Shell’s strategy has not changed as the company remains focused on delivering more value with less emissions, Shell New Energies US CEO Glenn Wright said this week, addressing unease about its position in the energy transition.

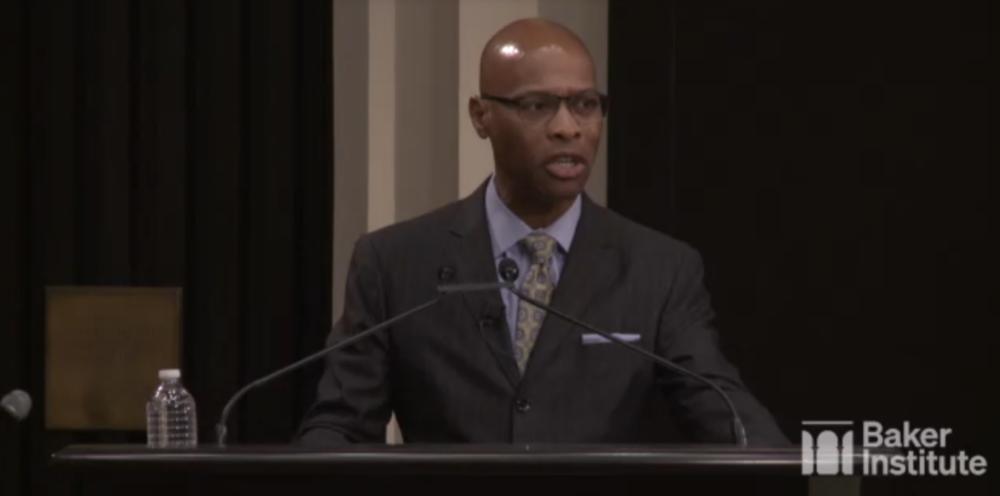

“In order for that to be a reality, it’s imperative that what we do is both economically viable, socially acceptable and environmentally sustainable,” Wright said Oct. 5 during an event co-hosted by the Baker Institute Center for Energy Studies and Baker Botts LLC in Houston. “Those are the three legs of the stool. If any one of those legs fails, the solution fails. So, our aim … is to continue our work and to decarbonize profitably.”

The comments were delivered in response to concerns that the supermajor was scaling back investments in renewable energy. Focused on increasing returns, Shell said it will hold oil output steady through 2030, having hit a lowered oil production target early through divestments.

Shell, which is targeting net-zero emissions by 2050, continues progress on providing cleaner energy solutions as energy demand rises, Wright said, pointing out how the company is repurposing the footprint of its energy and chemical parks. Shell’s low-carbon investment plans include investing between $10 billion and $15 billion through 2025 in areas such as biofuels, hydrogen, electric vehicle charging and carbon capture and storage.

“In my business, we will continue to invest in power opportunities, but we will do so in areas and spaces where it makes economic sense to do so and where we are incentivized to do so,” Wright said.

Energy companies, including Shell, are under pressure to not only provide affordable energy safely and lower emissions, but also increase returns for the shareholder. However, inflationary pressure and supply chain issues have posed obstacles, especially for offshore wind.

While the company has pulled out of some wind projects, including two wind projects offshore Ireland, it has powered forward with other investments. These have included the acquisitions of renewable natural gas company Nature Energy and Sprng Energy, a solar and wind power supplier, as well as starting construction on one of Europe’s largest renewable hydrogen plants.

The renewables investment comes alongside continued oil and gas production.

Protecting the core

Determining where to invest capital is probably the biggest question in boardrooms today, said Michael LaMotte, senior managing director for Guggenheim Securities. Speaking about E&Ps’ limited capital investment and moves to pay down debt and pay dividends, he said companies in the industry should protect the core first.

“Identify that and focus on it because that’s where all that cash comes from at the end of the day,” said LaMotte, who spoke on a separate panel. “The return on your capital is going to be enhanced if you improve the efficiency of the operations in and around that core.”

It is also important to think about creating long-term value. Despite views on the pace of the transition, the “transition is here and we are in it.” He spoke of the need for companies to leverage core competencies into new energies.

Many are doing just that. Think Occidental Petroleum Corp. in the carbon management space.

“[It’s] really important how to think about taking what feels like a liability, what feels like a compliance cost to the business, and flip it on its head and say, ‘okay, this is actually a new business opportunity,’” LaMotte said, acknowledging the core is not leaving anytime some.

Sharing similar sentiments as Wright, LaMotte added that investments must be economic with focus on obligations to shareholders to generate a return.

“But it also has to be cleaner. It’s striking that balance” between protecting the core and focusing on something new and cleaner to leverage competitive advantages.

By 2050, the world’s population is expected to exceed 9 billion, nearly 2 billion more people than today, Wright said. Energy demand will likely double.

“We must find ways to profitably decarbonize. I cannot emphasize that enough. We aim to decarbonize, but we must do so profitably,” Wright said. “And we must work closely with others in new ways because we can only reach net zero if society reaches it, too.”

Pumping up power

The most profound change and fastest growth will happen in the power sector, according to Wright. Shell deepened its position in the renewable power space with its 2021 acquisition of Savion, a large utility-scale solar and battery energy storage developer, and the 2022 launch of its residential retail business in Texas. The company manages more than 8 gigawatts of power generation across North America.

“Electricity is far and away the easiest energy source to decarbonize. Every energy consuming sector, which is everybody from road transport to home and commercial heating and cooling, to manufacturing and major industrial processes, is actively pursuing electrification in some fashion,” Wright said.

Like others in energy, he says reform is needed—particularly regarding access to interconnections and transmission reform—as more renewable energy lines up to flow to the grid.

“FERC Order 2023 starts to help us in this regard. … How this will play out will continue to unfold, but it will encourage and allow quicker access to bring renewables online,” Wright said. “We also need to ensure that the market design encourages resource adequacy. We can encourage certainly the development of renewables. What's important is that these assets are located in the right places at the right time.”

Power grids in parts of the U.S.—including the Electric Reliability Council of Texas—experienced stress this summer amid high demand and temperatures, which prompted some conservation alerts.

“As we see more and more renewables come onstream, we need more and more resources that can provide ancillary services that can help firm those renewables and ensure that the grid continues to operate,” Wright said.

Recommended Reading

CEO: Coterra ‘Deeply Curious’ on M&A Amid E&P Consolidation Wave

2024-02-26 - Coterra Energy has yet to get in on the large-scale M&A wave sweeping across the Lower 48—but CEO Tom Jorden said Coterra is keeping an eye on acquisition opportunities.

Permian E&P Midway Energy Partners Secures Backing from Post Oak

2024-02-09 - Midway Energy Partners will look to acquire and exploit opportunities in the Permian Basin with backing from Post Oak Energy Capital.

Why Endeavor Energy's Founder Sold His Company After Years of Rebuffing Offers

2024-02-13 - Autry Stephens', the 85-year-old wildcatter, decision to sell came after he was diagnosed with cancer, according to three people who discussed his health with him.

E&P Earnings Season Proves Up Stronger Efficiencies, Profits

2024-04-04 - The 2024 outlook for E&Ps largely surprises to the upside with conservative budgets and steady volumes.

JMR Services, A-Plus P&A to Merge Companies

2024-03-05 - The combined organization will operate under JMR Services and aims to become the largest pure-play plug and abandonment company in the nation.