attack to Ukraine.

The outcome of the conflict involving Israel and Hamas is still uncertain. The attempt by the U.S. to utilize the U.N. to put in place a cease-fire failed with Russia and China vetoing the resolution. It has been reported this weekend that the talks taking place in Qatar have apparently reached an impasse with Hamas stating that it will never agree to the framework that Israel is putting forth – even with Israel agreeing to the release of a greater number of Palestinian prisoners. Moreover, Israel still seems intent on moving the fight to southern Gaza and invading Rafah.

Despite the conflicts and the geopolitical uncertainty, crude oil, and oil products, for the most part, are continuing to flow, but the risk of a disruption is increasing.

Putting downward pressure on oil traders is the relative strength of the U.S. dollar. The U.S. Dollar Index ended the week at 103.70, up from the previous week of 103.43. We are still expecting that the Federal Reserve will not cut interest rates before June; but it is increasingly more probable that the Federal Reserve will cut rates in June, in part, because the Federal Reserve will not want to wait longer to initiate rate cuts to avoid being seen as influencing the presidential election. Additionally, the Federal Reserve is getting pressure from the business community to cut interest rates.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paisie, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

E&P Highlights: June 24, 2024

2024-06-24 - Here’s a roundup of the latest E&P headlines, including TotalEnergies working with Nigeria to reach FID on the Ubeta gas field and Chevron signing production sharing contracts for two blocks offshore Equatorial Guinea.

E&P Highlights: May 6, 2024

2024-05-06 - Here’s a roundup of the latest E&P headlines, including technology milestones and new contract awards.

Up to 50 Firms Seek US Oil Licenses in Venezuela, Official Says

2024-05-23 - Washington aims to prioritize issuing licenses to companies with existing oil output and assets over those seeking to enter the sanctioned OPEC nation for the first time, sources told Reuters.

Blankenship, Regens: More Demand, More M&A, More Regs

2024-05-23 - In 2024, the oil and gas industry is dealing with higher interest rates, armed conflicts in Europe and the Middle East, rising material costs, a decrease in Tier 1 acreage and new policies and laws.

US Drillers Cut Oil, Gas Rigs for Fourth Time in Five Weeks

2024-05-24 - The oil and gas rig count, an early indicator of future output, fell by four to 600 in the week to May 24 the lowest since January 2022.