Brad Johnson’s appointment as president and CEO on March 7 is the final piece in retooling the senior management team at Ultra Petroleum, which, within the past year, included both COO Jay Stratton and CFO David Honeyfield joining the company. (Source: Ultra Petroleum Corp.)

Ultra Petroleum Corp. (NASDAQ: UPL) said March 7 that Brad Johnson will officially assume the company’s top position after filling in as interim CEO for roughly a year.

The Rockies oil and gas producer, which has recruited a new senior management team within the past year, also reported quarterly results largely in line with analyst expectations but with higher spending.

Johnson has over 24 years of industry experience including operations, engineering, acquisitions, project management and corporate planning and previously worked for Anadarko Petroleum Corp. for 13 years before joining Ultra in 2008.

At Ultra, Johnson started out as director of reservoir engineering and planning. He was promoted in 2011 to serve as vice president of reservoir engineering and development and then to senior vice president of operations in 2014.

In February 2018, Johnson took over as interim CEO following the retirement of his predecessor Michael Watford.

“Since taking over as interim CEO Brad has demonstrated the ability to lead the company in an effective and efficient manner during an incredibly difficult natural gas price environment in the Rockies,” Evan Lederman, chairman of Ultra’s board, said in a statement. “Among other things, Brad has worked closely with the board to rationalize the development plan, opportunistically hedge to ensure more predictable cash flows, execute on liability management transactions and bank amendments to strengthen the balance sheet, refocus the development efforts on the vertical program to de-risk the capital investment program and oversee the detailed evaluation of the horizontal program focused on learning from our initial results.”

RELATED: Ultra Petroleum Relocates To Denver Area Following Utah Exit

Lederman is also a partner at Ultra’s largest shareholder, Fir Tree Partners. He joined the company’s board in early 2018. Ultra had previously said it would work collaboratively with the private investment firm to pursue value-maximizing strategies.

Johnson’s appointment as president and CEO on March 7 is the final piece in retooling the senior management team at Ultra, according to Lederman, which, within the past year, included both COO Jay Stratton and CFO David Honeyfield joining the company.

“The board believes that we now have a top-notch senior management team in place to successfully lead the company into the future,” Lederman said. “The management team and the board are fully committed to executing on a profitable and value-driven business model focused on shareholder returns and to take advantage of a rebound in historically low gas price realizations in the Rockies.”

Earnings, Outlook

Ultra reported adjusted net income of $27.4 million, or $0.14 per diluted share, for the quarter ended Dec. 31, compared with $95.5 million, or $0.49 per diluted share, a year earlier.

(Source: Ultra Petroleum Corp.)

Total revenues excluding hedging settlements from the quarter were $273.2 million as compared to $240.6 million during fourth-quarter 2017. The company’s production of natural gas and oil was 64.3 billion cubic feet equivalent (Bcfe), a decrease from 74.5 Bcfe in the same period of 2017. Fourth quarter production was comprised of 61.5 billion cubic feet of natural gas and about 473,000 barrels of oil.

“Fourth-quarter production was pre-announced and fourth-quarter financials overall were fairly in line, but fourth-quarter capex came in hot and [Ultra’s] ’19 plan looks somewhat weak vs. expectations. Fourth-quarter vertical well results solid,” said analysts with Capital One Securities Inc. in a March 7 research note.

In the fourth quarter, Ultra brought 23 gross (21.1 net) operated vertical wells online with an average 24-hour IP rate of 8.3 million cubic feet equivalent per day.

The company moved from a seven-rig program at the beginning of 2018 to a three-rig operated vertical well program during third-quarter 2018 in order to optimize cash flow and liquidity in the face of challenging regional gas pricing.

Total capital invested in the fourth quarter was $87.8 million with well costs reduced to $3.1 million, which the company attributed to its vertical-only drilling program. Still, the Capital One analysts noted that this brings the company’s spending to about $430 million vs. its budgeted $400 million to $415 million range for full-year 2018.

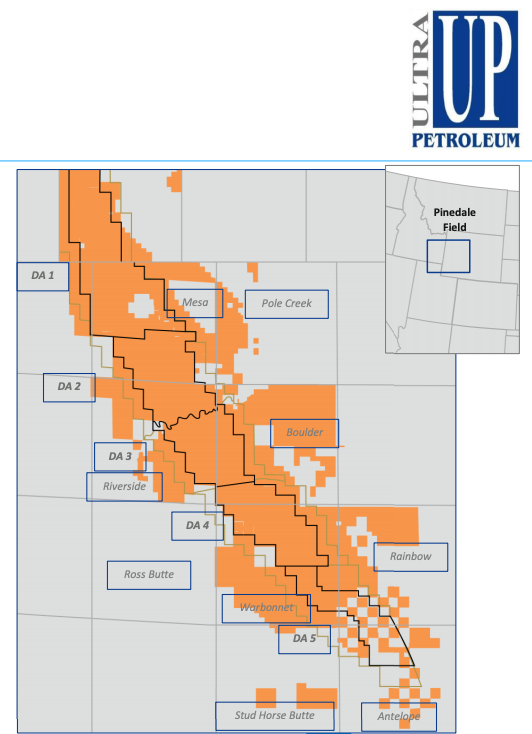

For 2019, Ultra plans to continue to run its three-rig program in the Pinedale core in Sublette County, Wyo., where the company holds the largest acreage position with about 79,000 net acres, according to the company website.

The company expects to spend about $320 million to $350 million in 2019 with between $275 million and $295 million for its vertical drilling and completions program. No capital is currently earmarked for horizontal drilling but Ultra said in the release it will continue its ongoing analysis to further de-risk future horizontal drilling opportunities on its acreage.

“We enter 2019 with positive momentum at Ultra,” Johnson said in the March 7 release. “The company is drilling vertical wells above recent historical averages, continuing the horizontal learnings, received a favorable ruling in the appeal of our make-whole claim, experienced improvements in regional gas pricing and we have strengthened our balance sheet through debt reductions.”

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Shipping Traffic Freezes Up in Port Waters After Baltimore Bridge Collapse

2024-03-26 - U.S. port of Baltimore traffic was suspended until further notice following a bridge collapse. At least 13 vessels expected to load coal were anchored near the port at the time of the incident.

What's Affecting Oil Prices This Week? (April 22, 2024)

2024-04-22 - Stratas Advisors predict that despite geopolitical tensions, the oil supply will not be disrupted, even with the U.S. House of Representatives inserting sanctions on Iran’s oil exports.

What's Affecting Oil Prices This Week? (April 15, 2024)

2024-04-15 - While concerns about the stability of oil supply are increasing, Stratas Advisors does not expect oil supply to be disrupted – unless there is further escalation in the Middle East.

Venture Global, Grain LNG Ink Deal to Provide LNG to UK

2024-02-05 - Under the agreement, Venture Global will have the ability to access 3 million tonnes per annum of LNG storage and regasification capacity at the Isle of Grain LNG terminal.

WoodMac: Market Likely to Absorb Aramco’s Downshift in Oil Production

2024-02-02 - Saudi Aramco’s move from a targeted 13 MMbbl/d capacity by 2027 is not expected to tighten the supply and demand balance this decade, Wood Mackenzie analysts said.