The closing of the transaction required approval by Anadarko’s shareholders, who voted overwhelmingly in support of the sale to Occidental Petroleum. (Source: Anadarko Petroleum Corp./Shutterstock.com)

Occidental Petroleum Corp. completed its acquisition of rival Anadarko Petroleum Corp. after Anadarko shareholders on Aug. 8 voted overwhelmingly in support of the sale.

The companies had agreed to the transaction, valued at $55 billion (including debt), in May following a bidding war with Chevron Corp., which had initially offered $48 billion in its bid to buy Anadarko.

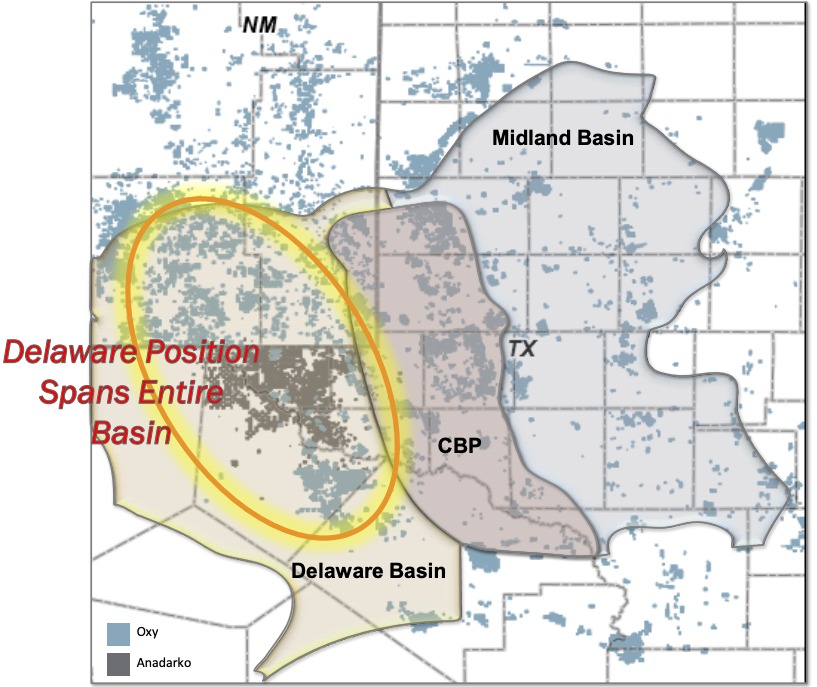

The acquisition of Anadarko adds a portfolio of international assets, including a prime position in the Permian Basin, to Occidental’s footprint. Occidental CEO Vicki Hollub expects to deliver at least $3.5 billion annually in cost and capital spending synergies from the combination, she said in a company press release.

“With Anadarko’s world-class asset portfolio now officially part of Occidental, we begin our work to integrate our two companies and unlock the significant value of this combination for shareholders,” Hollub said.

Hollub has also lined up asset sales and financings, including a $13 billion debt offering on Aug. 6, to support Occidental’s multibillion-dollar acquisition of Anadarko.

RELATED:

Investors Flock To Occidental’s $13 Billion Debt Offering

The closing of the transaction required approval by Anadarko’s shareholders at a special meeting held on Aug. 8. The shareholders voted 99% in favor of the deal in which they receive $59 in cash and 0.2934 shares of Occidental common stock per share of Anadarko stock.

Notably, the deal didn’t include approval by Occidental shareholders due to a $10 billion financing agreement with Warren Buffett’s Berkshire Hathaway Inc.—a move that has drawn the ire of activist investor Carl Icahn, who owns 4.4% of Occidental. Icahn has since launched a proxy campaign to replace four Occidental directors.

Effective after the end of trading today, Anadarko’s common stock will no longer trade on the New York Stock Exchange.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

AI Highs: Corva Predictive Drilling Powers Oilfield Efficiency

2024-05-20 - The energy sector is buzzing with talk of artificial intelligence, and Corva is capitalizing on its ability to synthesize complex data to optimize drilling operations with predictive drilling software.

Kimmeridge’s Mark Viviano on Reshaping the Energy Sector, SilverBow-Crescent Deal

2024-05-16 - Kimmeridge Energy Engagement Partners’ Mark Viviano says the company is evaluating the Crescent Energy and SilverBow Acquisition and how Kimmeridge played a key role in transforming the shale sector in this Hart Energy Exclusive interview.

SUPER DUG: Shale 4.0 Era about Building Scale- Rystad

2024-05-16 - The Shale 3.0 era or capital discipline era will be followed by the Shale 4.0 era, which will see companies focused on building scale, according to Rystad Energy Senior Shale Analyst Matthew Bernstein.

Adkins: Attacks on Fossil Fuels, Overregulation Poised to Backfire

2024-05-17 - Raymond James’ J. Marshall Adkins tells Hart Energy’s SUPER DUG conference attendees demonizing oil and gas, strenuous regulations and continued inflation are bound to have unexpected consequences for E&P opponents.