Range Resources is allocating its free cash flow towards debt reduction and maintaining flat production, the Marcellus E&P reported in second-quarter earnings. (Source: Hart Energy)

Marcellus-focused Range Resources Corp. delivered strong financial results in the second quarter, analysts say—despite headwinds from low commodity prices.

But bottoming natural gas prices may be taking a toll on oilfield service companies and lowering costs.

Fort Worth, Texas-based Range beat analyst expectations on production, free cash flow (FCF), EBITDA and other key metrics in second quarter financial results, said Gabriele Sorbara, managing director of equity research at Siebert Williams Shank & Co.

Range’s production averaged approximately 2.08 billion cubic feet equivalent per day (Bcfe/d) during the quarter, including 1.42 Bcf/d of natural gas and 102,532 bbl/d of NGL output.

“Range's competitive cost structure, low capital intensity, liquids optionality and thoughtful hedging allowed us to generate healthy full-cycle margins despite cyclically low commodity prices,” Range Resources CEO Dennis Degner said on a July 25 earnings call with analysts.

Degner transitioned to chief executive at Range earlier this summer, succeeding outgoing CEO Jeff Ventura.

The Appalachia gas producer continues to target a maintenance program this year: Range plans to keep production flat at between 2.12 Bcfe/d and 2.16 Bcfe/d (30% liquids) using an all-in capital budget of between $570 million and $615 million.

Range turned-in-line (TIL) 11 wells across its acreage position during the second quarter, well below Siebert Williams Shank & Co.’s estimate of 21 TILs for the quarter.

A ramp-up of production into the end of the year will depend on the timing of the company’s 41 remaining planned TILs in the second half of 2023, Sorbara said.

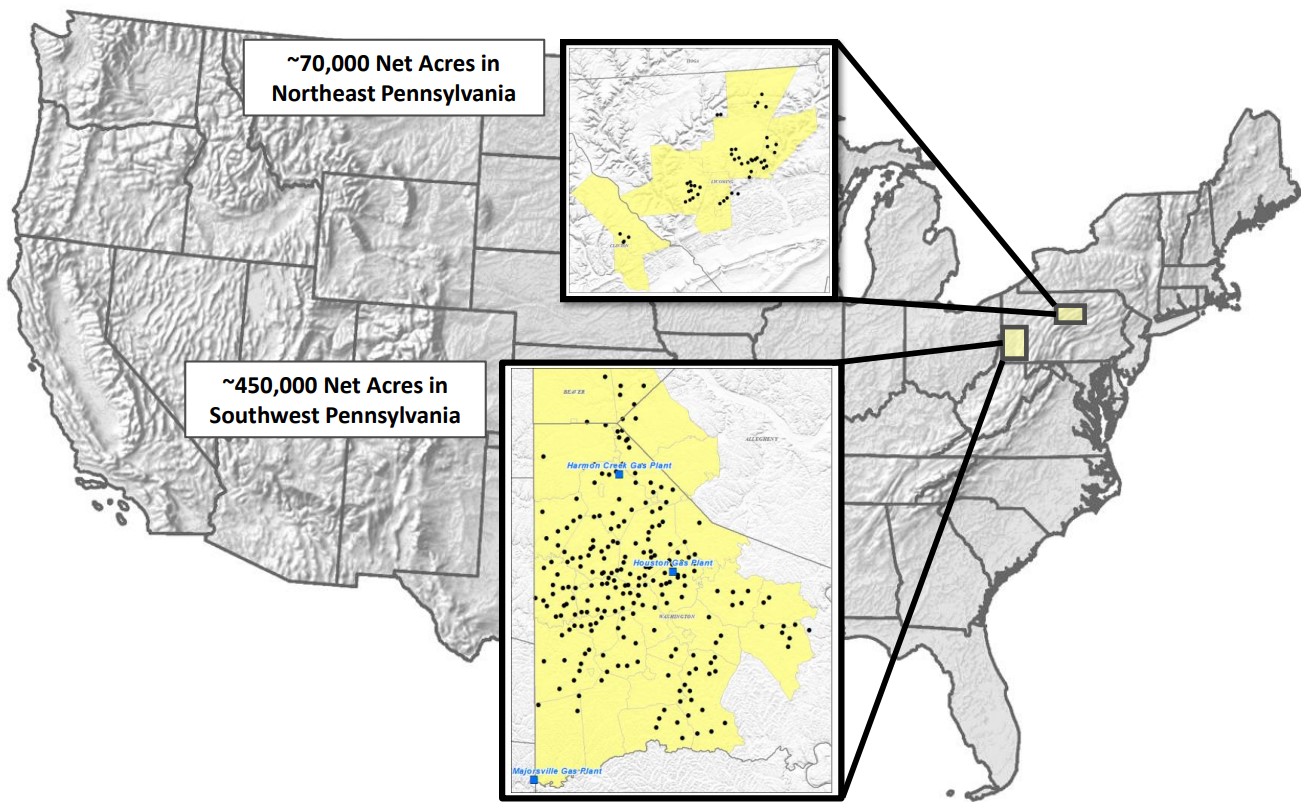

Range has an inventory life of around 3,000 undeveloped core locations across its Marcellus position. The company owns around 70,000 net acres in northeast Pennsylvania and about 450,000 net acres in southwest Pennsylvania.

RELATED: Range Resources CEO Jeff Ventura to Retire from Marcellus Shale Pioneer

Service costs falling

Range is seeing early signs of material and service cost deflation as rig activity declines in gas-weighted regions.

Range dropped to a single horizontal drilling rig during the early part of the third quarter; the company plans to maintain a one-rig program through the end of the year.

More broadly, rigs being pulled out of the gassy plays such as the Haynesville and Marcellus shales have started to raise questions about greater rig availability into 2024.

The company has also seen some pricing relief in areas like tubular goods and other inputs as supply chains normalize.

Degner said Range expects to have clearer visibility into where prices are headed as the bid process kicks off this fall.

“But I'd say, all in all, we're encouraged by some of the relief that we're seeing,” Degner said.

While reporting second-quarter earnings last week, oilfield services provider Liberty Energy said it does not expect to see a meaningful change in service prices in the near term—despite a weakening outlook for drilling and completion activity in North America.

But Liberty reported that E&Ps are seeing some respite from high prices for consumable inputs like drill pipe, steel casing, cement, frac sand and fuel.

RELATED: Liberty Energy: Drilling, Completion Activity to Fall in Back Half of ‘23

Debt reduction

Range continues to prioritize using its FCF to reduce debt. The company repurchased $61.6 million of its 2025 senior notes at a discount during the second quarter.

As expected, Range did not execute on any share buybacks during the quarter due to limited FCF, Sorbara said.

“Where we sit today, obviously, commodity prices are lower and by definition, cash flow is a little bit lower,” said Range CFO Mark Scucchi on the company’s earnings call.

While debt reduction remains a priority for Range, one of the keys to the company’s capital allocation and return of capital framework is the ability to move nimbly with the market, Scucchi said.

Range’s strong balance sheet gives the company the opportunity to step in and buy back shares if equity markets see a broad-based pullback, he said. Range has $1.1 billion remaining under its $1.5 billion share repurchase authorization.

“That approach to debt is the priority, but we clearly will make use of the share repurchase program just as we have for the last two years,” Scucchi said.

Analysts at Tudor, Pickering, Holt & Co. said it is “good to see Range opportunistically take in some of the debt stack” during the quarter, despite falling behind on share buyback expectations.

RELATED: Range Resources Flexing NGL Optionality as Nat Gas Prices Remain Low

Recommended Reading

E&P Highlights: March 11, 2024

2024-03-11 - Here’s a roundup of the latest E&P headlines, including a new bid round offshore Bangladesh and new contract awards.

Chevron Hunts Upside for Oil Recovery, D&C Savings with Permian Pilots

2024-02-06 - New techniques and technologies being piloted by Chevron in the Permian Basin are improving drilling and completed cycle times. Executives at the California-based major hope to eventually improve overall resource recovery from its shale portfolio.

TotalEnergies Fénix Platform Installed Offshore Argentina

2024-02-13 - First gas from the TotalEnergies-operated project is expected in fourth-quarter 2024.

US Oil, Gas Rig Count Rises to Highest Since September: Baker Hughes

2024-03-01 - The U.S. oil and natural gas rig count is at its highest since September 2023.

Comstock Continues Wildcatting, Drops Two Legacy Haynesville Rigs

2024-02-15 - The operator is dropping two of five rigs in its legacy East Texas and northwestern Louisiana play and continuing two north of Houston.