In the week since our last edition of What’s Affecting Oil Prices, Brent rose $0.67/bbl last week to average $67.71/bbl. WTI saw much stronger gains, increasing $1.58/bbl to average $59.39/bbl.

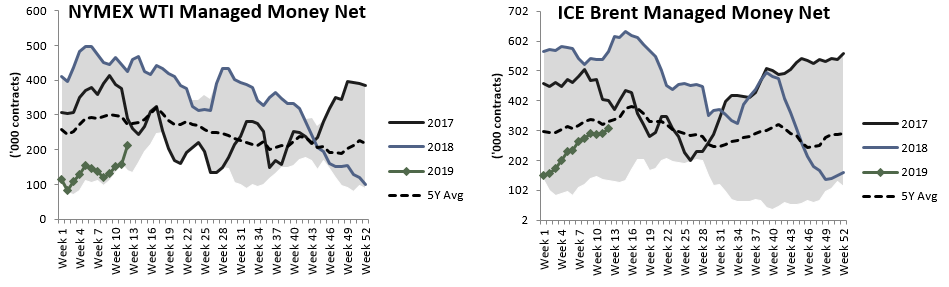

Managed money net long positioning for WTI also increased substantially in the CFTC’s latest report. For the week ahead, we expect both crudes to increase at more similar paces and Brent will likely average around $68/bbl.

Sanctions against Iran and Venezuela, as well as OPEC’s commitment to production cuts, have helped support prices. At the latest JMMC meeting, the members of the agreement announced that another meeting was not necessary in advance of the April OPEC meeting. Instead, a meeting should be scheduled in advance of the June meeting, when a decision about the fate of the production agreement will be made.

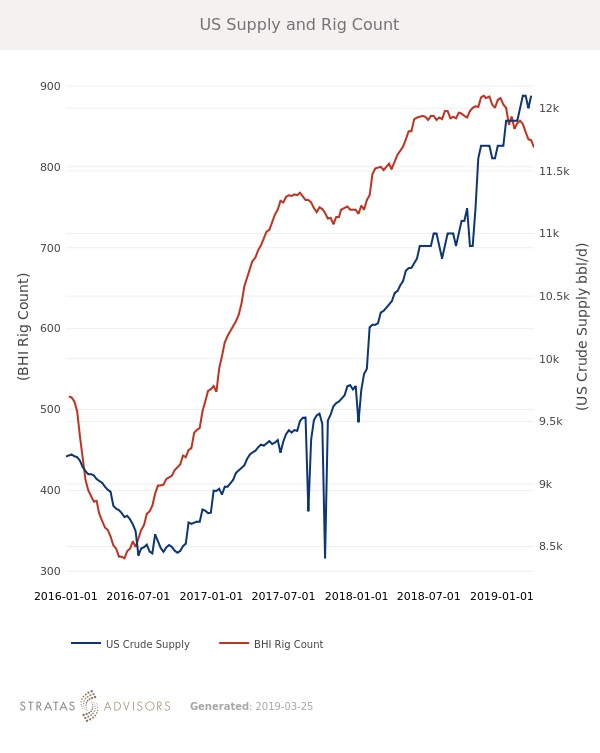

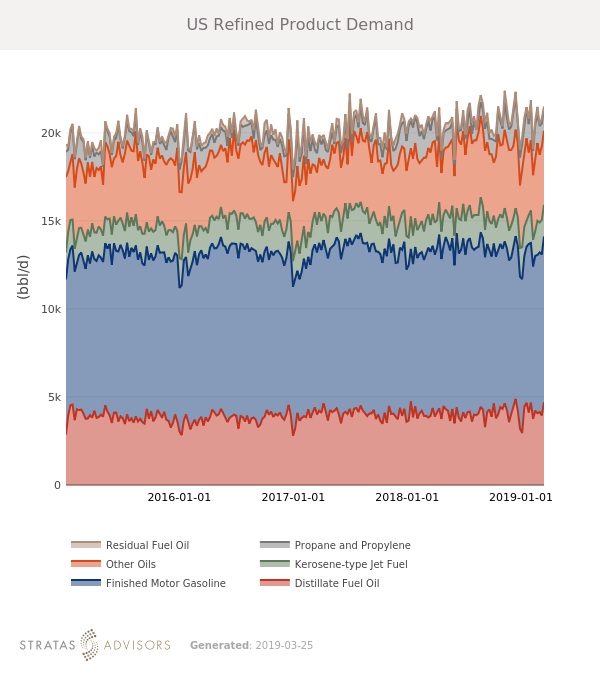

In the U.S., the onshore oil rig count fell for the fifth straight week. Product demand continues to hew to seasonally typical levels, disproving fears about a collapse in demand. In Europe, all product stocks except jet fuel are below their five-year average levels and product stocks are also generally falling in Singapore.

Geopolitical: Neutral

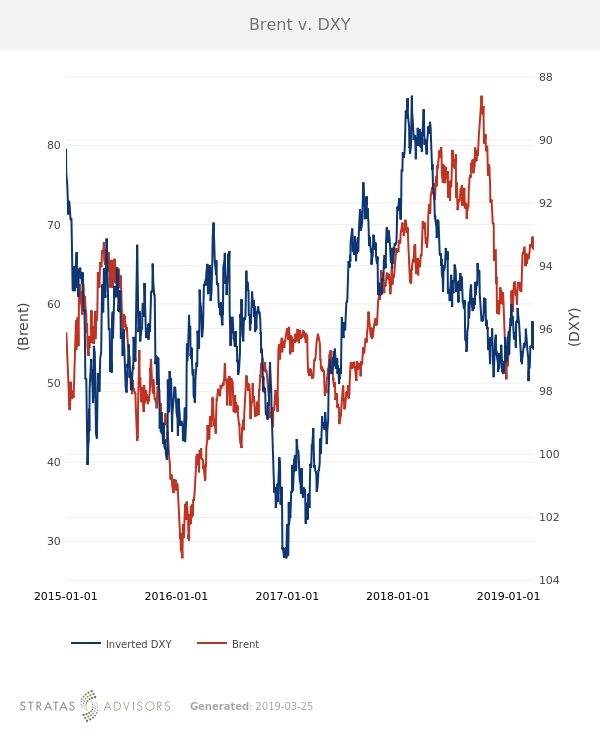

Dollar: Neutral

Trader Sentiment – Positive

Supply: Neutral

Demand: Positive

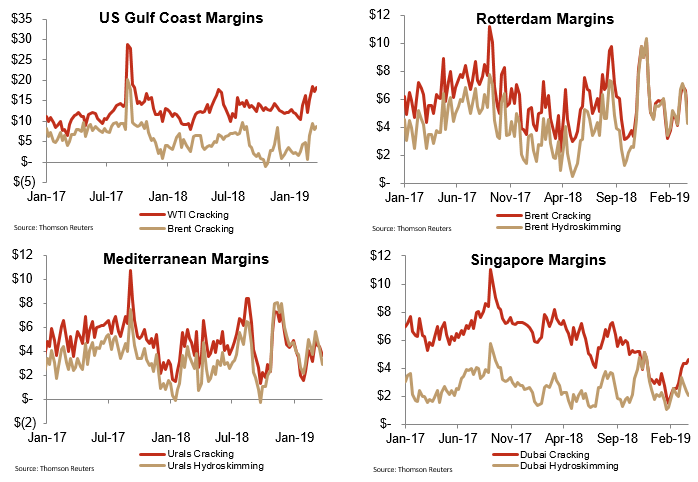

Refining Margins: Neutral

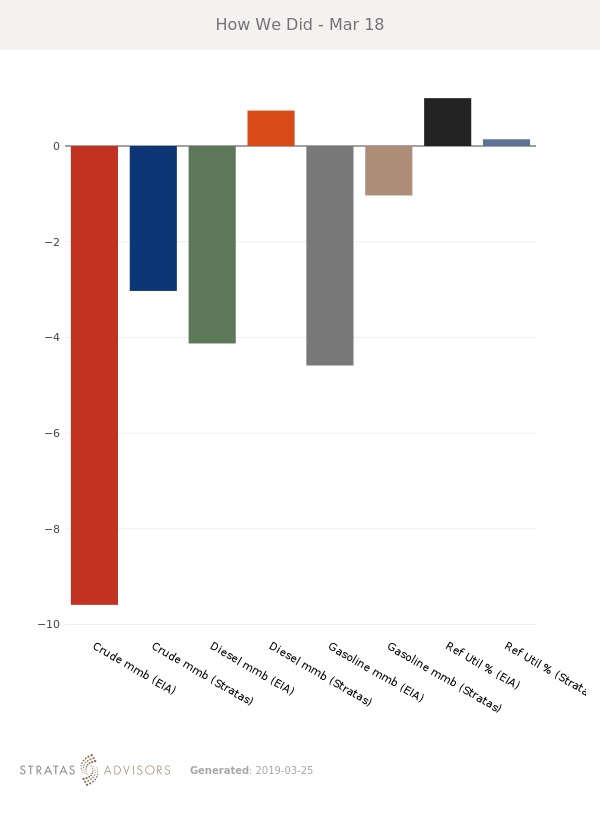

How We Did

Recommended Reading

Canadian Natural Resources Boosting Production in Oil Sands

2024-03-04 - Canadian Natural Resources will increase its quarterly dividend following record production volumes in the quarter.

After Megamerger, Canadian Pacific Kansas City Rail Ends 2023 on High

2024-02-02 - After the historic merger of two railways in April, revenues reached CA$3.8B for fourth-quarter 2023.

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

Kissler: OPEC+ Likely to Buoy Crude Prices—At Least Somewhat

2024-03-18 - By keeping its voluntary production cuts, OPEC+ is sending a clear signal that oil prices need to be sustainable for both producers and consumers.

Some Payne, But Mostly Gain for H&P in Q4 2023

2024-01-31 - Helmerich & Payne’s revenue grew internationally and in North America but declined in the Gulf of Mexico compared to the previous quarter.