(Source: Shutterstock.com)

An agreement by OPEC and Russia on April 9 to cut 10 MMbbl/d drew praise from some industry players but oil prices continued to plunge following the much-awaited decision.

WTI crude settled at $22.76/bbl on April 9, down about 9%. Brent futures also tumbled about 4% to $31.48/bbl.

Some say bigger cuts are needed to put a dent in the oversupply, which—combined with falling demand caused by a deadly virus—have led to massive capex cuts, layoffs and an uncertainty for U.S. shale players.

RELATED:

Oil Prices Erase Early Gains on Record OPEC+ Output Cut

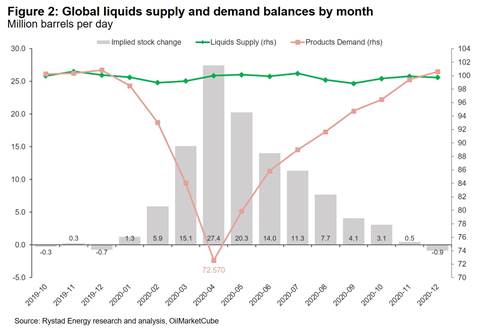

Rystad Energy analysts said the move will “save prices from falling into a deep abyss, but it will still not restore the desired market balance. … Even if a 10 million bbl/d cut is agreed upon, or even in the best-case scenario 15 million bbl/d if the U.S., Canada, Norway and Brazil join forces, an excess of supply of the magnitude of 5 million-10 million bbl/d will remain, and will need to be stored.”

Still, many believe the move is a step in the right direction, following the ill-timed breakup in March of the Saudi Arabia- and Russia-led OPEC+ alliance as each worked to gain market share.

“It’s a good and necessary first step to restore some sanity to the global markets and we hope signals the recognition that dumping excess oil into the U.S. market is a losing proposition for all concerned,” Harold Hamm, executive chairman of Continental Resources Inc., told Hart Energy in a statement. “However, we also all know that demand remains out of sync with supply. The world has lost almost 30 million barrels a day of demand.”

The plan calls for Saudi Arabia and Russia together to cut between 5 MMbbl/d, with other OPEC+ producers vowing to reduce production by another 5 MMbbl/d, according to a Financial Times report.

The U.S., Canada and other countries are being asked to cut an additional 5 MMbbl/d. That deal is expected to be hashed out at the G20 meeting on April 10.

Oil producers in the U.S. have already been cutting capex in response to the unfavorable market conditions, which came on top of cost-cutting measures previously taken to improve free cash flow, pay down debt and increase dividends.

The latest downturn, however, saw some U.S. shale players announcing cuts more than once within the same month.

“Here, in the United States, we are rapidly adjusting production to these new realities,” Hamm added. “We hope that the oil-producing nations take additional steps soon to better align demand with supply.”

A deeper production cut would’ve been ideal, though OPEC+’s decision will help keep storages from filling up in the short term, according to Bjornar Tonhaugen, head of oil markets for Rystad.

Still, “it is a disappointing development for many, who still realize the size of the oil oversupply. Reducing cuts after June won’t help either and market participants soon dropped their pre-meeting enthusiasm, quickly leading prices to another slump,” Tonhaugen said in a statement. “If the 10 million bbl/d cuts deal prevails, now hopes can only rely on what other countries outside the alliance will do. Friday might be another day of an exchange of emotions in the market, which may put its hopes on additional non-OPEC+ production cuts to reduce supply, and also on SPR (Strategic Petroleum Reserve) purchases to boost demand.”

Wood Mackenzie’s Ann-Louise Hittle said in a statement the 10 MMbbl/d cut supports second-quarter oil prices.

“Even a 5 million bbl/d reduction would see oil prices in the low $30s. It would ease pressure on storage and stem the steep price collapse we saw in March,” Hittle said. “A 10 million bbl/d reduction may seem small compared with some very high demand loss estimates, but if the curbs are implemented? It would slow the build-up in storage and avoid the surplus of supply over the second quarter, when the COVID-19 shutdowns are the extensive and demand lowest.”

Challenges, however, are still ahead for the oil and gas industry, considering the drop in demand was mostly behind market disruptions, says Mike Summers, president and CEO of the API.

“The best thing for the energy industry—and the entire U.S. economy—is to slow the spread of COVID-19 and stimulate the economy until demand stabilizes and it’s safe for Americans to return to work,” Summers said.

Recommended Reading

Oceaneering Won $200MM in Manufactured Products Contracts in Q4 2023

2024-02-05 - The revenues from Oceaneering International’s manufactured products contracts range in value from less than $10 million to greater than $100 million.

E&P Highlights: Feb. 5, 2024

2024-02-05 - Here’s a roundup of the latest E&P headlines, including an update on Enauta’s Atlanta Phase 1 project.

CNOOC’s Suizhong 36-1/Luda 5-2 Starts Production Offshore China

2024-02-05 - CNOOC plans 118 development wells in the shallow water project in the Bohai Sea — the largest secondary development and adjustment project offshore China.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

US Drillers Add Oil, Gas Rigs for Third Time in Four Weeks

2024-02-09 - Despite this week's rig increase, Baker Hughes said the total count was still down 138 rigs, or 18%, below this time last year.