Installation of wind turbines at sea can only be done when there are few waves and winds. (Source: Shutterstock)

Offshore wind players working to strengthen the sector, including in the U.S., have faced supply chain hurdles, higher inflation and rising interest rates — and more challenges may be in store.

Nevertheless, as some companies reset plans, canceling power purchase agreements and projects amid rising construction costs, German multinational RWE has weathered the storm. Speaking during the company’s capital markets day, CEO Markus Krebber said not one of RWE’s projects under development has experienced economic difficulties.

The company, which has exceeded earnings guidance for three consecutive years, called its strategy “resilient in a challenging environment,” pointing to its integrated business model with flex and firm generation, inflation-linked revenue streams and a pro-active procurement blueprint for challenging the supply chain.

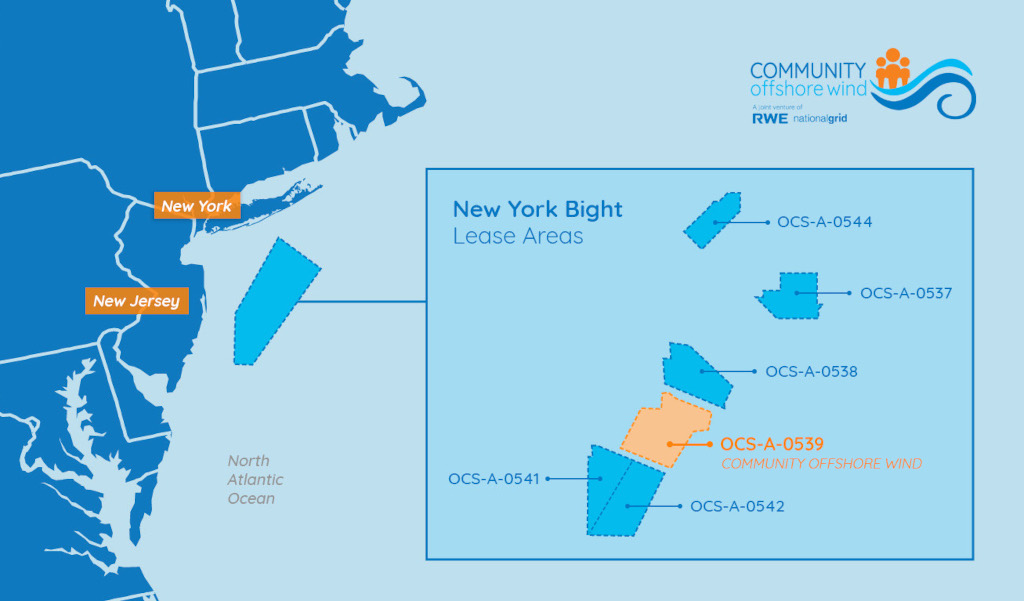

One of RWE’s targets is to raise 10 gigawatts (GW) of offshore wind capacity by 2030. The projects include the Community Offshore Wind in the New York Bight, which has a potential 3-GW capacity. The company is also moving toward development of floating wind offshore California and wind offshore Louisiana in the U.S. Gulf of Mexico.

Velda Addison, Hart Energy Senior Editor, Energy Transition, spoke with Sam Eaton, CEO of RWE Offshore Wind Holdings about the company’s strategies, challenges and offshore wind’s value proposition.

Velda Addison: RWE recently announced plans to invest about $60 billion worldwide and expand its green portfolio through 2030. What are the company’s plans for the approximately $22 billion set aside for the U.S.?

Sam Eaton: It was a very exciting announcement in [late November] around our Capital Markets Day to update our growing green strategy to invest what we say €55 billion, about US$60 billion today, in developing clean energy solutions around the world. And of that, about US$22 billion, or €20 billion, is set aside for the U.S. and that will be focused on expanding our leading positions in onshore and offshore renewables here in the U.S.

Importantly, as you may know, over the last couple of years, we’ve had a lot of success as both the fastest growing offshore wind developer in the U.S. and that’s coupled with also creating a position where we’re the fourth largest renewables company in the U.S. and the second largest solar developer here in the U.S.

VA: In recent years, the offshore wind sector has faced some supply chain delays and higher costs. What do you think are the biggest challenges ahead, looking at 2024, and beyond, for U.S. offshore wind and how is RWE addressing the challenges?

SE: Just to put it in context, let’s not forget that as we started this year, the U.S. in general had seven turbines spinning in the water. So, put that into context. RWE globally operates and maintains over 1,000 turbines. With that, you can really see that we’re just at the beginning of a nascent industry. By the end of 2023, you’ll have a double—maybe triple—of that capacity online. And by next year you might see 100 turbines, or thereabout, online. But a lot of growth that is ahead of us and a lot of opportunity that comes with that. For us, what we’re really focused on is we see the long-term fundamental case around why the U.S. needs offshore wind in order to add much needed domestic energy capacity and reduce emissions. But we have to be laser focused on executing our plans and delivering these projects successfully, putting steel in the water. And you can see that right now, just with the first couple of projects entering service in 2023 and starting to deliver power in the last month to the grid and more to come later this year. With that, you’re delivering jobs. You’re delivering investment in the nation’s ports and the supply chain; that really starts to build the foundation, which the offshore wind industry will be able to take off.

We at RWE are very focused on that value proposition, and that’s why we’ve been given the confidence to continue to invest in the offshore wind industry and where we have 25, 30 years of experience operating these projects, building these projects in Europe, combined with what we’re seeing in results already in the first projects [gives us] confidence to continue to make those investments. If you look at our success record overseas, we’ve been one of the few that continues to be able to take FID [final investment decision] on new projects. We’ve also been able to successfully complete projects in recent years. And with that, we will continue to leverage that experience as we build the platform here in the U.S.

VA: You mentioned the value proposition. Can you tell me a little bit more about offshore wind value proposition for RWE?

SE: Absolutely. First and foremost, it’s important to remember this is domestic energy. We’re reinvesting in the nation’s ports and in many cases in port facilities that haven’t received substantial investment in decades — if not a century or more — in order to be able to support the industry. We’re investing in and chartering ships in U.S. shipyards. Sometimes the first of a class that’s ever been built here in the U.S., and we’re employing thousands of U.S. workers in order to build that industry. It doesn’t get much more domestic in energy technology than that.

On top of that, you then get the added benefit of clean energy that comes with building offshore wind. And I think there’s an interesting statistic just to put in context of how important this industry is becoming to the U.S. Over 4,000 companies in the U.S. in 47 different states have already signed contracts to supply components or services to the offshore wind industry.

VA: What do you think are the must haves today to help scale the industry and to do so cost effectively?

SE: First, we’ve got a good foundation as the industry has started to come about and with the framework of the Inflation Reduction Act. We need to continue that momentum by putting reforms in place or modernizing the permitting regime to be able to handle a 21st century energy system. We shouldn’t forget that the current framework we use to permit projects across the economy, not just offshore wind projects, but all types of infrastructure was created over 50, 60 years ago and continued to be refined 20, 30, 40 years ago. That needs to be updated to reflect the challenges we see in effectively rewiring the nation’s economy for the 21st century.

With that, we also have to see continued investment and commitment to those investments across the industry both here in the U.S. East Coast as well as out on the West Coast, where we’re seeing the floating offshore wind market really get started and some important first steps that were taken out there with [California] legislation AB 1373 to create a market framework for offshore wind.

VA: Like you mentioned, RWE has been in the business for a while. The company has been in offshore wind for more than 20 years and is considered a pioneer in floating offshore wind. Given RWE’s experience and expertise across the entire value chain, what lessons does RWE have to offer the U.S. for growing a strong wind business generally, and more specifically for floating wind?

SE: Where we really have been successful across our portfolio in all technologies is being a strong partner with federal and state governments to design energy solutions that help them meet their energy reliability, energy security and clean energy goals. And with that, we think we have a strong framework or model that we can bring to each of these markets to partner with those state and federal governments to meet their goals. Beyond that, we also look at the innovation that we’re driving to create sustainability within the industry.

You can see where we have been pioneers on things like green steel and recyclable wind turbine blades. We’re the first in the industry to use recyclable turbine blades in our projects such as Sofia and Kaskasi and the under-construction project Thor. Just as importantly, we’ve taken the decision to start to bring greener steel into some of those projects.

On the floating side, we set out very strategically, very deliberately several years ago to make sure that we created a leadership position in floating offshore wind. Globally, we see a 250 GW opportunity in that space, and therefore, having that expertise is critical to our continued growth. With that, we’ve got two floating demonstration projects currently in the waters off of Europe: one off the coast of Norway and off the coast of Spain, which are providing a tremendous amount of real-world experience that we will then use to refine and better our plans in commercially developing markets like California. There’s a lot of really interesting, very technical questions that we’re being able to develop the answers to through that experience. That will play a pivotal part in our ability to bring that technology to a commercial scale in new markets like California.

VA: Renewable energy companies like RWE have responded to calls for more clean energy, both offshore and onshore. But the nation’s grids haven’t kept up pace. What steps should be taken to help improve the situation in your opinion?

SE: Well, I think No. 1 goes back to the conversation we had earlier about modernizing our permitting framework to recognize the challenges that we now face in truly rewiring this nation. The current grid was built around a hub-and-spoke network that was designed effectively in the ‘40s, ‘50s and ‘60s and a little bit in the ‘70s and then expanded from there in the ‘80s and ‘90s. Now, we’re turning that paradigm on its head by moving where we’re going to produce power to the outer edges of that network, and where it’s being consumed is either in similar demand centers or in some cases all new demand centers. That will require the infrastructure to boot the power, and the permitting regime has to keep up with those changes in the economy.

VA: Looking at the resources in the Gulf of Mexico, what is the region’s appeal for offshore wind development for RWE?

SE: No. 1 goes back to what is the industrial demand outlook both in this decade and into the 2030s and the ability to serve that demand with clean energy technologies. Today, the demand can be met with solar, but as that continues to grow, with literally 10s of thousands of new jobs being offered by industrial companies moving to that region, they will have to bring in other sources of clean energy to meet that demand. That will be where offshore wind plays its role. It is the only gigawatt class resource that is available near the load centers of the demand centers in Louisiana to meet that demand at this kind of scale.

VA: Can you provide an update on your Community Offshore Wind project in the New York Bight? What's the status?

SE: It’s a very exciting project that has really done quite some remarkable items over the last couple of years in terms of community engagement and really setting up the model for what it takes to successfully engage with communities like New York and the communities around Brooklyn. We are in the process of doing our technical development and considering routing options. We’ve had vessels out in the water for a better part of a year now doing our site surveys. But probably most importantly and most excitingly, we have just recently been awarded provisionally a 1.3-GW contract with the state of New York to begin commercializing the offtake of that project. We’ll then be looking for other opportunities to commercialize the remaining more than 2½ GW that we see in the lease. We look forward to working with states like New York and New Jersey on those opportunities throughout 2024 and 2025.

VA: What about offshore California with the floating wind lease area? It’s been about a year since you were awarded that lease.

SE: That market is early on in developing. As I mentioned earlier, the state took a very remarkable step earlier this year [2023] to put in place a legislative framework to create the market to sell floating offshore wind power into the California power market. We’re now working with the state to help define how that will be implemented as well as engaging with our local community around the Humboldt County area, both in Arcata, Eureka and other municipalities, to understand what the stakeholders are looking for with floating offshore wind and how we can best design a project that meets both the needs of the state as well as satisfactory to the local community and the tribal nations.

VA: Are there any other areas of energy that pique your interest offshore such as carbon storage or hydrogen?

SE: We as a company are focused on the long-term potential of hydrogen to be integrated into a clean energy economy. We have a number of demonstration projects both tied to offshore wind as well as other technologies that are underway in Europe, and we’re actively looking for opportunities in the U.S. But first and foremost is delivery on the strategy that we have announced around growing [wind] including the delivery of our offshore wind projects that we just talked about.

VA: Are there any other messages that you wanted to share?

SE: I think it’s very important to recognize that offshore wind really is getting its feet underneath it today. And with that, you’re seeing the fruits of the labor of the last number of years get the industry started with the first projects delivering power and states like New York taking the necessary commitment to keep the industry moving. We look forward to now delivering on these projects in the coming years.

Recommended Reading

TechnipFMC Eyes $30B in Subsea Orders by 2025

2024-02-23 - TechnipFMC is capitalizing on an industry shift in spending to offshore projects from land projects.

Green Swan Seeks US Financing for Global Decarbonization Projects

2024-02-21 - Green Swan, an investment platform seeking to provide capital to countries signed on to the Paris Agreement, is courting U.S. investors to fund decarbonization projects in countries including Iran and Venezuela, its executives told Hart Energy.

BP Pursues ‘25-by-‘25’ Target to Amp Up LNG Production

2024-02-15 - BP wants to boost its LNG portfolio to 25 mtpa by 2025 under a plan dubbed “25-by-25,” upping its portfolio by 9% compared to 2023, CEO Murray Auchincloss said during the company’s webcast with analysts.

Sunoco’s $7B Acquisition of NuStar Evades Further FTC Scrutiny

2024-04-09 - The waiting period under the Hart-Scott-Rodino Antitrust Improvements Act for Sunoco’s pending acquisition of NuStar Energy has expired, bringing the deal one step closer to completion.

BP’s Kate Thomson Promoted to CFO, Joins Board

2024-02-05 - Before becoming BP’s interim CFO in September 2023, Kate Thomson served as senior vice president of finance for production and operations.