The Lower 48 has been impacted by winter storms in early 2024, impacting gas production in the U.S. (Source: Shutterstock)

Rystad Energy sees little support for Henry Hub gas prices in coming weeks as dry gas production starts to rise following the Jan. 17 Arctic freeze that impacted all of the Lower 48.

Front-month prices are around $2.60/MMBtu compared to $2.70/MMBtu a week ago, and dry gas production is up after falling 7.9% during the week of Jan. 10-17, Rystad Vice President Kaushal Ramesh wrote Jan. 25 in a research report.

In Europe, Title Transfer Facility (TTF) prices reached $8.7/MMBtu compared to $8.8/MMBtu a week ago, while in Asia spot prices fell to $9.2/MMBtu compared to $9.6/MMBtu as demand in East Asia stays muted.

The U.S. National Weather Service (NWS) expects above average temperatures across most of the U.S. in coming days due to a new active wet weather pattern, the agency said Jan. 25 in a press release on its website.

Rystad says gas price movements have been limited due to fluctuating feedgas intake at U.S. LNG facilities which have averaged 13.8 Bcf/d to date in January compared to 14.65 Bcf/d in December.

“However, the near-term Henry Hub forward curve suggests the incentive to maximize production remains in place—full cost deliveries to Europe and East Asia total $6.5/MMBtu and $8/MMBtu, respectively—which we expect will provide immediate support to LNG prices in both regions,” Ramesh said.

Red Sea geopolitical risk

The recent deterioration in the security situation in the Red Sea, where Yemen-based Houthi militia in support of Palestine have disrupted global trade, poses a geopolitical risk to LNG prices, according to Oslo-based Rystad.

As a result, Qatar Energy has halted shipments through the Red Sea from mid-January and is rescheduling shipments with European buyers, according to Rystad.

An extended blockage of the route through the Red Sea from the Middle East poses an LNG supply risk to Europe, and Rystad expects the price impact to be delayed until Europe’s gas storage is further depleted.

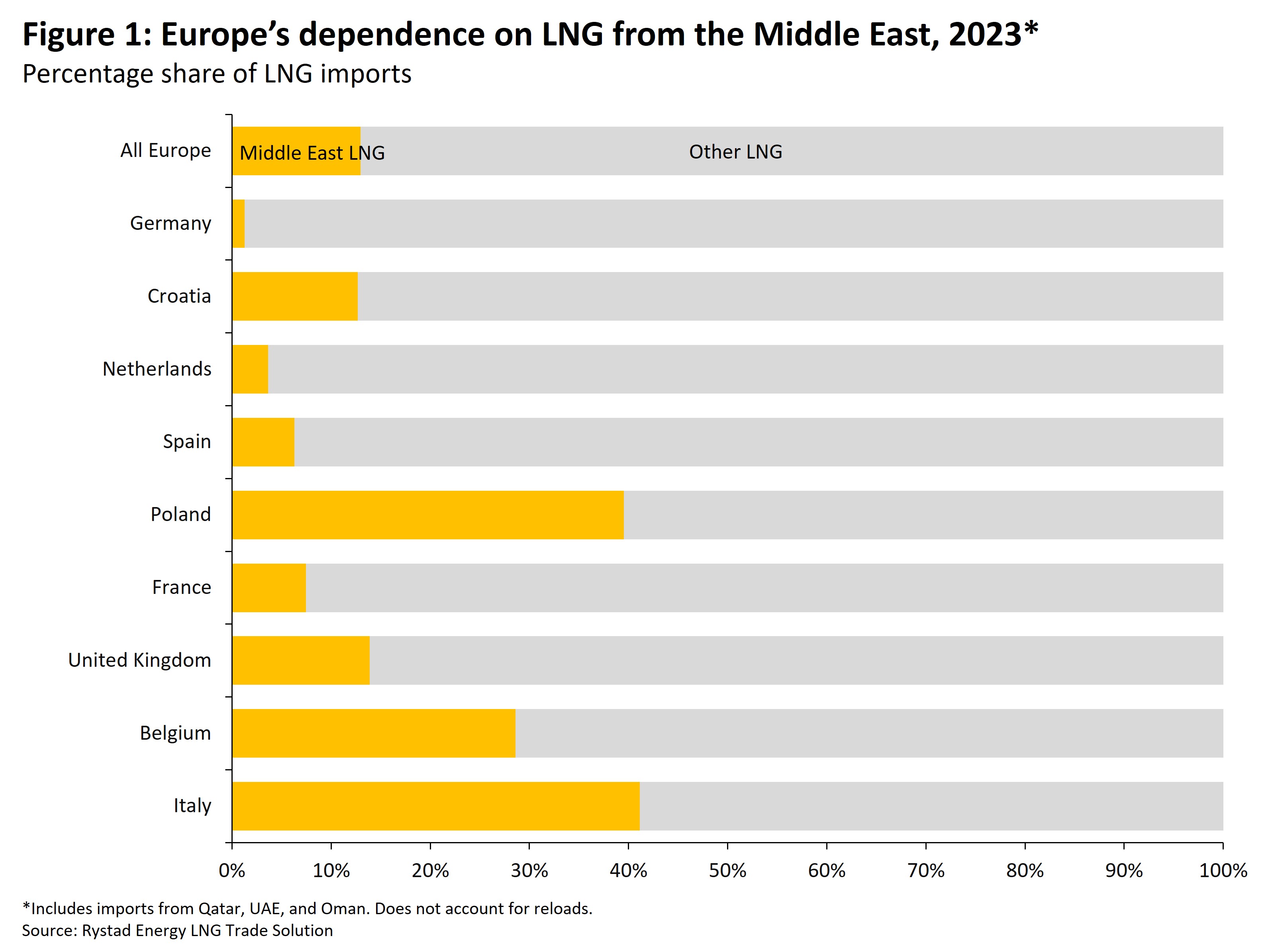

Around 15.5 million tonnes of LNG was sent through the Red Sea from the Middle East to Europe in 2023, representing 12.9% of the continent’s LNG supply last year, according to Rystad figures.

“However, it will take an increase in LNG prices before we see an increase in charter rates—more than 70 vessels could be delivered this year, representing fleet growth of more than 10%, whereas LNG production will only grow 3%,” Ramesh said. “It is unclear if the prospect of sustained additional voyage time would be acceptable to Qatar, or the prospect of lost canal fees would be acceptable to Egypt.”

Recommended Reading

AI in Oil: Revolution’s Coming, but Tech Adoption Remains Tentative

2024-04-05 - CERAWeek experts say AI will disrupt oil and gas jobs while new opportunities will emerge as the industry braces for an AI-driven workflow transformation.