British North Sea oil and gas producers will spend around 20 billion pounds (US$24 billion) on dismantling over 2,000 unused wells and facilities in the aging basin over the next decade, an industry group said on Nov. 22.

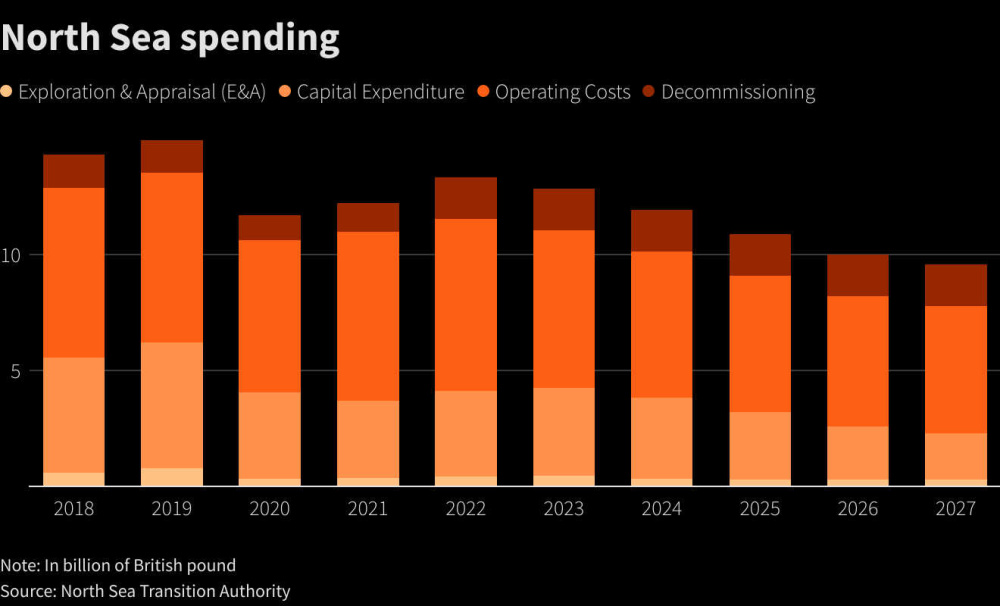

The cost burden for plugging wells and removing platforms, in what is known as decommissioning, is set to rise sharply over the next three to four years as more fields stop production, Offshore Energies UK (OEUK) warned in a report.

The growing bill coincides with British finance minister Jeremy Hunt’s decision last week to increase a windfall tax on North Sea producers to 35% from 25%, bringing total taxes on the sector to 75%, among the highest in the world.

OEUK estimates around 2,100 North Sea wells will be decommissioned over the next decade at an average cost of 7.8 million pounds per well, for a total of 19.7 billion pounds.

The proportion of spending on decommissioning in companies’ budgets is set to rise from 14% in 2022 to 19% by 2031.

Over 75% of total decommissioning spend will be within the central and northern North Sea.

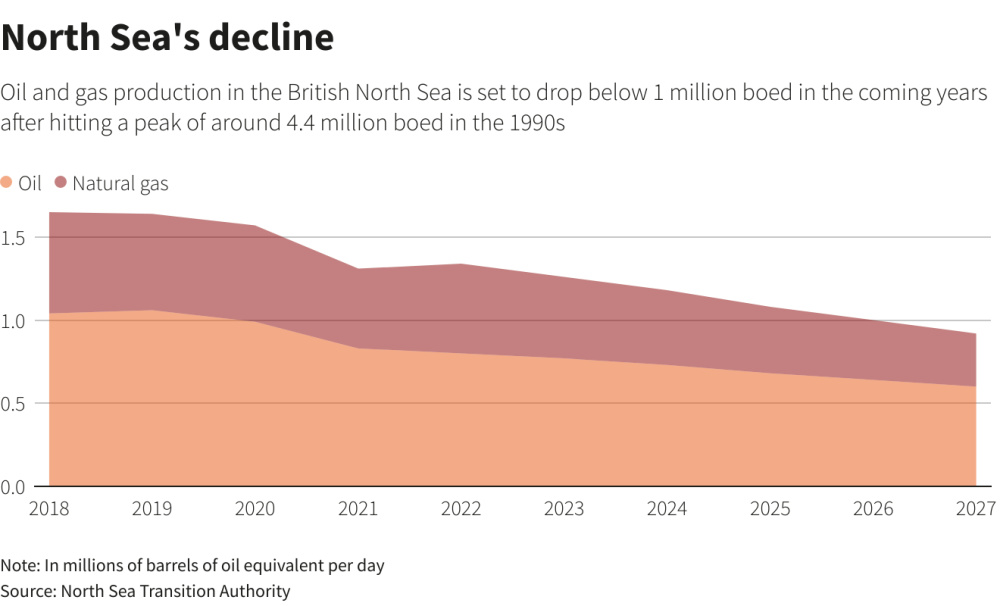

Oil and gas production in the North Sea, a major deepwater production hub since the 1970s, has been in steady decline since peaking at around 4.4 million boe/d in the 1990s.

Decommissioning costs can be offset against some taxes, but not against the latest windfall tax.

OEUK also warned the growing number of oil and gas workers turning to the fast-growing offshore wind industry in the region could create shortages of skilled workers for decommissioning.

“The U.K.’s decommissioning sector is snowballing and will continue growing for years to come,” OEUK Decommissioning Manager Ricky Thomson said in a statement.

"But this poses a challenge as well as an opportunity. The growth of renewables and demand for decommissioning services and expertise will create increasing pressure for resources."

(US$1 = 0.8469 pounds)

Recommended Reading

Pembina Pipeline Enters Ethane-Supply Agreement, Slow Walks LNG Project

2024-02-26 - Canadian midstream company Pembina Pipeline also said it would hold off on new LNG terminal decision in a fourth quarter earnings call.

Williams Beats 2023 Expectations, Touts Natgas Infrastructure Additions

2024-02-14 - Williams to continue developing natural gas infrastructure in 2024 with growth capex expected to top $1.45 billion.

Canadian Railway Companies Brace for Strike

2024-04-25 - A service disruption caused by a strike in May could delay freight deliveries of petrochemicals.

TC Energy’s Keystone Back Online After Temporary Service Halt

2024-03-10 - As Canada’s pipeline network runs full, producers are anxious for the Trans Mountain Expansion to come online.

Enbridge Announces $500MM Investment in Gulf Coast Facilities

2024-03-06 - Enbridge’s 2024 budget will go primarily towards crude export and storage, advancing plans that see continued growth in power generated by natural gas.