The two deals were initially priced at $174 million. (Source: Shutterstock)

Northern Oil and Gas (NOG) closed two previously announced acquisitions with private sellers in the Utica Shale and northern Delaware Basin assets for $162.6 million, the company said Feb. 5.

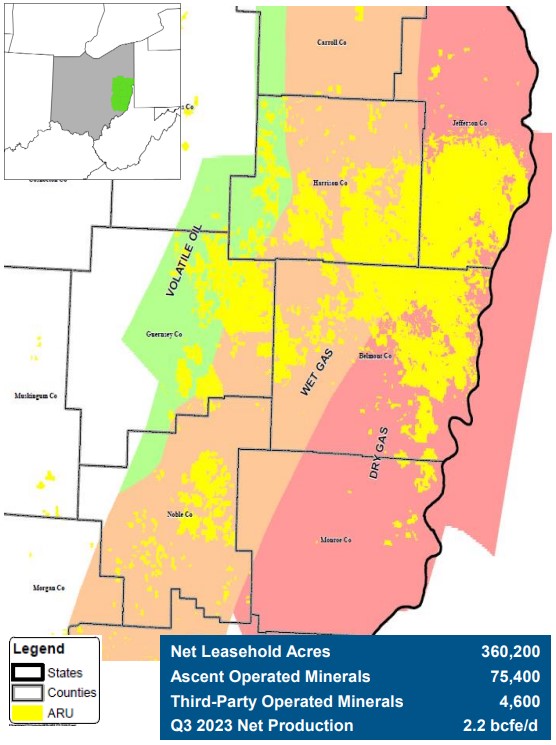

In November, NOG said it would enter the Utica Shale with the purchase of interests including 0.8 net producing wells and 1.7 net wells in process from a private party. The Minneapolis company added non-operated interests in Ohio’s Jefferson, Harrison, Belmont and Monroe counties. The primary target zones are the Point Pleasant Formation and the Utica Shale. Nearly all of the acquired Ohio assets are operated by Ascent Resources.

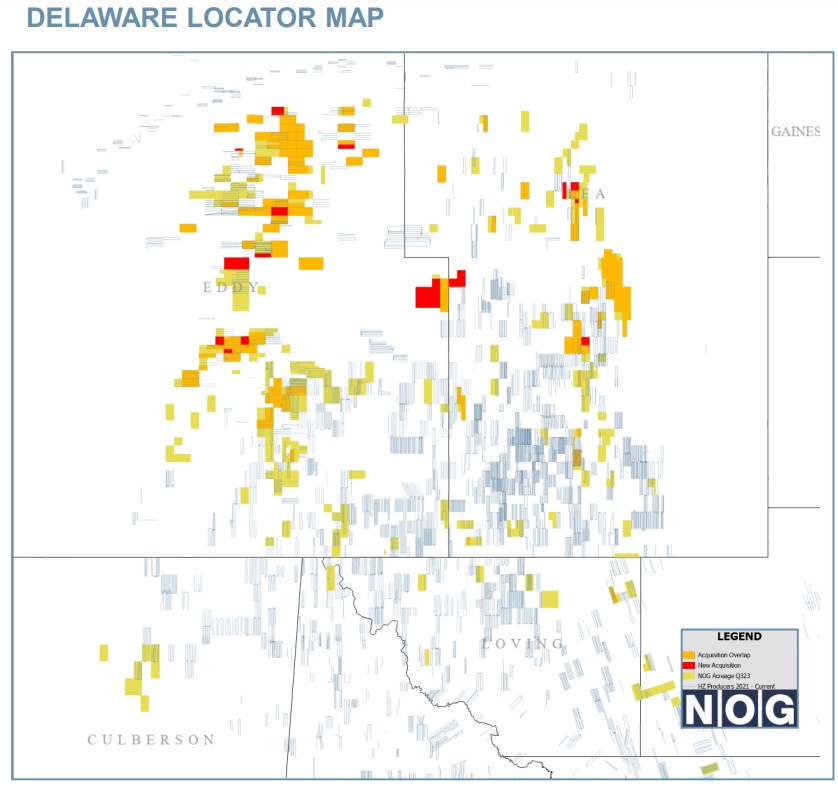

NOG also extended its footprint in the Delaware Basin in a separate transaction that bolts on non-operated interests across about 3,000 net acres in the northern part of the play. The interests are primarily in Lea and Eddy counties, New Mexico. The company owns existing interests in approximately 90% of the leasehold.

The two deals were initially priced at $174 million. NOG paid $28.4 million in closing costs incurred in fourth-quarter 2023 and the remaining $134.2 million in first-quarter 2024.

The first quarter closings were funded in part by a $17.1 million deposit paid at signing in November. The closing settlements are net of preliminary and customary purchase price adjustments and remain subject to post-closing settlements between the parties.

More information regarding these acquisitions can be found in NOG's Nov. 21, 2023, press release announcing the transactions, which is available here.

Citi served as financial adviser to NOG for the Delaware Basin transaction. TPH&Co, the energy business of Perella Weinberg Partners, served as financial adviser to the Delaware Basin seller. Kirkland & Ellis LLP is serving as NOG’s legal adviser for the Delaware Basin transaction. Steptoe & Johnson is serving as NOG’s legal adviser for the Utica transaction.

Recommended Reading

Northern Oil and Gas Executes on Ground Game A&D

2024-02-16 - The non-op E&P reported $25 million in “opportunistic” acquisitions in the fourth quarter.

Elk Range Royalties Makes Entry in Appalachia with Three-state Deal

2024-03-28 - NGP-backed Elk Range Royalties signed its first deal for mineral and royalty interests in Appalachia, including locations in Pennsylvania, Ohio and West Virginia.

APA Closes $4.5B Callon Deal, Deepening Permian Roots

2024-04-01 - About two-thirds of Apache’s daily production will come from the Permian Basin after APA Corp. completed its $4.5 billion takeout of Callon Petroleum.

Matador Bolts On Additional Interest from Advance Energy Partners

2024-02-27 - Matador Resources carved out additional mineral and royalty interests on the acreage it acquired from Advance Energy Partners for $1.6 billion last year.

Analysts: Diamondback-Endeavor Deal Creates New Permian Super Independent

2024-02-12 - The tie-up between Diamondback Energy and Endeavor Energy—two of the Permian’s top oil producers—is expected to create a new “super-independent” E&P with a market value north of $50 billion.