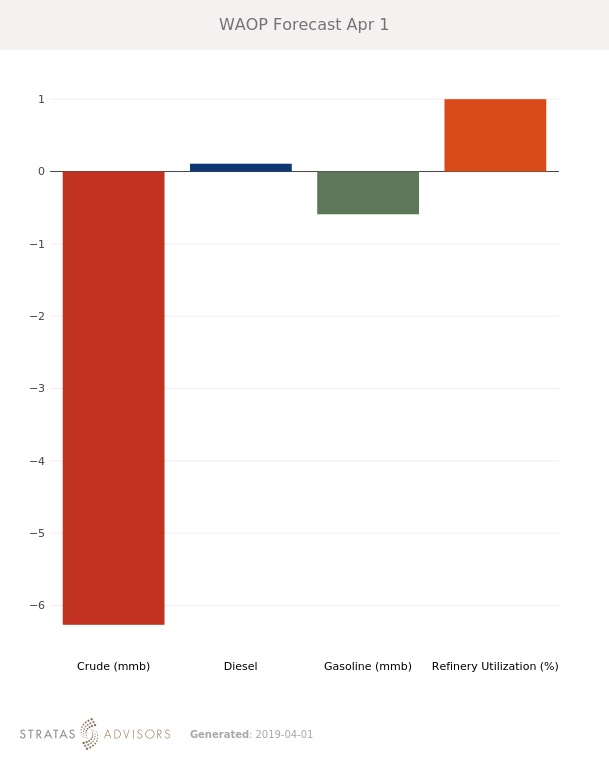

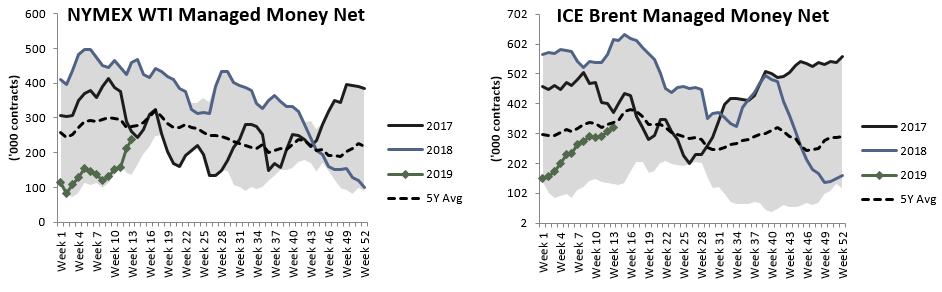

In the week since our last edition of What’s Affecting Oil Prices, Brent rose $0.14/bbl last week to average $67.84/bbl, in line with our expectations. WTI increased $0.13/bbl to average $59.52/bbl. Managed money net positioning increased for both Brent and WTI last week. For the week ahead, we expect both crudes to continue treading water although slanted to the upside. We expect Brent to average $68.25/bbl.

In Houston shipping and refining remains impacted by the recent petrochemical spill. Two refineries continue to curtail operations and gasoline imports fell to zero last week. The EIA’s upcoming weekly report could show a jump in Gulf Coast imports and exports as waterways are reopened. Refining activity may also show an increase.

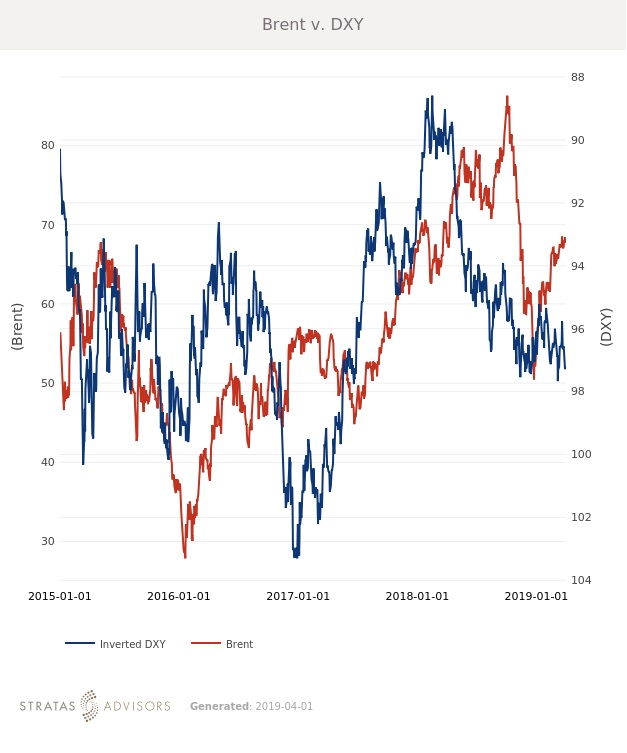

With few new events on the horizon, prices will struggle to find traction for the next few weeks. Price movements will likely be closely linked to the dollar and general market sentiment about the health of demand.

Late last week President Trump issued a new permit allowing TransCanada to move forward with the long-delayed Keystone Pipeline. This is part of his Administration’s “energy dominance” efforts to increase oil and gas independence in the U.S. The parameters of the permit, whether it will hold up in court, and if it would require yet another set of environmental reviews are all unclear at this stage, causing us to be pessimistic that it will lead to any substantive change. Additionally, a federal court struck down White House efforts to open new areas offshore and in the Arctic to oil and gas exploration. Presumably the Administration will appeal this decision, but this will have no immediate impact on producer plans. With current economics, few companies are actively interested in making large scale Arctic investments right now.

Geopolitical: Neutral

Dollar: Negative

Trader Sentiment: Positive

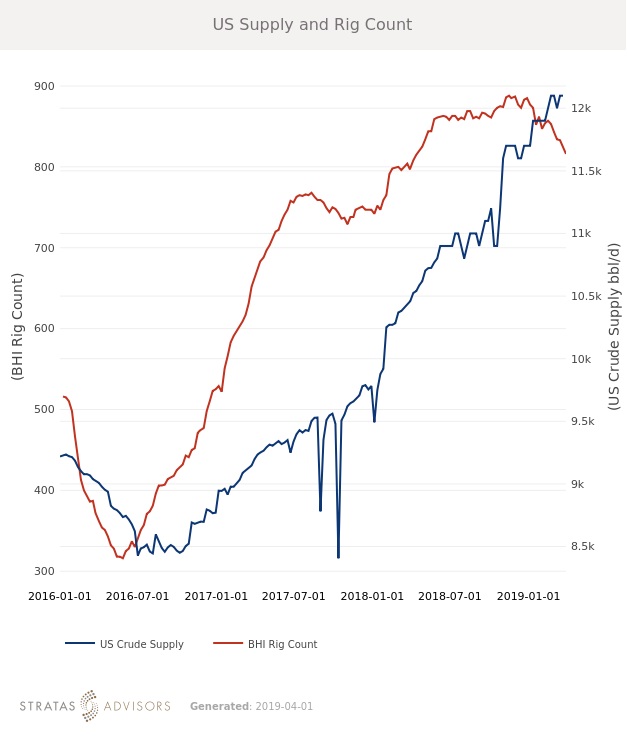

Supply: Neutral

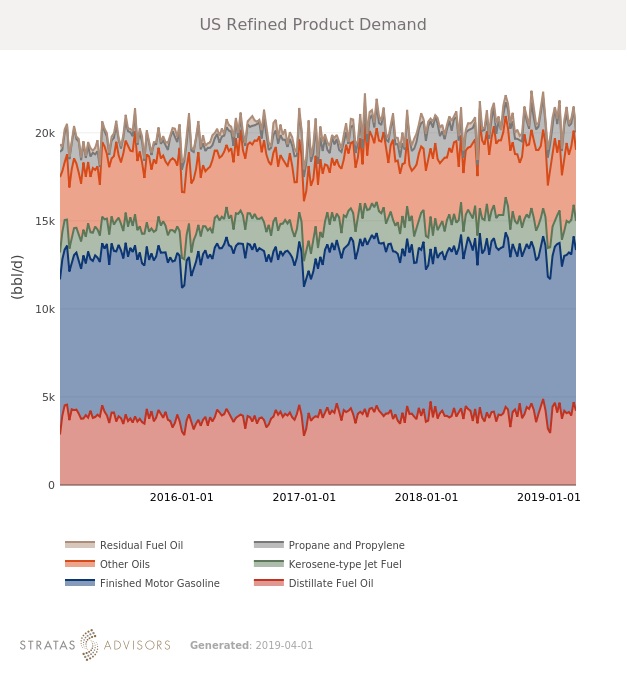

Demand: Positive

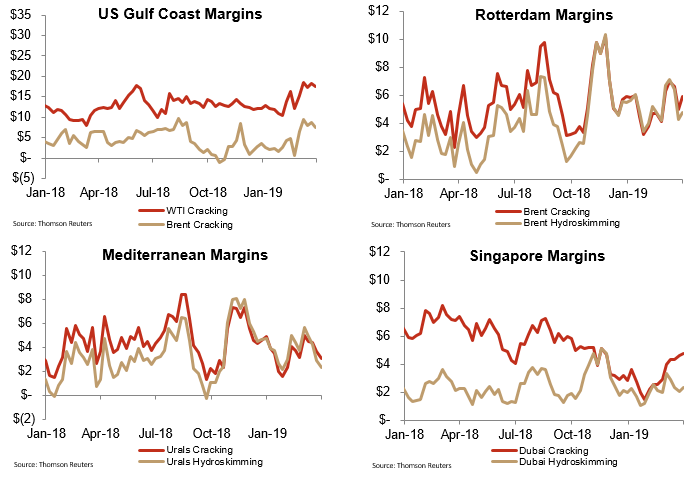

Refining Margins: Neutral

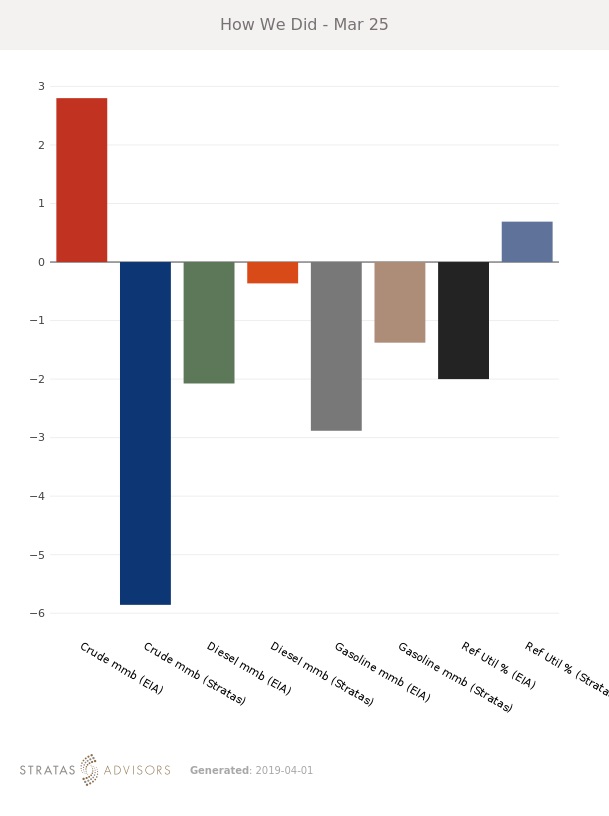

How We Did

Recommended Reading

Talos Energy Expands Leadership Team After $1.29B QuarterNorth Deal

2024-04-25 - Talos Energy President and CEO Tim Duncan said the company has expanded its leadership team as the company integrates its QuarterNorth Energy acquisition.

Energy Transfer Ups Quarterly Cash Distribution

2024-04-25 - Energy Transfer will increase its dividend by about 3%.

ProPetro Ups Share Repurchases by $100MM

2024-04-25 - ProPetro Holding Corp. is increasing its share repurchase program to a total of $200 million of common shares.

Baker Hughes Hikes Quarterly Dividend

2024-04-25 - Baker Hughes Co. increased its quarterly dividend by 11% year-over-year.

Weatherford M&A Efforts Focused on Integration, Not Scale

2024-04-25 - Services company Weatherford International executives are focused on making deals that, regardless of size or scale, can be integrated into the business, President and CEO Girish Saligram said.