Most of Occidental Petroleum’s planned $600 million investment in emerging low-carbon ventures for 2024 will go to STRATOS, CEO Vicki Hollub says. (Source: Shutterstock.com)

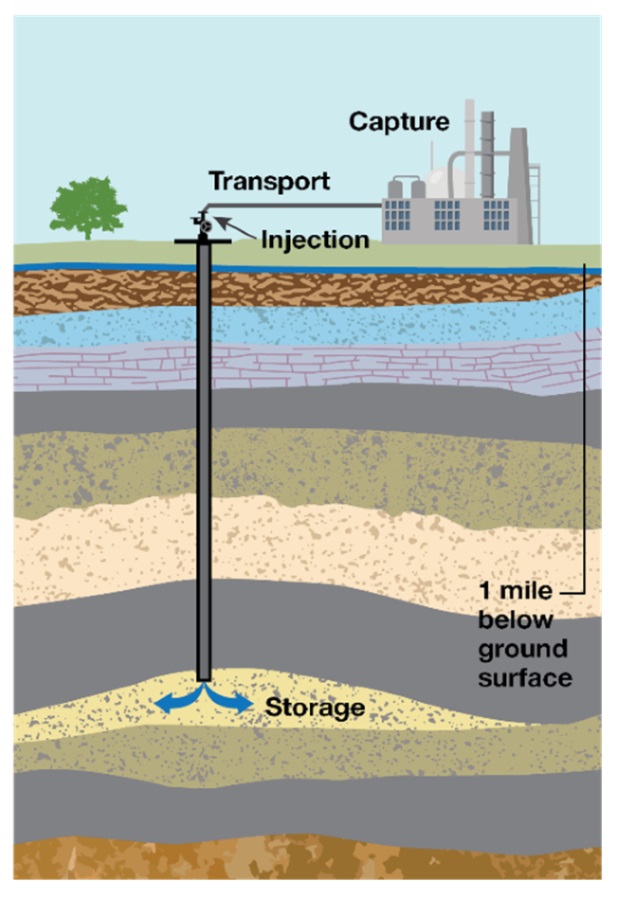

E&P Occidental Petroleum plans to submit another 10 Class VI permit applications requesting permission to inject CO2 underground as the company ramps up its carbon capture efforts, allocating capital for direct air capture (DAC) and sequestration hubs, executives said on the company’s latest earnings call.

Most of the company’s planned $600 million investment in its emerging low-carbon ventures (LCV) for 2024 will go to STRATOS, Occidental Petroleum CEO Vicki Hollub said. STRATOS, the company’s first DAC facility, remains on track for a mid-2025 commercial startup after construction is complete in Ector County, Texas.

“We’re making great progress towards advancing our net-zero pathway as we develop direct air capture and other exciting technologies,” Hollub said Feb. 15. “We see tremendous potential in LCV to increase Occidental’s cash flow resilience and generate solid long-term returns for our shareholders.”

Considered among the energy industry’s nascent technologies, DAC involves extracting CO2 directly from the atmosphere from anywhere. The captured CO2 can be stored deep underground or used for other applications—such as EOR and for products such as concrete, bioplastics, fuels and metal alternatives.

While the technology is viewed as a promising route toward lowering global emissions, DAC is expensive and requires loads of energy.

Designed to capture up to 500,000 tonnes of CO2 per year, STRATOS is expected to be the world’s largest direct air capture plant. The Permian Basin facility is being developed by Occidental’s 1PointFive subsidiary with a development license with Carbon Engineering, which Occidental acquired last year for $1.1 billion. The facility will be Occidental’s first industrial-scale DAC facility.

STRATOS landed funding last year from BlackRock through a fund managed by the firm’s Diversified Infrastructure business. In 2023, the firm’s investment totaled $100 million, a figure that Occidental expects will increase in 2024, Hollub said. The funds are in addition to the $600 million allocated to LCV.

“We’re excited also about our STRATOS joint venture with BlackRock, which we believe demonstrates that DAC is becoming an investable asset for world-class financial institutions. In addition, our teams signed on several more flagship carbon dioxide removal credit customers.”

In South Texas, where planning is underway for Occidental’s second DAC and sequestration hub, subsurface and well permitting investments have been made. Located on the King Ranch in Kleberg County, the South Texas DAC Hub is designed to remove and store up to 1 MMmt of CO2 annually. However, the hub’s Texas Gulf Coast location near industrial emitters and its access to 106,000 subsurface acres gives it the potential to remove and store up to 30 million metric tons of CO2 per year with DAC, Occidental said.

The project, which will be powered by solar energy, was selected in August 2023 to receive a grant from the U.S. Department of Energy’s (DOE) Office of Clean Energy Demonstrations. 1PointFive and a separate project led by Battelle in Louisiana were tapped to receive up to $1.2 billion in funding thanks to the 2021 Bipartisan Infrastructure Law.

“The discussions with the DOE are continuing and going quite well,” Hollub said. “The timing of the start of the front-end engineering and design will be dependent on the completion of some of those discussions and then the discussions will continue beyond that on getting prepared for the start of construction.”

Much of the South Texas DAC hub spend is to continue the buildout of the subsurface capability for CO2, added Richard Jackson, president of Occidental’s U.S. onshore resources and carbon management.

“Obviously, direct air capture is an anchor for the King Ranch area, but we continue to work on our other Gulf Coast hubs. We’ve submitted 8 Class VI [permit applications] and are expected to submit another 10 this year. So just kind of giving you scale of what … type of work has been going there. So, going really well.”

Globally, there are six commercial direct air capture plants in the works, according to the Global CCS Institute. These include Occidental’s STRATOS and South Texas hub along with Project Cypress, the southwest Louisiana DAC hub being developed by Battelle, Climeworks, Heirloom and Gulf Coast Sequestration.

Recommended Reading

Guyana’s Stabroek Boosts Production as Chevron Watches, Waits

2024-04-25 - Chevron Corp.’s planned $53 billion acquisition of Hess Corp. could potentially close in 2025, but in the meantime, the California-based energy giant is in a “read only” mode as an Exxon Mobil-led consortium boosts Guyana production.

US Interior Department Releases Offshore Wind Lease Schedule

2024-04-24 - The U.S. Interior Department’s schedule includes up to a dozen lease sales through 2028 for offshore wind, compared to three for oil and gas lease sales through 2029.

Utah’s Ute Tribe Demands FTC Allow XCL-Altamont Deal

2024-04-24 - More than 90% of the Utah Ute tribe’s income is from energy development on its 4.5-million-acre reservation and the tribe says XCL Resources’ bid to buy Altamont Energy shouldn’t be blocked.

Mexico Presidential Hopeful Sheinbaum Emphasizes Energy Sovereignty

2024-04-24 - Claudia Sheinbaum, vying to becoming Mexico’s next president this summer, says she isn’t in favor of an absolute privatization of the energy sector but she isn’t against private investments either.

Venture Global Gets FERC Nod to Process Gas for LNG

2024-04-23 - Venture Global’s massive export terminal will change natural gas flows across the Gulf of Mexico but its Plaquemines LNG export terminal may still be years away from delivering LNG to long-term customers.