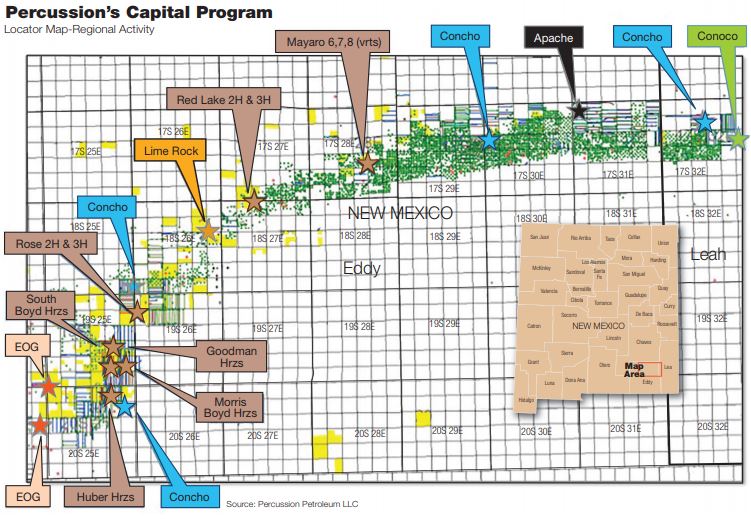

The Percussion Petroleum team has zeroed in on New Mexico’s Yeso in Eddy County within the Permian Basin’s Northwest Shelf as the platform for their first E&P. (Source: Robert D. Flaherty/Percussion Petroleum LLC)

[Editor's note: A version of this story appears in the January 2019 edition of Oil and Gas Investor. Subscribe to the magazine here.]

In January 2016, three E&P executives met at a Panera Bread in Houston and contemplated what had brought them to this point. John Campbell III, Brian Zwart and Lupe Carrillo had just departed Rockcliff Energy LLC as the operator closed out its first phase and moved onto Rockcliff II.

The triumvirate formed Percussion Petroleum LLC to take advantage of market bargains and ready private-equity cash available to snag those assets. “We quit our jobs and, then, looked at each other during the lowest oil price that I had personally seen in my career. We wondered if we had made the right decision,” said Campbell, CEO.

“We’re calculated. Two of us are engineers and Lupe has a very deep background in oil fields, so he’s seen the ups and downs in oil price before. We’re pretty risk-averse, so it was a pretty big leap for us.”

Confidence to go out on their own came from discovering they had developed complementary skills after years of working together. Meanwhile, low oil prices were creating buying opportunities. Most of all, “capital from private-equity firms was accessible to a younger team like us for the first time,” Campbell said.

Percussion Petroleum’s founders began their hunt for a platform asset in early 2016 as WTI was heading to less than $27 a barrel. From left to right, Lupe Carrillo, COO; John Campbell III, CEO; and Brian Zwart, chief technical officer. (Photo courtesy of Percussion Petroleum LLC)

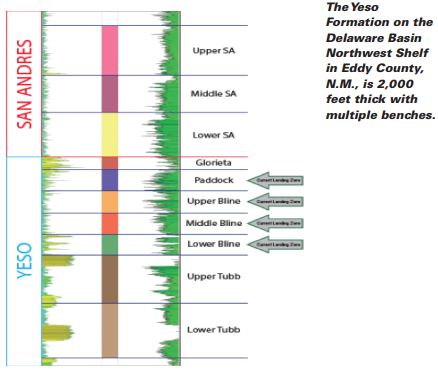

They best knew the ArkLaTex region and the Permian Basin, so they focused their efforts there, eventually settling on putting together acreage in the thick dolomite of the Yeso Formation of the Permian Basin in New Mexico’s Lea and Eddy counties.

They weren’t the first to use horizontal drilling in the Yeso to take advantage of what had been exploited with vertical drilling for decades. Concho Resources Inc. had begun drilling horizontal Yeso wells in 2016—making 40 wells of these that year—after a decade that produced 1,300 Yeso verticals for it on the Northwest Shelf.

Other E&Ps that started to work the Yeso horizontally include Apache Corp. (NYSE: APA), ConocoPhillips Co. (NYSE: COP), EOG Resources Inc. (NYSE: EOG) and Occidental Petroleum Corp. (NYSE: OXY). Part of the allure of the formation is that it is relatively shallow at 2,500 to 3,500 feet when compared with producing formations elsewhere in the Permian and in other basins. Completed wells may cost $4 million or less. Breakeven can be at $30 WTI or less.

For a somewhat risk-averse startup such as Percussion, it was irresistible.

In just two years, through numerous acquisitions, Percussion amassed 16,500 acres of Yeso on the Shelf, making it the biggest player in the western portion. Concho is the largest player on the other half of the Shelf.

The company has 46 employees, operates 220 wellbores, is drilling a new well every nine days and has identified 1,200 horizontal locations, while it adds more acreage. As of late October, production was 9,000 net barrels of oil equivalent per day.

Starting With PE

The team’s start came in February 2016 as Carnelian Energy Capital LP announced Percussion as its second investment from its inaugural $400-million fund. The Houston-based investment firm typically starts with commitments of less than $100 million. Carnelian closed its second fund at $600 million in mid-2017.

Campbell said he was introduced to the Carnelian partners by a friend and found a good fit. Carnelian partner Daniel Goodman recalled those first meetings and how well their goals aligned.

“I could instantly see that John’s work ethic, technical acumen and network were top tier,” Goodman said. “We spent time in and out of the office with John, Lupe and Brian making sure the relationship was strong before we partnered.

“We were drawn to their keen sense of value creation and the cohesiveness they demonstrated after having worked together at [Rockcliff and Quantum Resources Management LLC]. Just as with any relationship or partnership, fit is really important, and we all felt like we viewed the world the same way and were all committed to helping each other succeed.”

The team’s experience and skills were key in the deal-evaluation and -acquisition phase and in the current operations and expansion stage. Campbell and Zwart, both in their early 30s, grew up with family connections to the oil and gas industry in Houston before pursuing petroleum engineering degrees at the University of Texas. Carrillo, COO, grew up in Hobbs, N.M., where his father worked in the oil field off and on in the oil-price cycles, before going to the University of Houston for a degree in geology.

Campbell brings the downhole and business-development expertise to the team; he began his career in the E&P group at El Paso Corp. that was spun out as EP Energy Corp. (NYSE: EPE). Zwart, chief technical officer, specializes in subsurface geology and reservoir management; he began his career at Devon Energy Corp. (NYSE: DVN).

Carrillo, the eldest of the three at 45, is the Swiss Army knife of the group, with decades of experience handling accounting, finance, risk management and marketing, and managing field operations and lift costs. His career includes XTO Energy Inc. and Schlumberger Ltd. (NYSE: SLB).

The early days for the Percussion partners were initially in Zwart’s living room—the only one without children yet—and, then, in a run-down Houston office building where they rented a small space. The office had rusted metal, no security, some questionable tenants, a bad parking garage, infrequent elevator service and was in need of a paint job, recalled Zwart.

“We were doing everything from geologic mapping and economic modeling to taking out the trash and hooking up printers” after leaving the comfort of the established Rockcliff, Zwart said. “When we left, people thought we were crazy.”

They moved to offices a step up a few months later, but didn’t dip deeper into their equity commitment for a classier space until after they closed their first acquisition. Getting to that first deal took about seven months after looking at more than 200, evaluating 30, bidding on 15, negotiating on four and, then, closing on one.

Campbell said, “We worked every holiday that year. We didn’t see the light of day in 2016.”

Zwart said, “At first, we were trying to work it as fast as possible to disprove each deal. You can’t out-engineer, can’t exploit an asset you overpaid for. If we worked it for anywhere from a day to two weeks and it still checked all the boxes, then it would go to the third stage.”

What they were looking for was noncore assets from distressed companies that might want to sell to avert bankruptcy as oil dropped below $27. While some deals looked promising, most sellers decided to hang on to their positions in the Permian and elsewhere, even if that meant Chapter 11 in the hope that the assets would eventually lead them back to profitability. As deals fell through, it was on to the next and more grueling days of work.

What they ultimately found was a North Texas oilman ready to retire from the business and willing to sell in the Yeso. As part of the agreement, there was no press release about the acquisition from Nearburg Producing Co., but public data show the change in operator.

The Nearburg acquisition in Eddy County, N.M., included 6,000 net acres, 700 barrels of oil equivalent per day (boe/d) net production, 75 operated wells—and a significantly undercapitalized program.

The closing was cause for celebration. Carrillo said that, before the deal was closed, “I sent my wife on a mission to find a great bottle of champagne.” Time passed, “but, as soon as we got back from the lawyers’ offices, we popped that bottle then and there.”

Fatigue quickly set in. “We were too tired to celebrate too much,” Zwart said. “Our world is more like a chess game or a golf game with a fist pump for small victories along the way.” By the time bottle of the bubbly was gone, the mindset was already turning to the uphill road of hiring, integration and operations in New Mexico.

Things moved quickly then. “From an evaluation standpoint, [the deals] got easier because we were getting more familiar with the area,” Zwart said. While sometimes more complex, the larger acquisitions came together more quickly than smaller—yet crucial bolt-on—buys because the large-operator sellers didn’t have small-money sales high on their priority list.

In all, Percussion made more than 30 acquisitions in 2017.

The attention the horizontal Yeso play is getting lately has tended to drive up acreage prices, but there are a few large positions left in their core operating area, Zwart said. Campbell said the leasehold could grow from 16,500 acres to 20,000 in the months ahead. Meanwhile, Percussion is in the process of selling much of its roughly 6,000 acres of non-core assets outside the Yeso.

A Third The Cost

In April last year, Percussion completed four wells in Eddy County that included the highest reported 30-day IP for any of the more than 400 horizontal Yeso wells. The Goodman 22-4H flowed 1,208 boe/d on a three-stream basis (92% liquids; 89% oil), 1,440 boe/d on a 24-hour IP rate. The lateral measured 4,835 feet and the four wells cost between $3- and $4 million each.

The four wells together averaged 4,915 feet of productive lateral at just under 3,000 feet total vertical depth. Average 30-day IP for the group was 1,080 boe/d on a three-stream basis.

The results are enhanced by very brittle rock (“like hitting a car windshield with a hammer”) and by pushing the completions. The Goodman wells were stimulated with more than 1,000 pounds of proppant and 2,500 gallons of water per foot of lateral length.

“As we apply new completion technology across the multiple benches of the 2,000 foot-thick Yeso, we have seen the results continue to improve,” Campbell said. “The wells are demonstrating that our high oil IPs and increased EURs are repeatable across our position, yielding some of the best economics in the Lower 48.”

The team estimates Percussion has about 10 to 20 years of drilling inventory. In the field at year-end was one rig to prove up as many reserves as Percussion can. With 9,000 barrels per day (bbl/d) there is enough cash to keep things going without tapping the Carnelian equity.

“Well costs are about a third of the Delaware, yet EURs are the same,” said Tomas Ackerman, a Carnelian partner. “It is really the gift that keeps on giving, and the Percussion team has just scratched the surface in terms of developing the multiple zones on their acreage.”

It is drilling a new well every eight or nine days with the one rig. It’s planning to add a second by mid-2019; possibly, a third by year-end.

Much of the drilling is on federal land. Due to the Shelf’s long history of production, a lot of infrastructure already exists in the area.

In addition, trucking the oil is possible: The main roads have undergone repair and reconstruction in recent years and HollyFrontier Corp.’s (NYSE: HFC) 100,000-bbl/d Navajo refinery in Artesia, N.M., is just 10 miles from the heart of Percussion’s production.

Percussion recently installed lease automatic custody transfer units with pumps for quicker tanker-truck fills as opposed to using only gravity.

The company is working now on frack- and produced-water infrastructure in the area. The team sees a lot of upside in having strong water assets and rights. Campbell said Percussion spent a significant amount on water assets in 2017 and will aggressively do more this year as drilling intensifies. As part of its program, the company owns and operates a large-scale saltwater disposal system with 90,000 barrels of water per day capacity. It also owns a high-rate water transfer line from a third-party source well to Percussion-owned frack ponds with 600,000-barrel capacity, and has secured a long-term source water contract for 110,000-barrel water per day refresh rate.

While Carnelian doesn’t need to put any more money into Percussion for development, it stands ready to back possible acquisitions as they become available, Goodman said. “This specific asset is now cash flow positive, and we can fund drilling organically.

“That said, we continue to look for accretive acquisitions and expect some of the larger companies in the area to put their legacy Yeso assets on the market as they continue to refocus their companies on being single-basin pure-plays.”

Campbell said Percussion “is getting to the point of critical mass,” thanks to the number of wells drilled and proof of decades of drilling potential. Like most companies backed by private equity, selling is likely in the cards at some point. For now, the company is staying private and doesn’t need an IPO to continue its buying-and-development streak.

Ackerman said, “They have turned that play into one of the most economic oil plays in the country. They have also used their Rolodex and sheer hustle to grow their initial anchor asset through more than 50 bolt-on transactions. It has been really fun to watch the success that they’ve had.”

Campbell said there is a certain amount of hype that has arisen around the Yeso since Percussion started producing significant results in an area few were paying attention to, but he thinks it is well deserved.

“We made it shiny again.”

Recommended Reading

Energy Transition in Motion (Week of April 26, 2024)

2024-04-26 - Here is a look at some of this week’s renewable energy news, including the close of a $1.4 billion decarbonization-focused investment fund.

Solar Sector Awaits Feds’ Next Move on Tariffs

2024-04-25 - A group of solar manufacturers want the U.S. to impose tariffs to ensure panels and modules imported from four Southeast Asian countries are priced at fair market value.

Solar Panel Tariff, AD/CVD Speculation No Concern for NextEra

2024-04-24 - NextEra Energy CEO John Ketchum addressed speculation regarding solar panel tariffs and antidumping and countervailing duties on its latest earnings call.

NextEra Energy Dials Up Solar as Power Demand Grows

2024-04-23 - NextEra’s renewable energy arm added about 2,765 megawatts to its backlog in first-quarter 2024, marking its second-best quarter for renewables — and the best for solar and storage origination.