(Source: Shutterstock.com)

The U.S. Interior Department has proposed holding a second Gulf of Mexico offshore wind lease auction, offering more than 410,000 acres for development off the Louisiana and Texas Gulf Coast.

The move comes as the Biden-Harris administration targets 30 gigawatts of offshore wind capacity by 2030 as part of its clean energy drive. Combined, the four proposed areas have the potential to power about 1.2 million homes if developed, according to the Interior Department.

“We are taking action to jumpstart America’s offshore wind industry and using American innovation to deliver reliable, affordable power to homes and businesses, while also addressing the climate crisis,” Interior Secretary Deb Haaland said in a March 20 news release.

The offshore wind industry, however, has faced some challenging market conditions in the last year. Higher interest rates, supply chain constraints and rising inflation’s negative impact on costs took a toll on some offshore wind developers, leading to impairments and project exits.

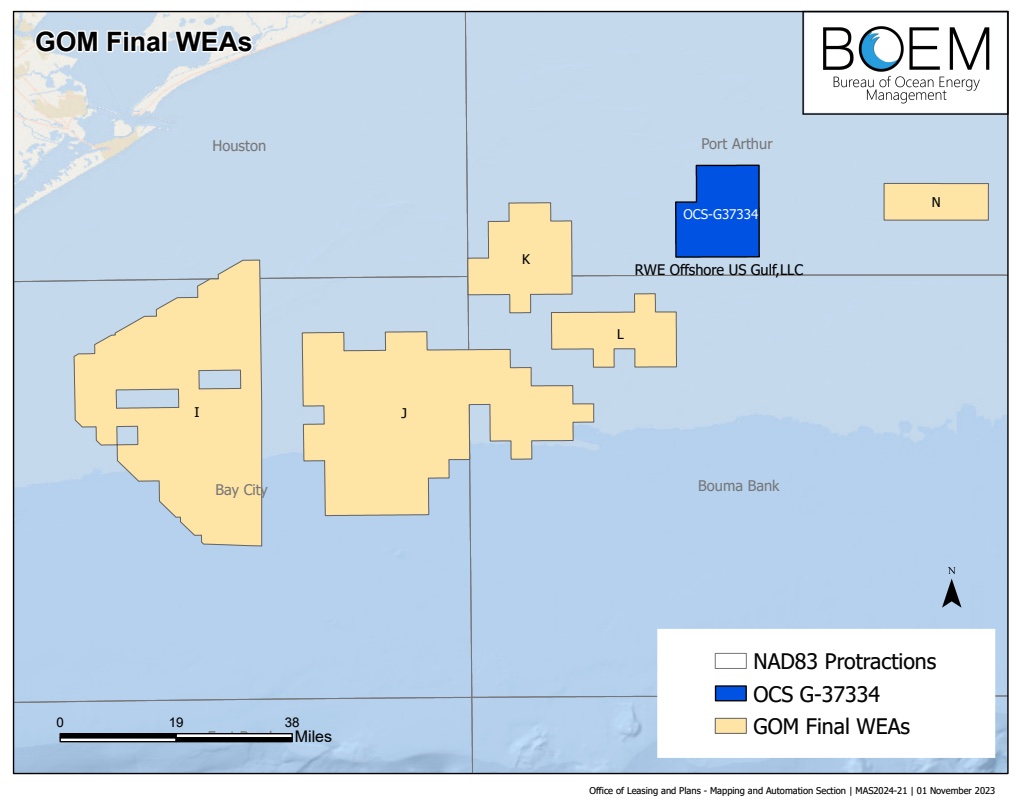

The nation’s first GoM wind lease sale, held in August 2023, resulted in only one winning bid. RWE Offshore US Gulf LLC placed a high bid of $5.6 million for rights to develop a lease area off Lake Charles, Louisiana. The two other lease areas offered—both off Texas—received no bids.

RELATED: BOEM Identifies Four Wind Energy Areas in GoM Amid Concerns

The Biden-Harris administration has held three offshore wind lease auctions in all, including the record-breaking New York Bight sale that drew competitive winning bids from six companies totaling about $4.37 billion.

The administration also held the nation’s first wind lease sale in the Pacific, paving the way for floating wind developments in deepwater. Plus, wind energy areas are in the process of being established off Oregon, the Gulf of Maine and the Central Atlantic.

“Consistent lease sales, including for oil and gas and wind energy, are essential for maintaining a steady flow of energy production,” National Ocean Industries Association (NOIA) President Erik Milito said. “Periods of inactivity in lease sales only serve to heighten uncertainty and risk pushing investment dollars overseas.”

As part of the process, the U.S. Bureau of Ocean Energy Management will seek public comment for 60 days, starting March 21, to get feedback on the proposed lease areas as well as potential lease revisions to include the production of hydrogen or other energy products using wind turbine generators.

Recommended Reading

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

Well Logging Could Get a Makeover

2024-02-27 - Aramco’s KASHF robot, expected to deploy in 2025, will be able to operate in both vertical and horizontal segments of wellbores.

Shell Brings Deepwater Rydberg Subsea Tieback Onstream

2024-02-23 - The two-well Gulf of Mexico development will send 16,000 boe/d at peak rates to the Appomattox production semisubmersible.

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.

Remotely Controlled Well Completion Carried Out at SNEPCo’s Bonga Field

2024-02-27 - Optime Subsea, which supplied the operation’s remotely operated controls system, says its technology reduces equipment from transportation lists and reduces operation time.