Non-op specialist Northern Oil & Gas is entering the Ohio Utica Shale and expanding its position in the northern Delaware Basin with approximately $174 million in M&A. (Source: Shutterstock)

Northern Oil & Gas Inc. is entering the Ohio Utica Shale and expanding Permian Basin footprint with approximately $174 million in M&A.

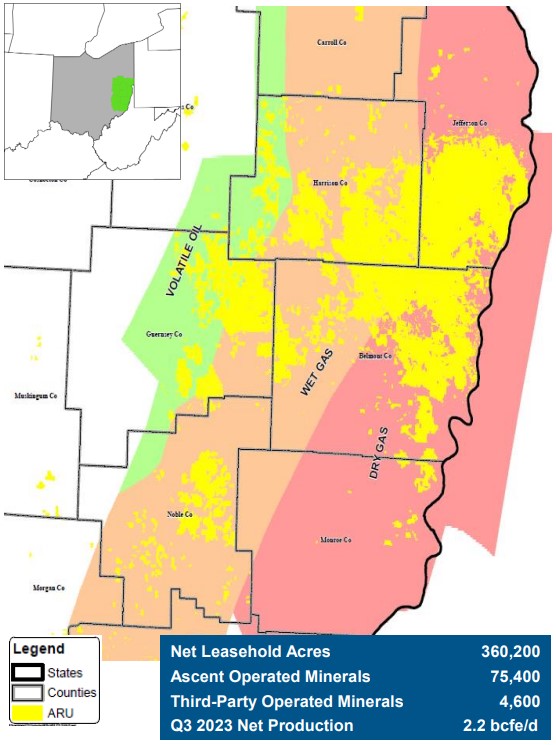

Minneapolis-based NOG inked an agreement with a private party to enter the Ohio Utica Shale through acquisition, scooping up non-operated interests in Jefferson, Harrison, Belmont and Monroe counties, Ohio. The primary target zones are the Point Pleasant Formation and the Utica Shale.

The acquired assets include 0.8 net producing wells and 1.7 net wells in process. Current production is approximately 23 MMcfe/d, or around 3,800 boe/d (~100% gas). NOG expects production from the Ohio assets to average slightly higher in 2024.

Nearly all the acquired Ohio assets are operated by Ascent Resources.

The Ohio Utica acquisition is expected to close in the fourth quarter, with an effective date of Nov. 1. NOG anticipates capex of around $14 million on the Ohio assets this year and $8 million in 2024.

EOG Resources has also been actively consolidating acreage in the region. Houston-based EOG added 25,000 net acres to its Ohio Utica footprint so far this year, the company said in third-quarter earnings.

At the time, EOG had around 430,000 net acres in the Ohio Utica, predominately in the volatile oil window of the play.

RELATED

Here’s What Else EOG Will Say About the ‘New’ Utica

Delaware Basin M&A

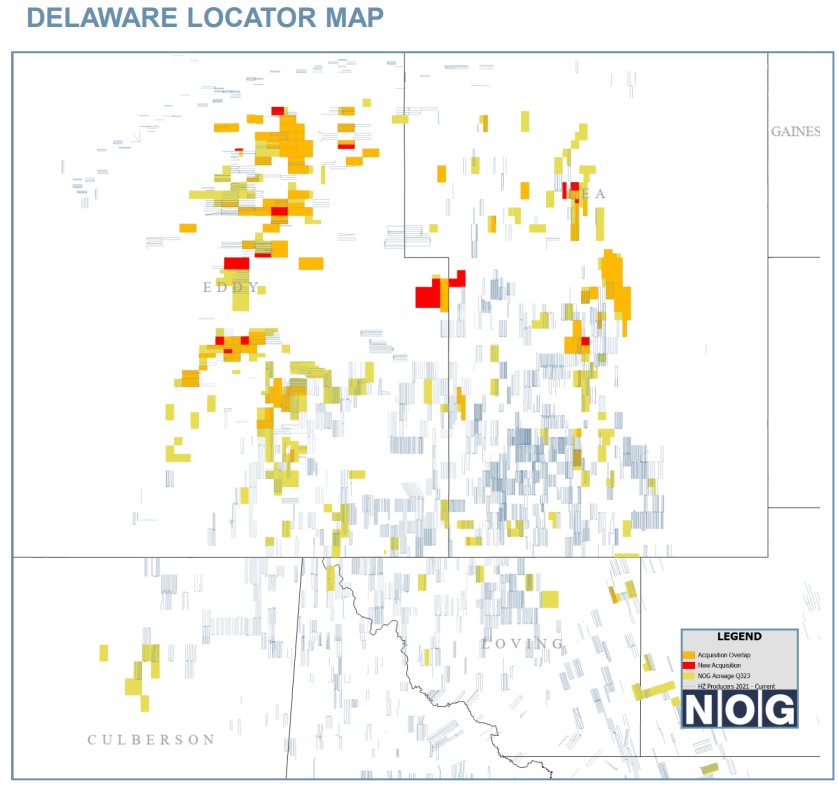

NOG is also expanding its position in the Permian’s Delaware Basin through a separate transaction.

The company is bolting on non-operated interests across about 3,000 net acres in the northern Delaware Basin, primarily located in Lea and Eddy counties, New Mexico. The company owns existing interests in approximately 90% of the leasehold.

The northern Delaware acquisition includes 13 net producing wells, one net well in progress and approximately 26.3 net undeveloped locations. Privately held Mewbourne Oil, one of the Permian’s top oil producers, is the largest operator and controls about 80% of the assets.

Current production from the assets is approximately 2,800 boe/d (2-stream, ~67% oil). The company anticipates output to average around 2,500 boe/d during 2024 before ramping up to more than 3,500 boe/d from 2025 through 2030.

Capex for the northern Delaware assets are expected to range between $25 million and $30 million in 2024.

“After closing, our Permian lands will approach ~40,000 net acres and definitively become our most active and largest basin in terms of activity and production,” said NOG President Adam Dirlam in a Nov. 21 news release.

The deal is expected to close in first-quarter 2024, with an effective date of Nov. 1, 2023.

The combined purchase price for both deals is about $174 million, including $170 million in cash and 107,657 shares of NOG common stock. The stock portion of the deal is valued at approximately $4 million based on NOG’s closing price of $37.43 per share on Nov. 20.

“These transactions demonstrate our continued ability to successfully acquire high quality assets in the core of their respective basins, with best-in-class operating parties,” said NOG CEO Nick O’Grady. “We expect the assets to be accretive in 2024 and to accelerate further in future years.”

Citi served as financial adviser to NOG for the Delaware Basin transaction. TPH&Co, the energy business of Perella Weinberg Partners, served as financial adviser to the Delaware Basin seller.

Kirkland & Ellis LLP is serving as NOG’s legal advisor for the Delaware Basin transaction. Steptoe & Johnson is serving as NOG’s legal advisor for the Utica transaction.

RELATED

Exclusive Q&A: NOG’s Non-Op M&A Strategy ‘Will Keep Us Very Busy,’ CEO Says

Recommended Reading

Hirs: AI and Energy—Is There Enough to Go Around?

2024-11-07 - AI data centers need a constant supply of electricity, and the nation’s grids are unprepared.

As Permian Gas Pipelines Quickly Fill, More Buildout Likely—EDA

2024-10-28 - Natural gas volatility remains—typically with prices down, and then down further—but demand is developing rapidly for an expanded energy market, East Daley Analytics says.

Range Confirms: Data Center Talk Underway for Marcellus Gas-fired Power

2024-10-24 - Deals will take a while, however, as these multi-gigawatt agreements are also multi-decade investments, said Range Resources CFO Mark Scucci.

Companies Hop on Digital Twins, AI Trends to Transform Day-to-day Processes

2024-10-23 - A big trend for oil and gas companies is applying AI and digital twin technology into everyday processes, said Kongsberg Digital's Yorinde Lokin-Knegtering at Gastech 2024.

Morgan Stanley Backs Data Center Builder as AI Fervor Grows

2024-10-21 - Morgan Stanley Infrastructure Partners (MSIP) is backing data center developer Flexential as demand for AI and high-performance computing grows.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.