Exxon Mobil has been operating in the country for 25 years and producing oil and gas in eastern Russia since 2005 in a partnership involving two Rosneft affiliates. (Source: Shutterstock.com)

Some of the world’s biggest oil companies and commodity traders are at risk of disruption to their extensive business operations in Russia if the west follows through with “unprecedented” sanctions against Moscow for any further invasion of Ukraine.

The U.S. has emphasized measures that would target Russia’s financial sector and members of President Vladimir Putin’s inner circle, rather than sanctions that would directly disrupt supplies of Russian oil and gas into Europe and potentially push elevated energy prices even higher.

However, the G7’s threat of financial and economic sanctions on “a wide array of sectoral and individual targets” could still hit oil companies such as BP, Shell and Exxon Mobil, and commodity traders such as Glencore, Vitol and Trafigura, which all have important business relationships in the country.

RELATED:

Russia on the Eve of War: Indifference, Irony and Gas

Germany Blocks Nord Stream 2 Gas Project as Ukraine Crisis Deepens

“Extensive sanctions would be really problematic for the energy sector, even if they don’t directly target exports,” said Livia Paggi, head of political risk at consultancy GPW.

Russia’s energy industry is so vast and the involvement of Putin’s allies so pervasive that new sanctions would, at a minimum, force western companies “to down tools while they worked out their exposure.”

BP owns almost a fifth of Russia’s largest oil producer Rosneft. U.K.-listed rival Shell controls 27.5% of Gazprom’s huge Sakhalin-2 offshore gas project in Russia’s far east. Exxon Mobil has been operating in the country for 25 years and producing oil and gas in eastern Russia since 2005 in a partnership involving two Rosneft affiliates.

Trafigura and Vitol both have stakes in a controversial Arctic oil project run by Rosneft, and are big traders of Russian oil. Geneva-based Gunvor also lifts Russian crude while Glencore owns 10.55% of En+, the hydropower and metals group formerly controlled by Russian oligarch Oleg Deripaska, as well as a small stake in Rosneft.

The state-backed oil producer has been under U.S. and EU sanctions since 2014 when Russia annexed Crimea from Ukraine.

The measures were designed to ensure Rosneft could still export oil and gas but stymie its future growth. It blocked the energy producer’s access to western financing with a maturity longer than 90 days, and its access to technology and personnel needed for certain exploration activities.

Rosneft’s CEO, Igor Sechin, was also targeted with individual sanctions that prevent U.S. nationals or entities from dealing with him.

As a result, BP, for example, was still able to report profits of more than $2.4 billion from its Rosneft stake last year and collect $640 million in dividends, while CEO Bernard Looney has continued to sit on the Russian group’s board.

Brian O’Toole, a former sanctions expert at the U.S. Treasury’s Office of Foreign Assets Control, said the thrust of any new energy-related sanctions was likely to be similar, and that “any significant sanctions on Gazprom and Rosneft that affect the current supply” were unlikely.

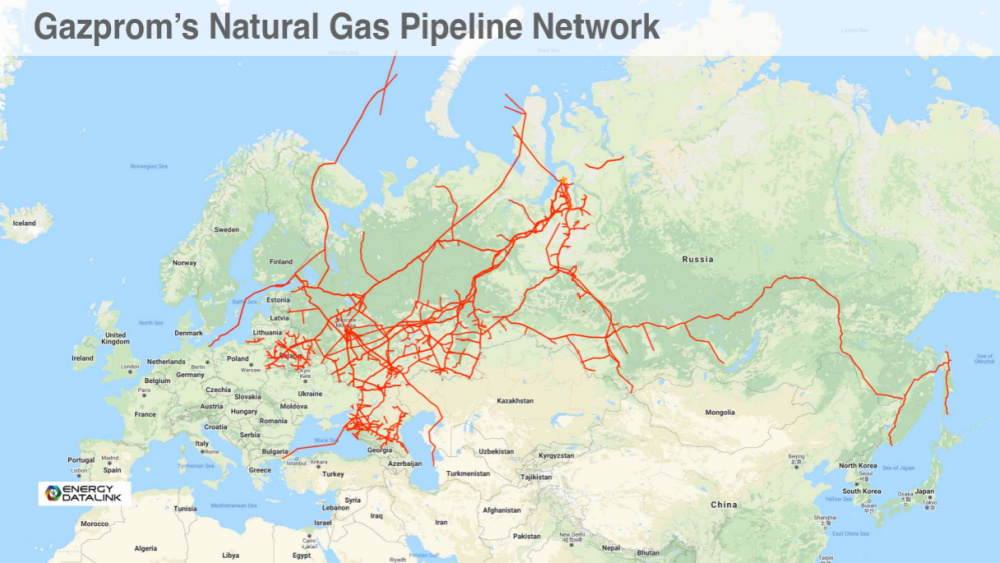

Instead, sanctions might target midstream infrastructure including pipelines or downstream businesses such as Russian trading houses, O’Toole added. “Things like that may be more palatable and might not have an impact on current production but would send something of a message that the energy sector is not completely untouchable.”

U.S. President Joe Biden last week suggested the most severe sanctions would target Russia’s largest financial institutions. Such measures—such as eventually blocking Russia from international payments network Swift—would be unlikely to prevent western companies from taking or making payment for energy supplies but would make it more difficult for groups such as BP or Shell to operate, said O’Toole, now a non-resident senior fellow at the Atlantic Council think-tank in Washington.

Helima Croft, global head of commodity strategy at RBC Capital Markets, said the Biden administration continued to stress it would not directly target Russian energy exports but that some measures under consideration could make it “challenging” for international oil companies. “These measures are apparently not at the top of the implementation list but could be included in the second or third round of punitive measures,” she said in a note.

BP, Shell and Exxon Mobil declined to comment. In an interview with the Financial Times this month, Looney said BP would only worry about new sanctions if and when they materialized. “Let’s see what happens. There are sanctions today, we comply with sanctions and we will continue to do so,” he said.

Trafigura, Vitol, Glencore and Gunvor all declined to comment.

In 2018, when the U.S. imposed sanctions on Deripaska and his aluminium companies Rusal and En+ it threw metals markets into chaos and caused significant supply chain disruptions.

Rusal, in which Glencore then held a 9% stake, was blacklisted by financial institutions, creating huge problems for European companies and sending the price of aluminium on the London Metal Exchange up by a third.

Russia is also a key producer of palladium, which carmakers use to remove toxic emissions from exhaust fumes, as well as platinum, copper and nickel, a key battery material.

The biggest risk to commodity markets, however, would come not from the sanctions but from how Russia might retaliate, said RBC’s Croft.

“There is broad concern about the weaponization of commodities by Russia in response to potentially facing the most onerous sanctions to date,” she said.

Given an already tight market, with gas at record levels and oil trading above $90/bbl for the first time in seven years, any move by Russia to hold back supply would send prices even higher.

Christian Lindner, Germany’s finance minister, told Financial Times last week that the Kremlin could retaliate by reducing or even stopping gas flows to Europe.

Russia supplies Europe with about 40% of its gas. It is also the world’s third-largest oil producer, behind the U.S. and Saudi Arabia, pumping roughly 10 million bbl/d last year, approximately 10% of global output.

“There is very little the west can do in terms of sanctions that doesn’t directly harm their direct commercial interests,” said GPW’s Paggi.

* This article has been amended to reflect that BP last year reported profits of more than $2.4 billion from its Rosneft stake, from which it collected $640 million in dividends.