British North Sea oil and gas producers will spend around 20 billion pounds (US$24 billion) on dismantling over 2,000 unused wells and facilities in the aging basin over the next decade, an industry group said on Nov. 22.

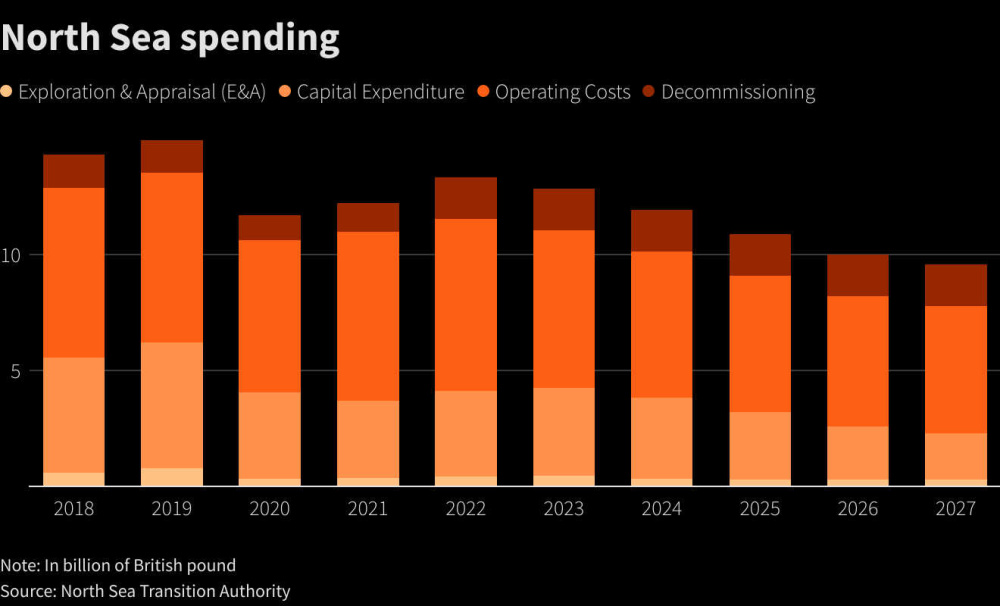

The cost burden for plugging wells and removing platforms, in what is known as decommissioning, is set to rise sharply over the next three to four years as more fields stop production, Offshore Energies UK (OEUK) warned in a report.

The growing bill coincides with British finance minister Jeremy Hunt’s decision last week to increase a windfall tax on North Sea producers to 35% from 25%, bringing total taxes on the sector to 75%, among the highest in the world.

OEUK estimates around 2,100 North Sea wells will be decommissioned over the next decade at an average cost of 7.8 million pounds per well, for a total of 19.7 billion pounds.

The proportion of spending on decommissioning in companies’ budgets is set to rise from 14% in 2022 to 19% by 2031.

Over 75% of total decommissioning spend will be within the central and northern North Sea.

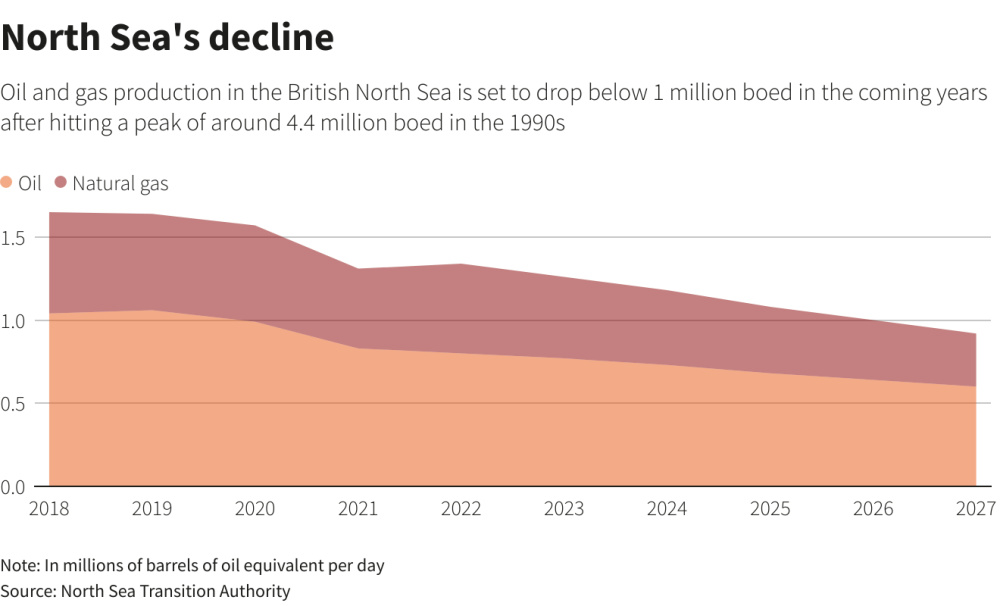

Oil and gas production in the North Sea, a major deepwater production hub since the 1970s, has been in steady decline since peaking at around 4.4 million boe/d in the 1990s.

Decommissioning costs can be offset against some taxes, but not against the latest windfall tax.

OEUK also warned the growing number of oil and gas workers turning to the fast-growing offshore wind industry in the region could create shortages of skilled workers for decommissioning.

“The U.K.’s decommissioning sector is snowballing and will continue growing for years to come,” OEUK Decommissioning Manager Ricky Thomson said in a statement.

"But this poses a challenge as well as an opportunity. The growth of renewables and demand for decommissioning services and expertise will create increasing pressure for resources."

(US$1 = 0.8469 pounds)

Recommended Reading

Shipping Traffic Freezes Up in Port Waters After Baltimore Bridge Collapse

2024-03-26 - U.S. port of Baltimore traffic was suspended until further notice following a bridge collapse. At least 13 vessels expected to load coal were anchored near the port at the time of the incident.

Segrist: The LNG Pause and a Big, Dumb Question

2024-04-25 - In trying to understand the White House’s decision to pause LNG export permits and wondering if it’s just a red herring, one big, dumb question must be asked.

CERAWeek: Tecpetrol CEO Touts Argentina Conventional, Unconventional Potential

2024-03-28 - Tecpetrol CEO Ricardo Markous touted Argentina’s conventional and unconventional potential saying the country’s oil production would nearly double by 2030 while LNG exports would likely evolve over three phases.

Woodside Brings in the Know-how

2024-04-01 - Woodside Energy Group CEO Meg O’Neill is relying on technical sophistication to guide the Australian giant as it takes on three challenging projects in the U.S. Gulf of Mexico.

Exclusive: Chevron Balancing Low Carbon Intensity, Global Oil, Gas Needs

2024-03-28 - Colin Parfitt, president of midstream at Chevron, discusses how the company continues to grow its traditional oil and gas business while focusing on growing its new energies production, in this Hart Energy Exclusive interview.