Ring Energy recently divested acreage in the Permian Basin as the E&P works to shore up its balance sheet and reduce debt. (Source: Shutterstock.com)

Ring Energy recently divested acreage in the Permian Basin as the E&P works to shore up its balance sheet and reduce debt.

The Woodlands, Texas-based Ring Energy sold its non-core asset position in the Permian’s Delaware Basin to an unidentified private buyer, the company disclosed in a July 5 news release.

The divested Delaware assets included recent average production of approximately 240 boe/d (85% oil). Ring generated net proceeds of about $7.8 million through the sale. The deal, completed during the second quarter, has an effective date of March 1, 2023.

As Ring continues to pay down debt and focus its development efforts on its core operating areas in Texas, the company is also looking to sell operated assets in New Mexico.

Ring had more than 18,000 net acres and an average production of 279 boe/d in its Delaware Basin position as of the end of 2022, according to Securities and Exchange Commission filings.

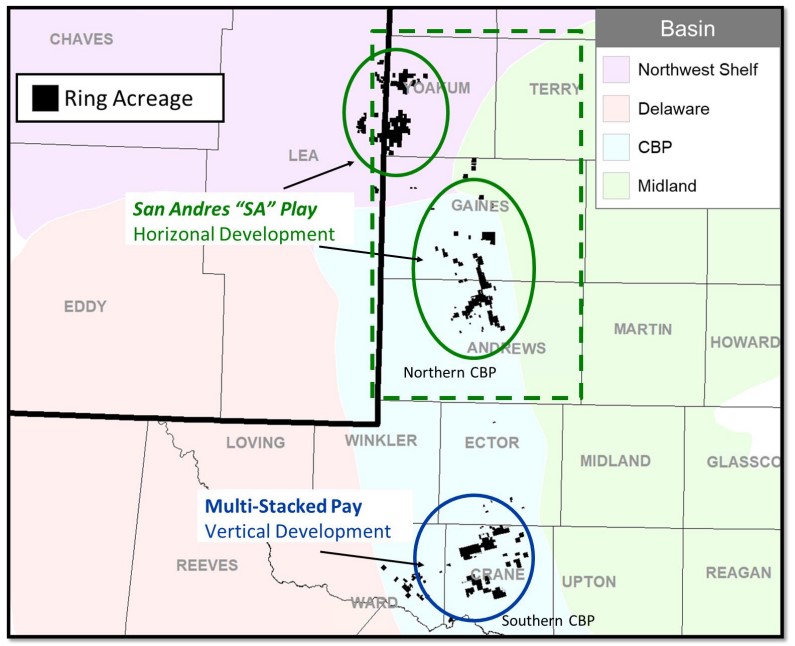

“This sale emphasizes our focus on building and developing our core positions in the Northwest Shelf and Central Basin Platform that continue to generate significant returns for our shareholders,” said Paul D. McKinney, chairman and CEO of Ring.

Ring’s New Mexico assets up for sale include 5,180 net acres and an average production of approximately 300 boe/d (93% oil), Ring said.

Ring focuses most of its operations in the Permian’s Central Basin Platform and Northwest Shelf.

The company added scale to its Central Basin Platform position through a $465 million acquisition of Warburg Pincus-backed Stronghold Energy II last year.

The deal with Stronghold added approximately 37,000 net acres—primarily in and around Crane County, Texas—and production of about 9,100 boe/d (54% oil, 75% liquids).

RELATED: Anatomy of a Deal: Ring Energy’s Conventional Wisdom

Debt reduction

Ring used some of the excess cash flow from the Delaware sale to help reduce borrowings under the company’s credit facility.

Ring reduced debt by $25 million during the second quarter—to $397 million in outstanding borrowings compared to $422 million during the first quarter.

The E&P recently reaffirmed its borrowing base at $600 million under a $1 billion senior revolving credit facility. An undisclosed number of banks led by Truist Financial Corp. made the reaffirmation.

The company aims to continue reducing its debt load during the second half of the year, depending on hydrocarbon prices, market conditions and Ring’s capital spending plans.

Ring lowered its leverage ratio from 3.5x at the end of 2021 to 1.65x by first-quarter 2023, the company said in its latest earnings report. As of early May, Ring’s leverage ratio was estimated to be around 1.5x, according to an investor presentation.

As the company works to strengthen its balance sheet, Ring is also keeping an eye open for accretive acquisition opportunities in the Permian Basin, McKinney said in an interview with Hart Energy earlier this year.

RELATED: Ring Energy Borrowing Base Reaffirmed at $600 Million

Recommended Reading

CEO: Continental Adds Midland Basin Acreage, Explores Woodford, Barnett

2024-04-11 - Continental Resources is adding leases in Midland and Ector counties, Texas, as the private E&P hunts for drilling locations to explore. Continental is also testing deeper Barnett and Woodford intervals across its Permian footprint, CEO Doug Lawler said in an exclusive interview.

For Sale, Again: Oily Northern Midland’s HighPeak Energy

2024-03-08 - The E&P is looking to hitch a ride on heated, renewed Permian Basin M&A.

Barnett & Beyond: Marathon, Oxy, Peers Testing Deeper Permian Zones

2024-04-29 - Marathon Oil, Occidental, Continental Resources and others are reaching under the Permian’s popular benches for new drilling locations. Analysts think there are areas of the basin where the Permian’s deeper zones can compete for capital.

Chevron Hunts Upside for Oil Recovery, D&C Savings with Permian Pilots

2024-02-06 - New techniques and technologies being piloted by Chevron in the Permian Basin are improving drilling and completed cycle times. Executives at the California-based major hope to eventually improve overall resource recovery from its shale portfolio.

Evolution Petroleum Sees Progress on SCOOP/STACK, Chaveroo Operations

2024-03-11 - Evolution expects to participate in future development blocks, holding in aggregate over 70 additional horizontal well locations.