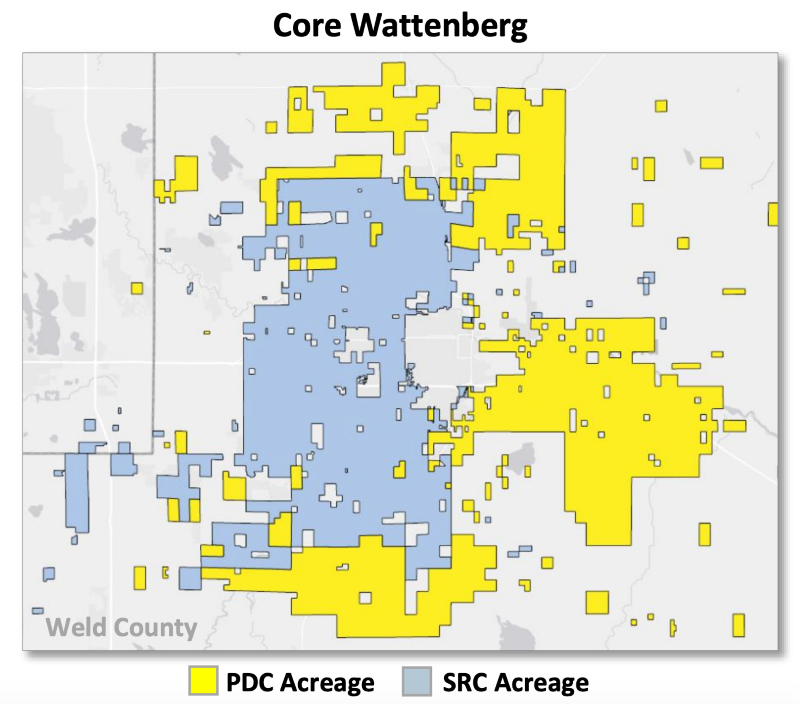

Pro forma the SRC merger, PDC Energy will have about 182,000 consolidated core Wattenberg net acres, of which nearly 100% is located in Weld County, Colo. (Source: Hart Energy)

[Editor's note: Story updated at 8:11 a.m. CDT Aug. 27.]

PDC Energy Inc. is answering activist investor calls made earlier this year to return more cash to shareholders with an all-stock merger worth roughly $1.7 billion including the assumption of debt.

The Denver-based oil and gas producer announced the merger agreement with SRC Energy Inc. on Aug. 26 expected to materially increase PDC’s scale and free cash profile that the company said will enhance its ability to return additional capital to shareholders.

In the agreement, PDC will acquire SRC Energy, gaining SRC’s core area of operations is in the Greater Wattenberg Field of the Denver-Julesburg (D-J) Basin. Combined, the company is set to become the second-largest producer in the D-J Basin.

“SRC’s complimentary, high-quality assets in the core Wattenberg, coupled with our existing inventory and track record of operational excellence will create a best-in-class operator with the size, scale and financial positioning to thrive in today’s market,” Bart Brookman, president and CEO of PDC, said in a statement on Aug. 26.

The news of the deal, which analysts called a merger of equals, initially sent shares of both companies soaring.

“Finally, an E&P deal that gets the stamp of approval from Wall Street,” Mike Kelly, senior analysts with Seaport Global Securities, wrote in an Aug. 26 research note. “We’re encouraged to see investors look past the fact that the deal is not accretive on an EV/EBITDA basis and instead focus on the accretiveness on [free cash flow, return on capital employed and net asset value].”

Pro forma the merger, PDC will have about 182,000 consolidated core Wattenberg net acres, of which nearly 100% is located in Weld County, Colo. The company also holds roughly 36,000 net acres in the Delaware Basin, which it had entered in 2016. Combined production is roughly 200,000 barrels of oil equivalent per day.

“We remain committed to our core Delaware Basin acreage position and are confident the combined company with its multi-basin focus will be well-positioned to deliver superior shareholder returns,” Brookman continued in his statement.

RELATED:

“Colorado Oil And Gas: Battleground State” featured in the April 2019 issue of Oil and Gas Investor

PDC Energy Divests Permian Basin Midstream Assets For $310 Million

Kimmeridge Energy Management Co., a private-equity firm which owns about 5.1% of PDC’s shares, has campaigned for the producer to cut costs and return more cash to shareholders. Specifically, the firm called for the return of proceeds from asset sales to shareholders.

Assuming $55 per barrel NYMEX oil, the pro forma company expects to generate about $800 million of free cash flow between the second half of 2019 and year-end 2021, half of which is planned to be returned to shareholders through an increased share repurchase program.

PDC is also expecting the combination to generate significant corporate synergies including annual G&A savings of about $50 million. The pro forma company will maintain a strong, through-cycle balance sheet with pro forma leverage of 1.3 times as of June 30.

Seaport analysts Kelly noted the expected 11% free cash flow yield for fiscal-year 2020 plus a plan to devote roughly half of its $800 million free cash flow through 2021 to share buybacks “should sound good to even the most cynical E&P haters.”

SRC shareholders will receive a fixed exchange ratio of 0.158 PDC shares for each share of SRC common stock, representing an implied value of $3.99 per share based on the PDC closing price as of Aug. 23. The $1.7 billion transaction also includes the assumption of SRC’s net debt of about $685 million as of June 30.

Commenting on the transaction, Lynn A. Peterson, CEO and chairman of the board of SRC Energy, said: “We believe that this transaction will establish the combined company as a leader in the Colorado energy industry. The transaction also provides SRC shareholders with the opportunity to participate in the significant upside potential created by a larger-scale D-J Basin producer with complementary assets in the prolific Delaware Basin.”

The transaction, which has been unanimously approved by each company’s board of directors, is expected to close in fourth-quarter 2019.

J.P. Morgan is exclusive financial adviser to PDC for the transaction, and Wachtell, Lipton, Rosen & Katz is its legal counsel. Citi and Goldman Sachs & Co. are serving as financial advisers to SRC and Akin Gump Strauss Hauer & Feld LLP is the company’s legal counsel.

Recommended Reading

E&P Highlights: June 24, 2024

2024-06-24 - Here’s a roundup of the latest E&P headlines, including TotalEnergies working with Nigeria to reach FID on the Ubeta gas field and Chevron signing production sharing contracts for two blocks offshore Equatorial Guinea.

E&P Highlights: May 6, 2024

2024-05-06 - Here’s a roundup of the latest E&P headlines, including technology milestones and new contract awards.

Up to 50 Firms Seek US Oil Licenses in Venezuela, Official Says

2024-05-23 - Washington aims to prioritize issuing licenses to companies with existing oil output and assets over those seeking to enter the sanctioned OPEC nation for the first time, sources told Reuters.

Blankenship, Regens: More Demand, More M&A, More Regs

2024-05-23 - In 2024, the oil and gas industry is dealing with higher interest rates, armed conflicts in Europe and the Middle East, rising material costs, a decrease in Tier 1 acreage and new policies and laws.

US Drillers Cut Oil, Gas Rigs for Fourth Time in Five Weeks

2024-05-24 - The oil and gas rig count, an early indicator of future output, fell by four to 600 in the week to May 24 the lowest since January 2022.