NGL extraction plant. (Source: Shutterstock)

Appalachian gas producer Range Resources Corp. is tapping its liquids-rich footprint as natural gas markets continue to face severe price volatility and humdrum natural gas prices.

Range’s NGL marketing agreements contributed to a premium of $1.63/bbl over Mont Belvieu pricing during first-quarter 2023, based on its realized NGL price of $27.60/bbl, the company said in its first-quarter earnings call. During the call, executives also addressed recent rumors that the company was a potential M&A target.

The company mainly focused on its shift to NGL production. During the first quarter totaled approximately 9.29 MMbbl, or net production of 103,219 bbl/d, up 10% during the same period in 2022. That’s down slightly from levels in fourth-quarter 2022, when net NGL production was 107,806 bbl/d.

Range COO Dennis Degner, who was tapped as the E&P’s next president and CEO earlier this year, said the company’s NGL optionality is a key differentiator for Range compared to other natural gas producers.

“This becomes more evident when natural gas prices are challenged like they have been to start 2023,” Degner said on the company’s first-quarter earnings call on April 25.

After capitalizing on high natural gas prices last year, U.S. gas producers have been pressured by oversupply, high levels of storage and weaker-than-expected demand.

Henry Hub natural gas prices are expected to average $2.94 per million British thermal unit (MMBtu) in 2023, down over 50% from an average of $6.42/MMBtu last year, according to the U.S. Energy Information Administration’s latest outlook.

Range’s net gas production was about 1.48 Bcf/d during the first quarter, down from 1.52 Bcf/d last quarter. The company reported a natural gas differential of $0.14 below Nymex pricing, including basis hedging, for the quarter.

Total production for the quarter was 2.14 billion cubic feet equivalent per day (Bcfe/d). Range plans to maintain relatively flat production in 2023 at between 2.12 Bcfe/d and 2.16 Bcfe/d.

RELATED: EIA Raises Crude Price Forecast, Slashes Natural Gas Price Outlook

Signs of service cost deflation

E&Ps have had to pay sky-high cost inflation for drilling and completion services in the past year. But Range is starting to see signs of relief on service costs.

The company is seeing increased rig availability, more schedule openings for spot frac crews and some relief in pricing for tubular products and frac sand.

“Year-to-date in 2023, we have seen the price of rigs and pumping crews start to show signs of receding slightly,” he said.

While utilization of specialty equipment like high-spec drilling rigs and electric frac fleets remains high, Range believes service costs could begin to decline in the second half of 2023. Those costs are expected to fall more materially in 2024.

Range shuts down M&A rumors

Media reports have indicated that Range could be an acquisition target by larger E&Ps looking to boost their inventories. In February, reports surfaced that Permian Basin pure-play Pioneer Natural Resources was weighing a deal to acquire Range.

Pioneer denied the reports, saying the company was not contemplating a significant business combination or acquisition.

Shortly after the rumors surfaced, Range announced that its current president and CEO, Jeff Ventura, would retire after two decades with the company. Degner is slated to take over the leadership positions at Range’s annual shareholder meeting on May 10.

But Degner said the public shouldn’t expect to see big changes from Range under new leadership. With Range in the best operational and financial shape it’s been in, the company plans to continue staying the course, he said.

“Ultimately, we’re prepared to go it alone,” Degner said.

Total revenues for the first quarter totaled $1.18 billion, up over 550% from $180.74 million in the same period last year and down 28% from $1.63 billion last quarter.

Adjusting for non-recurring items, adjusted earnings came in at $0.99 per share for the quarter.

RELATED: Range Resources CEO Jeff Ventura to Retire from Marcellus Shale Pioneer

In-basin growth opportunities

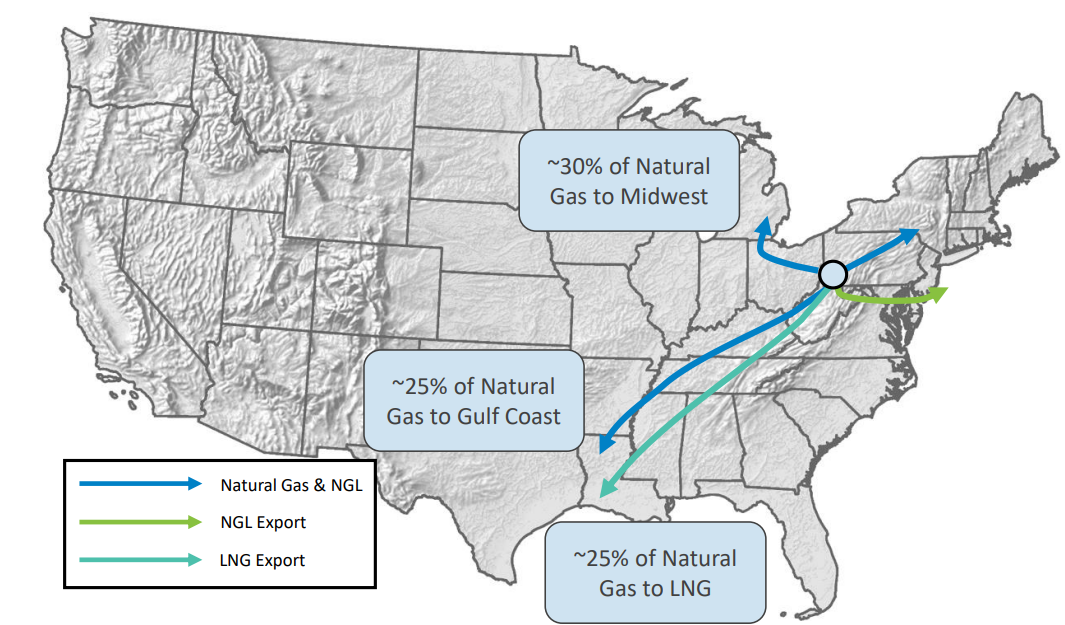

A large portion – about 80% – of the NGL and gas Range produces ends up outside the Appalachia region in demand centers such as the Gulf Coast and the Midwest, as well as for liquefaction.

But the company sees greater in-basin opportunities to offload gas and NGL in the future.

One example of increased in-basin demand stems from Shell’s major polyethylene manufacturing facility in Pennsylvania, which started operations late last year. Combined cycle natural gas power facilities have also continued to express interest in being in the region, Degner said.

“That's going to take, as you would imagine, time to further develop and put that infrastructure in place,” Degner said. “But it also has to compete with our ability to get that gas, as an example, transported to the Gulf versus being right there in basin.”

Recommended Reading

Permian Operations at Risk as Wastewater Equation Remains Unbalanced

2024-06-17 - Wastewater injection is a growing cause of induced seismic activity in oil- and gas-producing regions in the U.S., and without proper management solutions, operational capacities are at risk.

Permian Recycling Facility Passes 50 MMbbl of Water Recycling

2024-05-20 - Occidental Petroleum and Select Water Solutions have collaborated on water treatment and recycling at the site since 2021.

Industry Consolidation Reshapes List of Top 100 Private Producers in the Lower 48

2024-06-24 - Public-private M&A brings new players to top slots in private operators list.

SM Energy Targets Prolific Dean in New Northern Midland Play

2024-05-09 - KeyBanc Capital Markets reports SM Energy’s wells “measure up well to anything being drilled in the Midland Basin by anybody today.”

Northern Midland: EOG Brings on Dean Oil Well in SE Dawson Stepout

2024-06-18 - EOG Resources has not stated yet that Dawson County is the location of its new “stealth play.” It remained mum in an investment-banking conference this week.