“When emissions are reduced by divestment, those emissions have not disappeared but simply moved around," says Miles Weinstein, energy transition analyst at GlobalData. (Source: Leonid Ikan/Shutterstock.com)

While some of the largest oil and gas producers have successfully lowered their emissions in line with sustainability goals, research and consulting firm GlobalData notes that a large portion of those reductions come from divestments. The analytics company forecasts global production to increase by 8% by 2026, stressing the need for stronger action to ensure methane emissions do not rise with it.

U.S. is the second-largest methane emitter from oil and gas operations at 12.3 Mt. Studies have suggested that the scope of the methane problem is larger than government reports have led people to believe due to the limitations of current measurement techniques.

“When emissions are reduced by divestment, those emissions have not disappeared but simply moved around," said Miles Weinstein, energy transition analyst at GlobalData.

"Emission intensity has been reduced in many cases, but in the face of increasing production, more efforts will be necessary to meet national and international climate targets. After all, the oil and gas industry is responsible for around a quarter of methane emissions globally.”

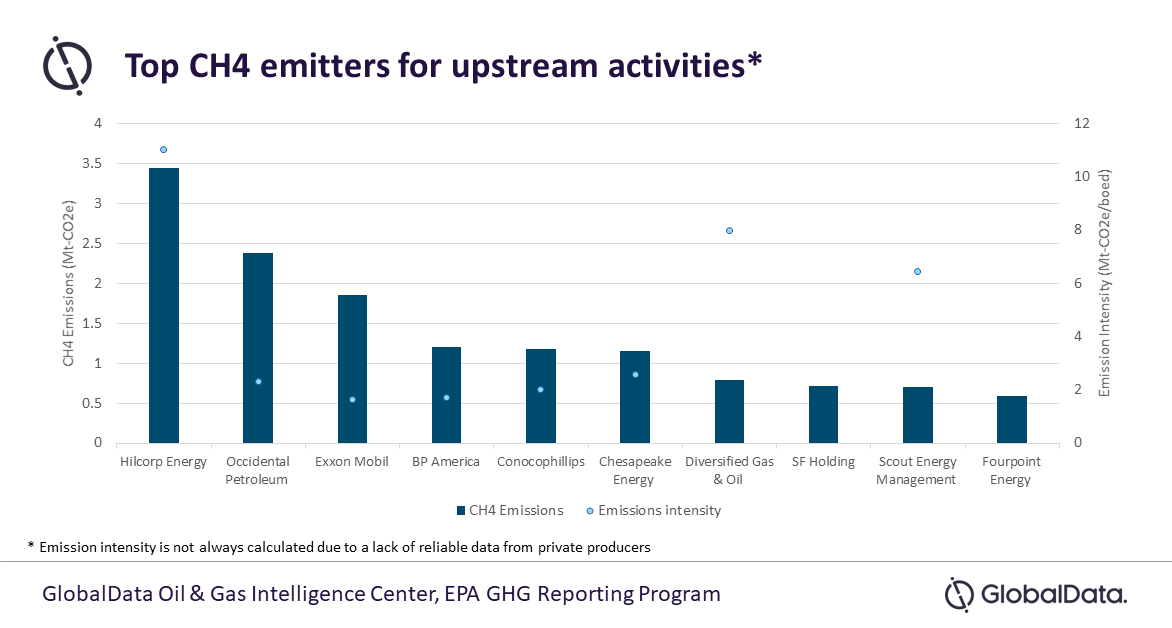

GlobalData’s latest report shows that Hilcorp Energy has been the largest methane emitter among upstream operators for the third year in a row, with reported CH4 emissions at 3.4 Mt of CO2 equivalent in 2020, and has the highest emission intensity among top emitters, at 11 Mt of CO2 equivalent per boe/d. Meanwhile, Energy Transfer, a midstream company, is the largest emitter overall with 6.1 Mt-CO2e.

Weinstein continued, “Hilcorp’s emission intensity tripled in 2017, the same year a large number of wells were acquired from ConocoPhillips. Meanwhile, ConocoPhillips’ emission intensity decreased 50% that year. Other companies have shared similar strategies that rapidly reduce their own emissions without greatly affecting the net total. However, many of the same companies do have plans in place to make real emissions reductions using technological improvements.”

In the U.S., an estimated 21% of oil and gas methane emissions could have been abated at zero net cost or net profit in 2020. The emission abatement measures mainly include methods of capturing gas that would otherwise be vented to the atmosphere, and replacing gas-powered pneumatic devices with electric ones. The gas saved can then be used or sold, reducing costs or bringing revenue.

“While the U.S. has below-average emission intensity, there is a lot of room for improvement," Weinstein noted. "The good news is that solutions to drastically reduce emissions are available today—in some cases at zero net cost or even net profit.”

He continued, “If gas prices continue to rise, so will the portion of emissions that can be economically abated.”

The sector activities responsible for most of the emissions are oil and gas production, gathering and boosting, and natural gas distribution. Much of it originates from gas venting from various equipment types, and equipment leaks.

Weinstein explained that offshore oil and gas and onshore crude oil production are the sectors with the most potential for low-cost emissions abatement, mainly due to to their lower production of natural gas relative to oil. Meanwhile, he said onshore gas and downstream operations would have higher average costs as natural gas has a predominant role in production, transportation and processing.

With the recent announcement of the Global Methane Pledge at COP26, the EPA has proposed rules to regulate methane from existing sources for the first time. The regulation includes monitoring and fixing of leaks, especially where large leaks are likely, as well as regulations and emission limits on specific equipment. The regulation is expected to reduce methane emissions by 74% from 2005 levels by 2030. If approved, it would take effect in 2023.

Commenting on EPA's proposed regulations, Weinstein said they have much wider coverage than current ones, which applied to new sources only and did not result in significant reductions.

"The new regulations take a performance-based approach in some cases by allowing companies flexibility in the methods they use to meet the requirements. This is thought to be ultimately more effective than a prescriptive, one-size-fits-all approach. Thus, real progress on methane reduction is likely if the regulations are approved," he said.

Recommended Reading

Proven Volumes at Aramco’s Jafurah Field Jump on New Booking Approach

2024-02-27 - Aramco’s addition of 15 Tcf of gas and 2 Bbbl of condensate brings Jafurah’s proven reserves up to 229 Tcf of gas and 75 Bbbl of condensate.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

Well Logging Could Get a Makeover

2024-02-27 - Aramco’s KASHF robot, expected to deploy in 2025, will be able to operate in both vertical and horizontal segments of wellbores.