According to GlobalData, natural gas production from the Marcellus and Utica shale formations will reach a combined 38.3 Bcf/d by 2025. (Source: Helge Hansen/Equinor)

With gas prices soaring to record highs coupled with additional pipeline capacity, the Marcellus and Utica shale plays are showing strong growth fundamentals.

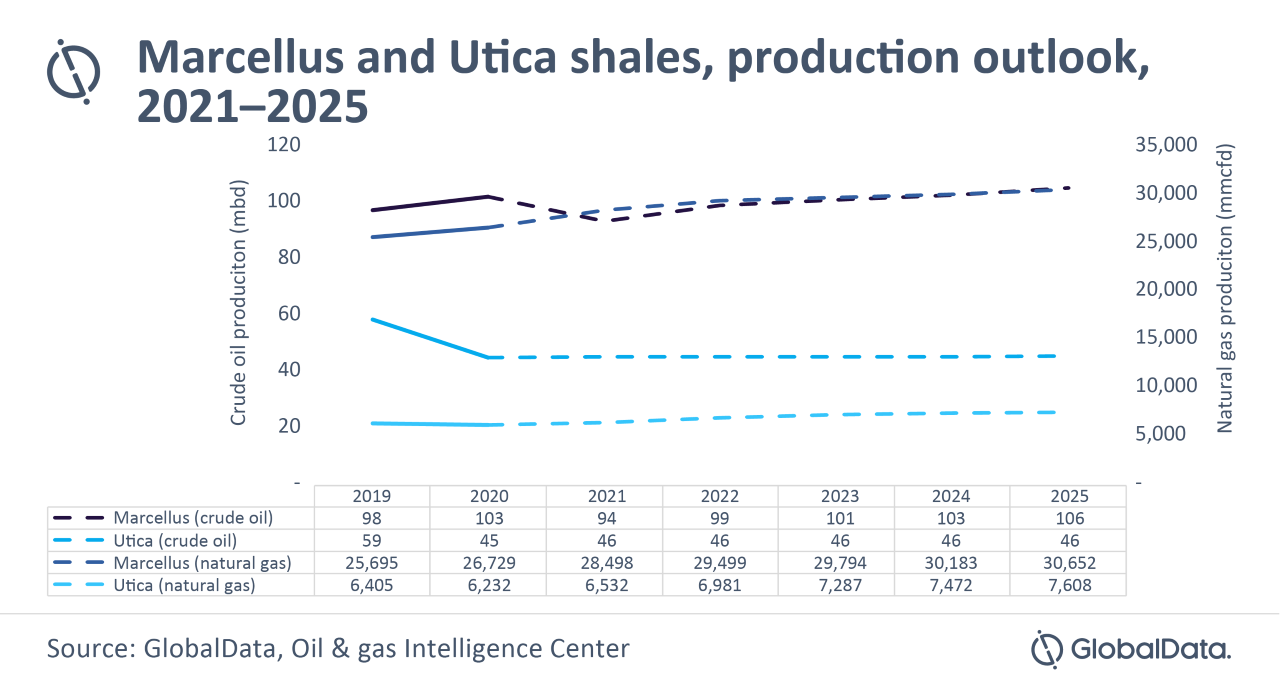

Leading data and analytics company GlobalData recently forecast natural gas production from the Marcellus and Utica formations is expected to rise at a compound annual growth rate of 5.1% to reach a combined 38.3 Bcf/d by 2025.

In its latest report, GlobalData noted that the natural gas plays of the Appalachia Basin saw a minimal change in production and drilling activity during the economic downturn caused by COVID-19 in 2020. During fourth-quarter 2020 and into January 2021, the Marcellus and Utica shale plays saw an increase in production before levelling out during the first and second quarters of 2021.

“Not only did natural gas appraisal and development evade some of the more devastating impacts COVD-19 had on other areas of the oil and gas industry, but natural gas production in these shales exceeded pre-pandemic levels in 2021, reaching 35 Bcf/d on an annual basis,” commented Svetlana Doh, oil and gas analyst at GlobalData. “In fact, Marcellus and Utica accounted for nearly one-third of the total natural gas production in the U.S.”

Reflecting similar sentiment, Rystad Energy analysts told attendees of Hart Energy’s recent DUG East/Marcellus-Utica Midstream Conference that Appalachia is producing record levels of natural gas and producers should be able to maintain or grow that output without the significant investment in wells required in past years.

By 2025, GlobalData forecasts the natural gas production in both the shale plays will exceed its pre-pandemic level, while crude oil production is forecasted to recover at slower pace during the same period.

“In 2020, with the crash in oil prices, operators saw massive reductions in capital expenditures and headcounts,” Doh added. “The U.S. shale industry also witnessed record numbers of bankruptcies and debt restructurings. Operators continue to recover from this downturn. As a result, deal activity in the Marcellus and Utica shales is still below pre-pandemic levels.”

The biggest operators in the region like Chesapeake Energy Corp., EQT Corp. and Southwestern Energy Co. all added scale within the past several years through M&A activity. The most recent example is Chesapeake’s planned purchase of Chief Oil & Gas, announced on Jan. 25.

Still, GlobalData said the total M&A deal value in these shale plays is up just 1% over 2020, and down approximately 5% from 2019 through three quarters.

“M&A activity in other crude oil plays in the U.S. was mainly related to the consolidation tactic of bigger oil and gas companies holding assets across multiple plays,” Doh said. “However, Appalachia is the biggest natural gas play in the U.S., and deals occur mainly for medium-to-small sized operators within a handful of gas plays in the country, resulting in a smaller total deal value.”

Recommended Reading

Kissler: OPEC+ Likely to Buoy Crude Prices—At Least Somewhat

2024-03-18 - By keeping its voluntary production cuts, OPEC+ is sending a clear signal that oil prices need to be sustainable for both producers and consumers.

Buffett: ‘No Interest’ in Occidental Takeover, Praises 'Hallelujah!' Shale

2024-02-27 - Berkshire Hathaway’s Warren Buffett added that the U.S. electric power situation is “ominous.”

Aramco Reports Second Highest Net Income for 2023

2024-03-15 - The year-on-year decline was due to lower crude oil prices and volumes sold and lower refining and chemicals margins.

Air Liquide Eyes More Investments as Backlog Grows to $4.8B

2024-02-22 - Air Liquide reported a net profit of €3.08 billion ($US3.33 billion) for 2023, up more than 11% compared to 2022.

Mach Natural Resources Declares 4Q 2023 Distribution

2024-02-20 - Mach Natural Resource’s distribution is payable March 14 to common unitholders of record by Feb. 29.