After a year of major expansion for Sitio Royalties Corp., including a $4.8 billion merger, the mineral and royalty company is seeking more growth this year.

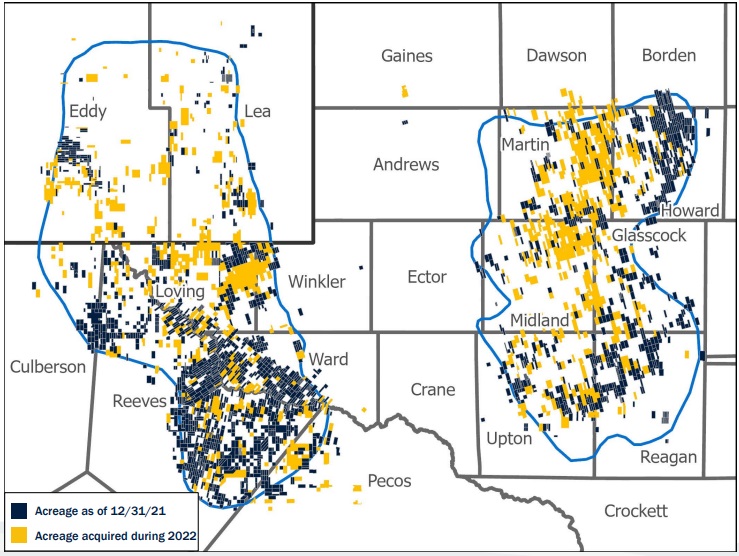

Denver-based Sitio started 2022 as a private company, called Desert Peak, which owned approximately 106,000 net royalty acres in the Permian Basin.

Following a string of acquisitions and a reverse merger with Falcon Minerals last summer, Sitio has emerged as one of the largest public oil and gas mineral and royalty players in the U.S.

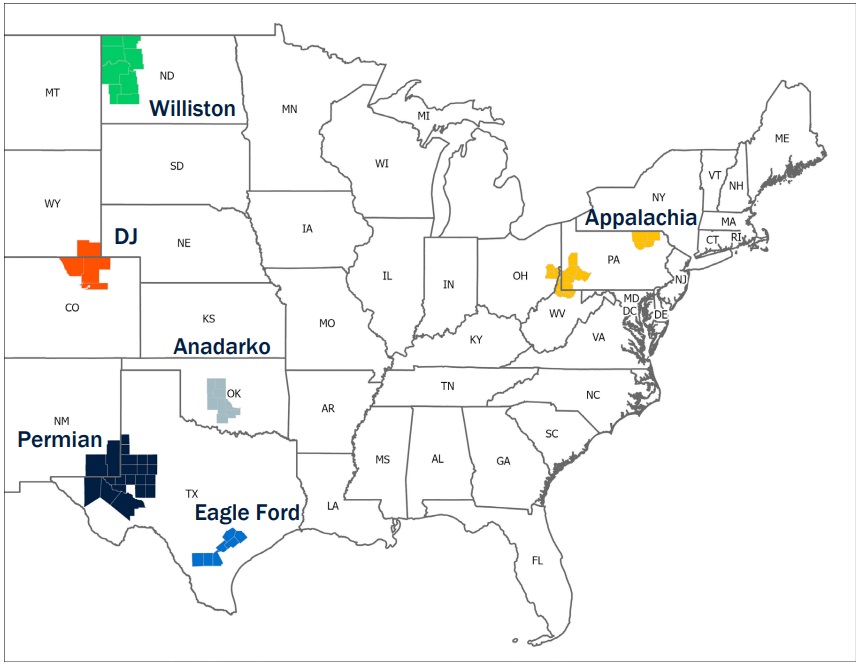

Sitio got a major boost through its $4.8 billion merger with Brigham Minerals Inc. in December, which expanded the company’s footprint in the Permian’s Delaware and Midland basins, the Oklahoma SCOOP and STACK plays, the Denver-Julesburg Basin (D-J Basin) and the Williston Basin.

Sitio’s acquisitions and expansion last year led the company to start 2023 with 260,000 net royalty acres across seven key production basins.

Despite a year of massive growth in 2022, Sitio still wants to get bigger, CEO Chris Conoscenti said on April 10 during the World Oilman’s Mineral & Royalty Conference in Houston.

“The investors are pushing us to get more scale,” Conoscenti said. “We’re still too small to matter to a lot of the investors that we’re targeting.”

RELATED: Sitio, Brigham Close $4.8 Billion Merger

Sitio hunting for scale

Sitio already has a sizable footprint in the mighty Permian — about 70% of the company’s assets are located in the basin.

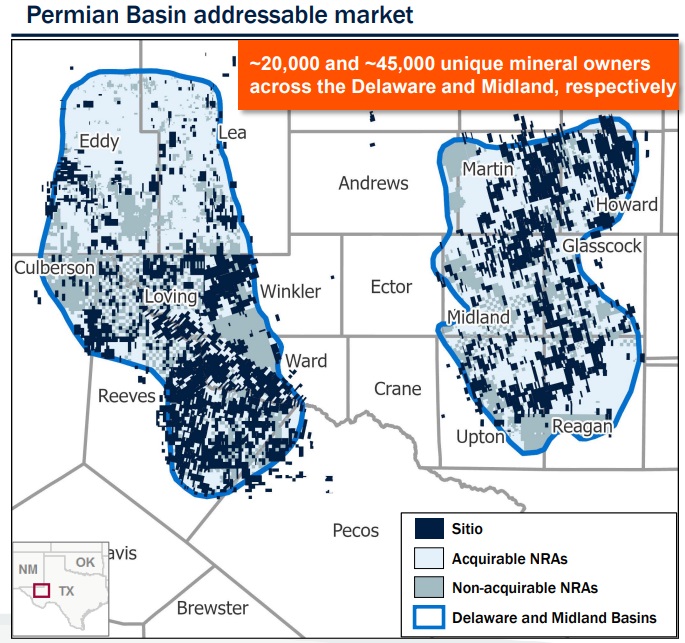

But the Permian remains Sitio’s primary target area for accretive acquisitions. Sitio has identified tens of thousands of unique mineral owners spread across the Delaware and Midland basins with net royalty acreage positions able to be acquired.

As Sitio explores for its next large-scale acquisition, the company will consider deals in most production basins, he said. But, finding attractive M&A opportunities in more mature oil and gas basins has been a challenge for the company.

“I candidly don’t care where the next acquisition geographically is – if it meets our return thresholds,” Conoscenti said. “That said, we’re having a real hard time meeting those return thresholds in basins that are, at best, flatlining — or, at worst, in decline.”

Ultimately, Sitio believes there will be fewer opportunities for large-scale acquisitions this year compared to 2022, the company said in its fourth-quarter 2022 earnings call.

Sitio has made several offers to acquire more mineral assets so far this year, Conoscenti said. But the company hasn’t executed any deals because the bid-ask spread was too wide.

“If attractive consolidation opportunities do not materialize, we will continue to focus on strengthening the balance sheet by paying down our pre-payable debt and building liquidity for when market conditions normalize,” he said on the call.

RELATED: Kimbell Royalty Partners Boosts Midland Basin Position with $143 Million Deal

M&A has record year

Mineral and royalty deals had a banner year in 2022 as transactions reached $6.7 billion, according to data from RBC Richardson Barr.

That’s nearly double the previous high watermark of $3.5 billion in minerals and royalties deals consummated in 2018, RBC said.

The surge in dealmaking followed two rather paltry years in A&D in 2020 ($1.5 billion) and 2021 ($1.1 billion), said Rusty Shepherd, managing director at RBC Richardson Barr, who also spoke at the conference.

Recommended Reading

Darbonne: ‘The Dance’ of US Policy Leaving Energy Mid Slip

2024-08-30 - The 1909 Matisse painting known as “The Dance” demonstrates the outcome of one of the U.S.’ pillars falling down.

Analyst: US NGL Market Tightens Links to Crude, NatGas Production

2024-08-30 - A boost in propane and ethane development is tied to the opening of the Matterhorn Pipeline in the Permian, evidence of the increasingly closer link between different sectors of the energy industry.

EDF Renewables Secures Investment in Solar Energy Storage Project

2024-08-30 - Power Sustainable Energy Infrastructure acquired a 50% stake in EDF Renewables North America’s Desert Quartzite Solar+Storage Project in California.

Energy Transition in Motion (Week of Aug. 30, 2024)

2024-08-30 - Here is a look at some of this week’s renewable energy news, including a more than $2 billion hydrogen and atmospheric gases facility in the works.

Australian Shale Wildcatter Tamboran Spuds First 2-Well Beetaloo Pad

2024-08-30 - Tamboran investor Helmerich & Payne is drilling the 2-mile laterals, while fellow investor Liberty Energy has a frac fleet en route to complete the wells, Tamboran Resources reported.