Experts at Hart Energy's Carbon & ESG Strategies conference expressed confidence that technology and capitalism could make tremendous gains in the carbon capture, reduce greenhouse gases – and make money. (Source: Hart Energy)

Carbon credits have the digitally-backed verification needed for buyers’ due diligence, and there are hundreds of people who want to buy. What’s lacking: standardization needed to bring about a free market approach to reduce greenhouse gases at scale.

These were the contentions of experts who spoke about the carbon credit lifecycle at Hart Energy’s Carbon & ESG Strategies conference on Aug. 30. They expressed confidence that technology and capitalism could make tremendous gains in the carbon capture, reduce greenhouse gases–and make money.

“I always say that applied science and structured finance can solve any problem that we have in mind,” said Pedro Blanco, managing director and head of business development at Capturiant, a global environmental asset validator.

John McDougal, vice president of Anew Climate, a carbon credit developer and environmental commodities company, said carbon credits are changing the landscape.

“Carbon [credit] is becoming more of a currency, and it’s going to start tying into everything we do," McDougal said. "It is voluntary now [but] you’re seeing evidence of compliance markets emerging everywhere, including in the U.S.”

James Row, managing partner of Entoro Capital, said there are more than 250 groups worldwide that are eager to buy carbon credits.

Deanna Reitman, a commodities lawyer with the multinational law firm DLA Piper, said many potential buyers of carbon credit buyers are companies outside of the oil and gas industry that are looking for ways to reduce their carbon footprint and reach their own ESG goals.

Row said broad standardization is needed in order to reach the next step in the markets.

“Each one of these countries and groups has grown up in a silo. They have different definitions,” he said. “There’s a massive effort, among a number of groups globally to have a standard—to get to standardization. You can't really have really robust trading until you have standardization.”

Some of that standardization may be on its way as regulations are promulgated, and Reitman said, agencies are moving forward.

“The Commodity Futures Trading Commission [CFTC] said that they are going to start prosecuting, and they have, and the more we digitize, the more we will see more enforcement,” she said. “The digital assets space right now is heavily under scrutiny by both the Securities Exchange Commission and the CFTC. They’re here to regulate it, and they will.”

Carbon credit market fundamentals

Five principles must be met for carbon credit sales to work at scale, said McDougal. They must be science based, verifiable, third party accredited, permanent and enforceable.

Reitman said distributed ledger technology and blockchain provide the transparency to assure that those principles are being met.

“It lets you look under the hood. It lets you see for yourself whether all five principles have been met. It also lets you decide the type of project credit that you want to buy,” she said.

Reitman said the credits must be treated as commodities, and investors will risk violating banking regulations if they treat the credits as securities.

However, Row said some countries outside of the U.S. are considering regulation that allows carbon credits to be treated as securities.

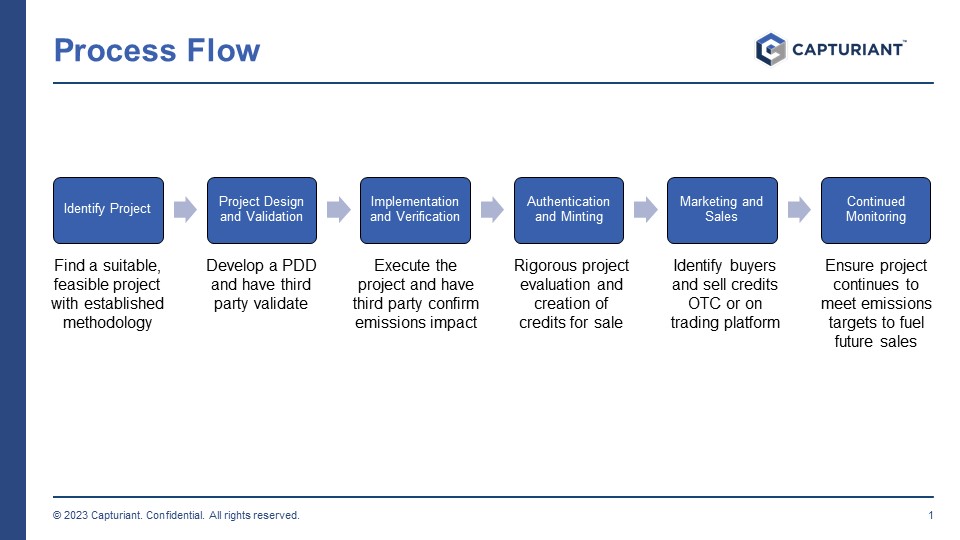

Blanco detailed how the carbon lifecycle will create the carbon credit.

He said a rigorous evaluation results in a mint on the company’s distributed ledger technology and posted on a registry.

Reitman said this authentication helps lay the groundwork for dashboards on the sale of carbon futures, the first iterations of which already exist in the EU.

“We’ll see more and more futures with that underlying carbon credit as a commodity. Just like agriculture or just like metal, just like oil and gas are your underlying commodity for the derivative,” she said.

Panelists said they saw free market forces providing solutions for the climate transition.

“The historical registries have made us believe that we have to be at war with the oil and gas industry to help reduce carbon,” Reitman said, “and I do not believe that is true. That is not the place where war should be had.”

Recommended Reading

Marketed: Wylease AFE Asset Packages in Johnson County, Wyoming

2024-04-29 - Wylease LLC has retained EnergyNet for the sale of three Niobrara Shale AFE (authorization for expenditure) packages in Johnson County, Wyoming.

M&A Spotlight Shifts from Permian to Bakken, Marcellus

2024-04-29 - Potential deals-in-waiting include the Bakken’s Grayson Mill Energy, EQT's remaining non-operated Marcellus portfolio and some Shell and BP assets in the Haynesville, Rystad said.

C-NLOPB Issues Call for Bids in Eastern Newfoundland

2024-04-29 - Winners of the Call for Bids No. NL24-CFB01 will be selected based on the highest total of money the bidder commits to spend on exploration of a parcel during the first six years of a nine-year license.

Tivoli Midstream Buys Southeast Texas Coast Infrastructure

2024-04-29 - Tivoli Midstream acquired the Chocolate Bayou from Ascend Performance Materials, including storage and land for development.

Phoenix Capital Group Acquires Uinta Basin Royalty Interests

2024-04-29 - Phoenix Capital Group’s acquisition of 1,500 net royalty acres in Duchesne County, Utah, brings the company's investment in the Uinta Basin to more than $60 million, the company said.