Riposte Capital LLC, which owns approximately 9.9% of SilverBow’s outstanding shares, found Kimmeridge’s proposal “to be highly compelling." (Source: Shutterstock)

Kimmeridge’s proposed merger with South Texas E&P SilverBow Resources is gaining support from other SilverBow investors.

Riposte Capital LLC, which owns approximately 9.9% of SilverBow’s outstanding shares, found Kimmeridge’s proposal “to be highly compelling,” the New York-based asset manager said in a March 21 statement.

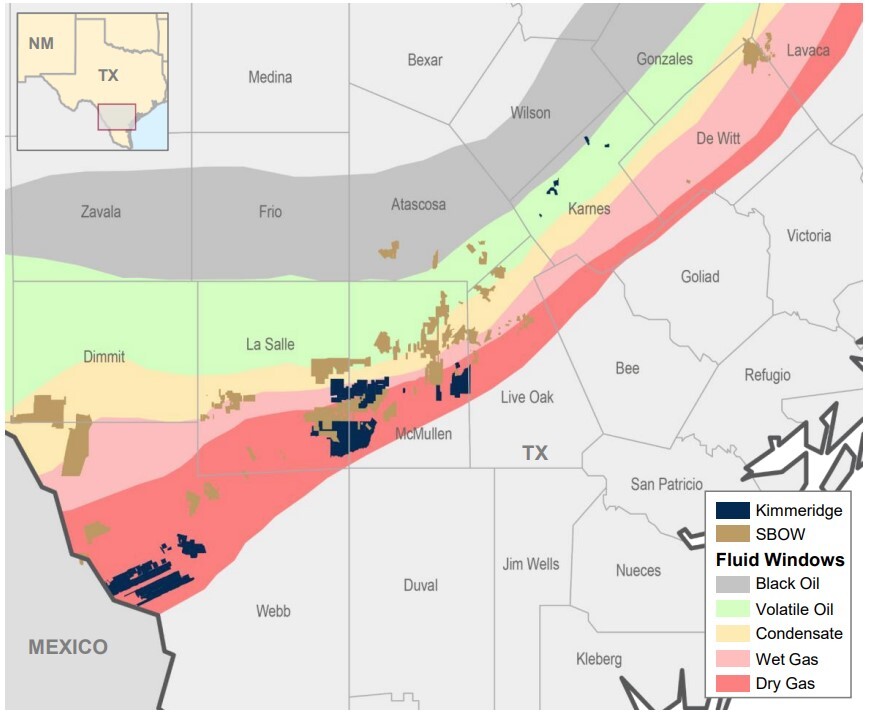

In an open letter issued earlier in March, upstream investor Kimmeridge Energy Management laid out a proposal to combine SilverBow (SBOW) with Kimmeridge Texas Gas (KTG). Both E&Ps have complementary acreage footprints in South Texas near the Texas-Mexico border.

Kimmeridge is offering to contribute KTG’s assets to SilverBow in exchange for 32.4 million SBOW shares, priced at $34 per share. The bid represents a 7% premium to SilverBow’s March 12 closing stock price.

Kimmeridge will also contribute $500 million of equity capital in exchange for shares issued by the combined company. The firm is SilverBow’s largest investor, holding about 12.9% of the E&P’s outstanding shares.

Riposte urged SilverBow to jump on Kimmeridge’s offer.

“The benefits of the transaction are clear: the combined entity would be positioned to lead further consolidation in the region and would be instantly attractive to the public markets given its scale, modest leverage, inventory depth and projected 2025 EBITDA in line with peers,” Riposte wrote in the statement.

Combining KTG with SilverBow would create a South Texas gas player with an average production of 900 MMcfe/d.

Together, the E&P’s footprint would span 370,000 net acres in the Austin Chalk and Eagle Ford Shale.

KTG was formed in 2022 through the acquisition of Laredo Energy Operating. The company produced 202.5 MMcf/d of gas and 2,620 bbl/d of oil and condensate in December 2023, according to Texas Railroad Commission (RRC) data.

The gas production is primarily from Webb County, Texas, in the Eagle Ford’s gas fairway.

SilverBow has also gotten bigger in the area recently. In November, the company closed a $700 million acquisition of Chesapeake Energy’s South Texas assets, adding an average 32,000 boe/d of net production.

“Riposte believes the overwhelming majority of shareholders want the board to seize this opportunity to transform SilverBow for the benefit of all the company's stakeholders,” Riposte said.

Last summer, Riposte publicly pushed SilverBow to explore a sale.

RELATED: Kimmeridge Fast Forwards on SilverBow with Takeover Bid

When activists activate

Kimmeridge’s activist investor campaign with SilverBow has played out publicly and, at times, in dramatic fashion.

The investment firm says it has “sought to engage in a constructive dialogue” with the SilverBow board about a proposed combination—but that its efforts have been consistently dismissed.

In February, Kimmeridge asked for three seats on the SilverBow board and to remove one board member.

In a March 1 response, SilverBow alleged that Kimmeridge had a “hidden self-serving agenda.”

“We believe the launch of this proxy fight is a next step in a nearly two-year effort on the part of Kimmeridge to force a merger with Kimmeridge Texas Gas (formerly Laredo Energy) … on terms unfavorable to SilverBow and its shareholders,” SilverBow’s board wrote in a March 1 shareholder letter.

Discussions between SilverBow and Kimmeridge around combining SilverBow and KTG began in July 2022. That September, SilverBow proposed combining with the KTG assets.

SilverBow’s offer was rejected by Kimmeridge, “driven primarily by differences in valuation that resulted from the pullback in natural gas prices from the time Kimmeridge agreed to purchase the KTG assets.”

Kimmeridge later proposed an all-cash, take-private deal with SilverBow in February 2023; the parties reached a verbal agreement to pursue the transaction, SilverBow said in a regulatory filing.

But Kimmeridge “ultimately abandoned the transaction after they were unable to secure the requisite financing—despite their written proposal expressly stating that there were no financing contingencies,” SilverBow wrote.

Riposte similarly claimed that SilverBow has “repeatedly” ignored shareholders’ interests in its own letter.

Riposte pointed to SilverBow adopting a “poison pill” provision in September 2022 after Kimmeridge disclosed its acquisition of over $100 million in SilverBow shares.

Adopting the poison pill 18 months ago “has only alienated the company from the public domain and deterred prospective shareholders from investing,” Riposte wrote.

RELATED: SilverBow ‘Poison Pill’ Attempts to Fend Off Possible Kimmeridge Takeover

Recommended Reading

President: Financial Debt for Mexico's Pemex Totaled $106.8B End of 2023

2024-02-21 - President Andres Manuel Lopez Obrador revealed the debt data in a chart from a presentation on Pemex at a government press conference.

Kimmeridge Fast Forwards on SilverBow with Takeover Bid

2024-03-13 - Investment firm Kimmeridge Energy Management, which first asked for additional SilverBow Resources board seats, has followed up with a buyout offer. A deal would make a nearly 1 Bcfe/d Eagle Ford pureplay.

M4E Lithium Closes Funding for Brazilian Lithium Exploration

2024-03-15 - M4E’s financing package includes an equity investment, a royalty purchase and an option for a strategic offtake agreement.

Laredo Oil Subsidiary, Erehwon Enter Into Drilling Agreement with Texakoma

2024-03-14 - The agreement with Lustre Oil and Erehwon Oil & Gas would allow Texakoma to participate in the development of 7,375 net acres of mineral rights in Valley County, Montana.

California Resources Corp. Nominates Christian Kendall to Board of Directors

2024-03-21 - California Resources Corp. has nominated Christian Kendall, former president and CEO of Denbury, to serve on its board.