E&P investor Kimmeridge Energy Management is offering $34 per SilverBow Resources share, asking the South Texas E&P’s shareholders to do a deal by April 26.

The bid, a 7% premium to SilverBow’s March 12 closing stock price, is elevated from a February request for three board seats that met with a damning reply from SilverBow.

SilverBow shares closed at $31.72 pre-announcement; the company’s 30-day average was $28.12. At opening on March 13, after Kimmeridge’s offer went public, shares were trading at $32.85 per unit.

On March 13, SilverBow confirmed receiving the Kimmeridge proposal in which it offers to contribute the assets of Kimmeridge Texas Gas (KTG) and $500 million of cash in exchange for shares issued by the combined entity.

“Following the proposed transaction, Kimmeridge would control a supermajority of the combined company, including the shares currently held by Kimmeridge, with the remaining shares held by public shareholders,” SilverBow said in a press release.

SilverBow said it would “carefully review and consider the proposal to determine the course of action that it believes is in the best interest of the company and all of its shareholders.”

SilverBow noted that it has engaged extensively with Kimmeridge, consistent with its goal of maximizing shareholder value, beginning in August 2022. On March 1, 2024, the company disclosed its history of engagement and negotiation with Kimmeridge on Form 8-K filed with the Securities and Exchange Commission.

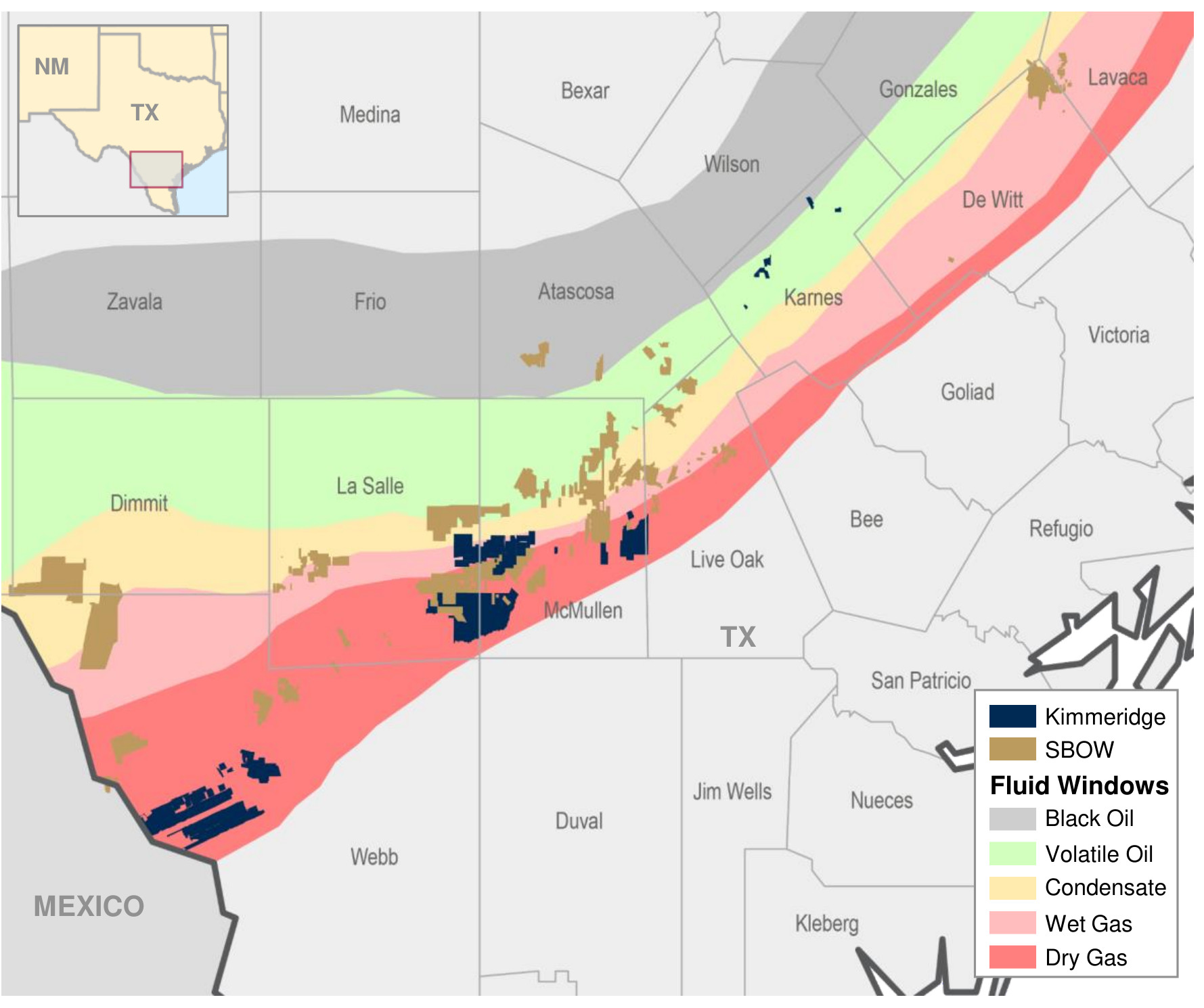

Kimmeridge’s proposed merger of its South Texas E&P KTG with SilverBow would grow production to 900 MMcfe/d across 370,000 net acres. The combined company would hold 5 Tcfe of proved reserves and 1,600 well locations.

Separately, Kimmeridge is looking to cover a 267 MMcf/d LNG-supply deal. SilverBow (SBOW) currently produces some 476 MMcf/d. KTG produces 315 MMcfe/d, 85% gas.

KTG has an enterprise value of $1.42 billion, according to Kimmeridge. The investment firm would get 32.4 million SilverBow shares for the KTG property.

For the additional $500 million cash investment, Kimmeridge would get 14.7 million SBOW shares. At closing, it would hold 50.3 million SBOW shares. The cash infusion would be used to reduce SilverBow’s debt.

Ben Dell, a Kimmeridge co-founder and managing partner, wrote before markets opened March 13, “We believe all shareholders will benefit from the opportunity to participate in the compelling upside of a larger and more resilient company that is uniquely positioned to drive growth and lead the next phase of consolidation in the Eagle Ford.”

Kimmeridge holds 12.9% (3.3 million) of SBOW shares currently. Additional large shareholders include Riposte Capital (9.7%), BlackRock Inc. (5.9%), State Street (4.15%) and Strategic Value Partners (1.5%), according to Securities and Exchange Commission filings.

KTG holds 148,000 net acres in the Eagle Ford play, neighboring SilverBow in some areas.

“If SilverBow is as committed to hearing the perspectives of shareholders as it purports to be, then it will be open to the following proposed process,” Dell wrote.

He added, “Contrary to what the SilverBow board would have you believe, Kimmeridge's focus throughout our engagement has squarely been on putting forward a highly compelling transaction that paves the way for value creation for all.”

Kimmeridge said its advisers include Barclays and RBC Capital Markets.

The first offer

Kimmeridge’s February ask was for three seats and to remove one board member.

SilverBow’s board replied March 1 that Kimmeridge had a “hidden self-serving agenda.”

"We believe the launch of this proxy fight is a next step in [Kimmeridge’s] nearly two-year effort … to force a merger with KTG on terms unfavorable to SilverBow and its shareholders,” the board wrote to investors at the time.

On Feb. 29, SilverBow’s market cap was $724 million, while the shares were $28.10. The trailing-12-month price-to-earnings ratio was 2.34; price to book, 0.69; profit margin, 86.33%; debt-to-capital, 48.53%; and annual revenue of $652 million, according to Fidelity.

Kimmeridge’s year-end 2023 holdings also included California Resources, which is buying Aera Energy; Chesapeake Energy and Southwestern Energy, which are merging; Enerplus Corp., which is merging into Chord Energy and which Kimmeridge’s SilverBow board nominee Doug Brooks formerly led; and Civitas Resources.

Kimmeridge wrote March 13 that SilverBow would begin throwing off cash to shareholders in 2025 under its plans for the E&P and Kimmeridge would have five of nine board members.

As an example of Kimmeridge’s past E&P consolidation, he pointed to the Kimmeridge-led formation of Rockies and Permian-focused Civitas Resources—an amalgamation of several E&Ps that has grown from a $1.2 billion operator to $7 billion today.

Recommended Reading

Oceaneering Won $200MM in Manufactured Products Contracts in Q4 2023

2024-02-05 - The revenues from Oceaneering International’s manufactured products contracts range in value from less than $10 million to greater than $100 million.

E&P Highlights: Feb. 5, 2024

2024-02-05 - Here’s a roundup of the latest E&P headlines, including an update on Enauta’s Atlanta Phase 1 project.

CNOOC’s Suizhong 36-1/Luda 5-2 Starts Production Offshore China

2024-02-05 - CNOOC plans 118 development wells in the shallow water project in the Bohai Sea — the largest secondary development and adjustment project offshore China.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

US Drillers Add Oil, Gas Rigs for Third Time in Four Weeks

2024-02-09 - Despite this week's rig increase, Baker Hughes said the total count was still down 138 rigs, or 18%, below this time last year.