What makes the Ohio Utica Combo play new? “It’s been a bit of a sleepy basin. Everyone knew that there was a liquids window there, obviously, and it hasn’t really been revisited in a number of years,” Yacob said. (Source: 68STEELPHOTOGRAPHY / Shutterstock.com)

Making the “Utica Combo” its seventh play in its portfolio, EOG Resources Inc. shared more details about what it plans to do differently in Ohio’s volatile oil window than had Chesapeake Energy Corp. and others in the past.

Chesapeake sold its Ohio Utica position in 2018 to Encino Energy Partners for $2 billion, including more than 900,000 net acres in each of the Utica’s four phase windows (west to east: black oil, volatile oil, wet gas and dry gas) and producing more than 600 MMcfe/d.

On Nov. 3, EOG Resources disclosed in its third-quarter earnings announcement it had established a new position in the Ohio Utica Combo play through the accumulation of acreage. Here’s a summary of intel EOG shared in a call with investors, combined with details from its press release and slides.

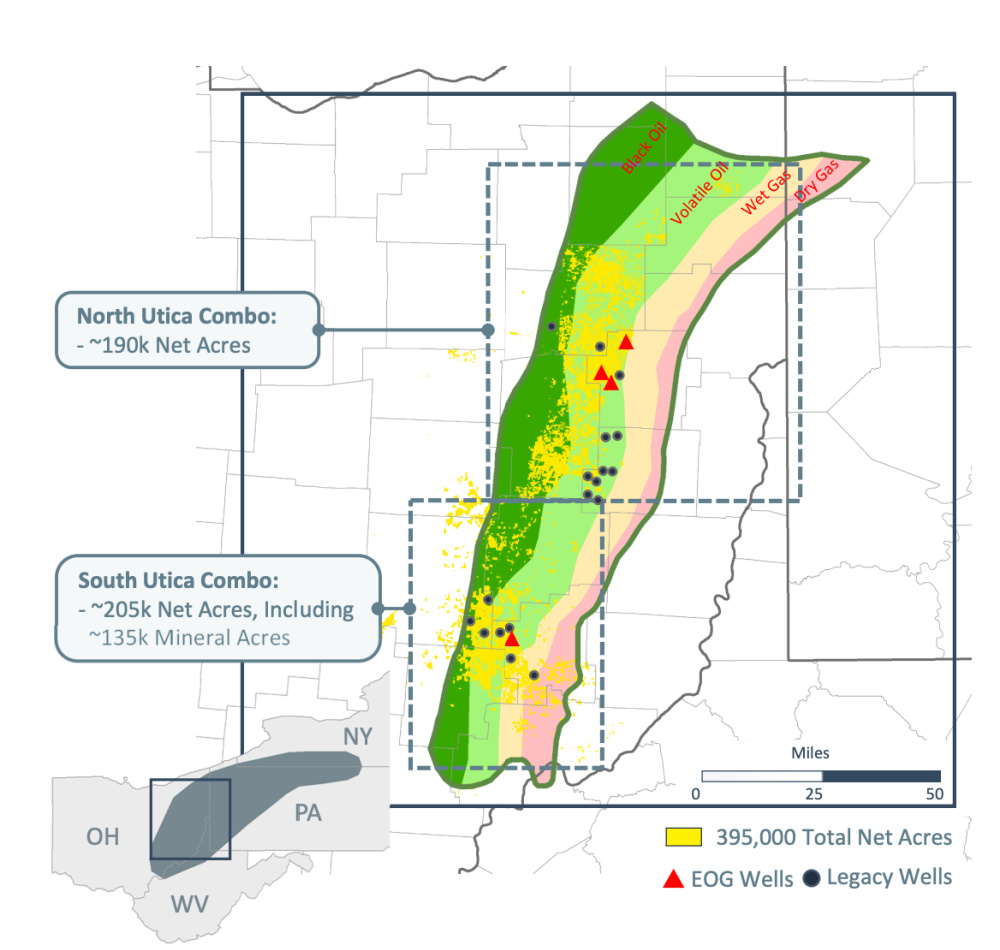

- Leased 395,000 net acres and bought the mineral interests of 135,000 of these. The mineral interests are in the 205,000-net-acre southern fairway where EOG’s new leasehold is primarily in Guernsey, Noble, Muskingum and Morgan counties.

The other 190,000 net acres are in the northern fairway where EOG’s acreage is primarily in Stark, Carroll, Tuscarawas and Harrison counties.

- In addition to where it owns the mineral rights, most of the rest of the leasehold is HBP, said Ezra Yacob, chairman and CEO.

- Total spend was under $500 million. That included acquiring 18 legacy wells for modeling the reservoir. The average lease cost per net acre was less than $600. Separately, the minerals interests were acquired at an average of $1,800 an acre.

“[The Ohio Utica combo is] really almost reminiscent of what we saw nearly a decade ago happening in the Delaware Basin where it was a bit of a sleepy basin with a lot of ‘show’ wells.”—Ezra Yacob, EOG Resources Inc.

- It’s estimating F&D of less than $5 per boe.

- Plans are for three-mile laterals and expectations are that these will have EURs of between 2 million and 3 million boe, “depending on where we’re at in the play” but “it’s early,” Yacob said.

- Liquids content is between 60% and 70% with about half of that being oil.

- Four wells have been completed with one in the southern acreage. Drilled in far western Noble County, it’s the most prolific of the four. Its two-week IP was more than 2,500 bbl/d of oil and 3,500 boe/d from a 12,000-ft lateral.

The three northern-acreage wells are in far western Carroll County. The laterals on these are shorter than 12,000 ft.

- The 12,000-ft-lateral well was drilled in “a little over six days and stayed 99% in an eight-ft target,” said Ken Boedeker, executive vice president, E&P.

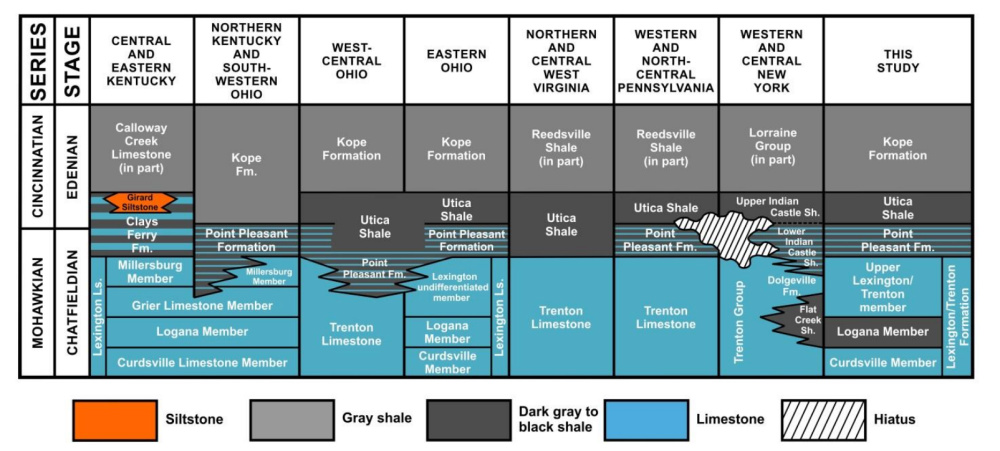

That target is in the Point Pleasant. In eastern Ohio, the Point Pleasant formation sits under the Utica shale and above the Lexington/Trenton limestone. Point Pleasant consists of a roughly 50:50 mix of shale and fossiliferous limestone, plus a small amount of siltstone, according to the Appalachian Oil & Gas Research Consortium (AOGRC) at West Virginia University.

- EOG plans 20 more wells next year in the northern and southern acreage combined. Since the wells can be drilled quickly, Boedeker said, EOG expects to get them all landed during the year with one rig.

Potential-well inventory will be determined after that.

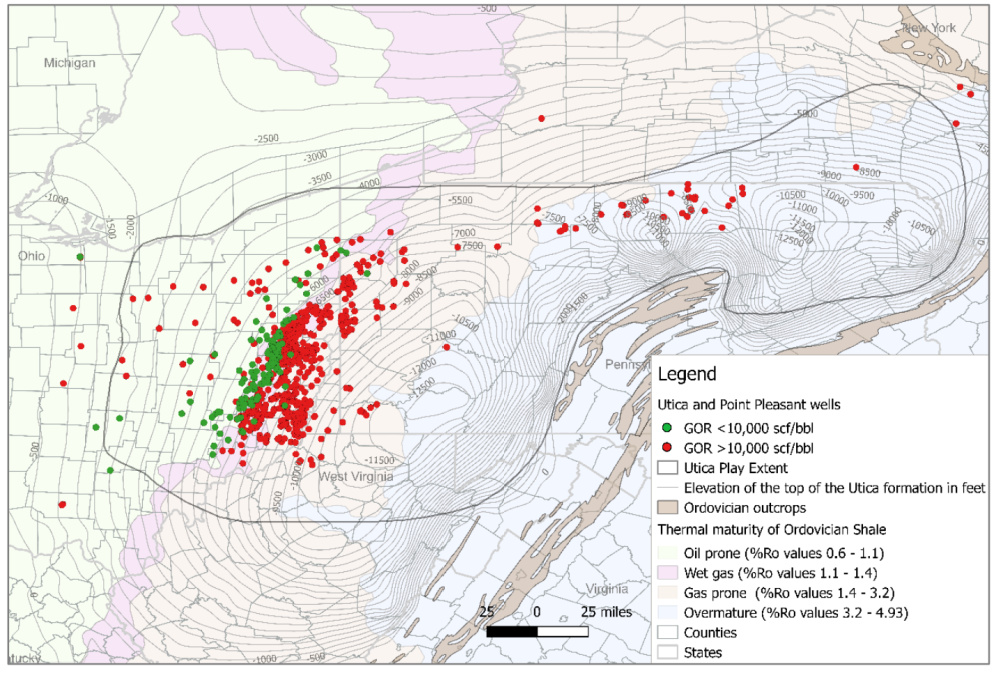

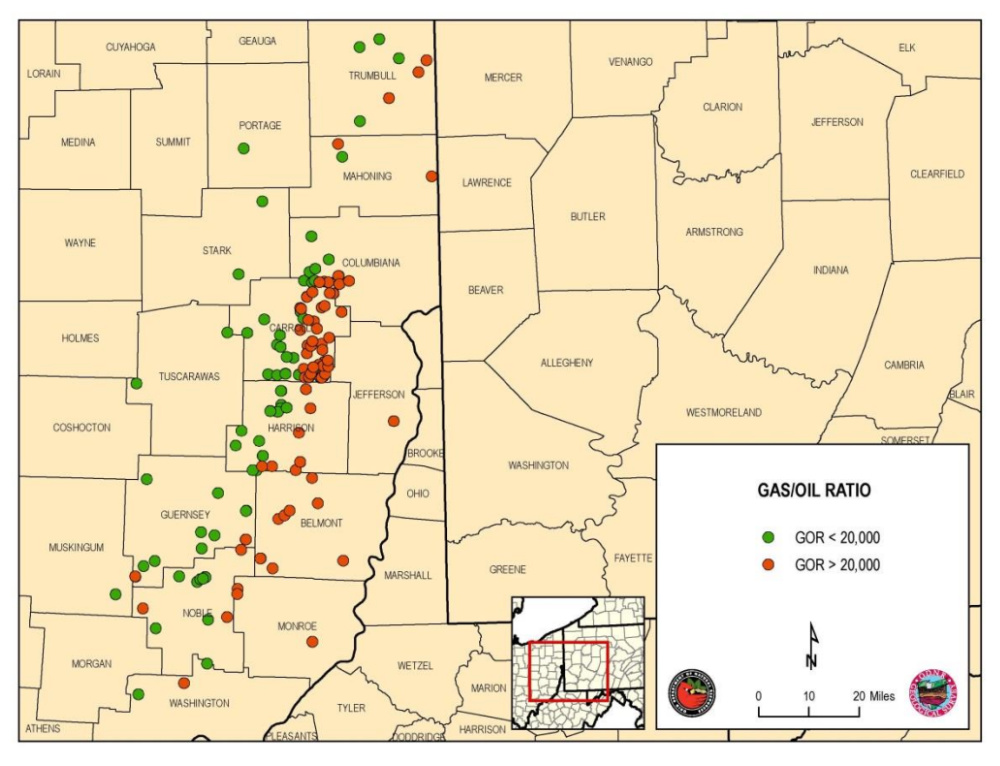

- EOG is focusing along the trend where Utica/Point Pleasant wells’ gas-oil ratio (GOR) is less than 10,000 scfg/bo, as per a comparison of EOG’s play map with one by the U.S. Energy Information Administration, and less than 20,000 scfg/bo based on one by the AOGRC.

Note: EIA calculated the initial gas-to-oil ratio for each well using the first six months of liquid and/or gas production. Vitrinite reflectance (Ro) is calculated from conodont and bitumenen reflectance data.

It’s “enough gas to help us lift our wells,” Boedeker said. “At this point in time, we don’t see that we’ll need much artificial lift through the life of these wells. It’s right on the right portion of that phase window.”

- Based on results from the first four wells, three-mile laterals in the play would earn what EOG deems “double premium” returns. What it deems a “premium” return is based on $40 oil, $16 NGL and $2.50 gas.

Boedeker said, “We actually think that we have double premium potential across the entire acreage position.”

- While others have operated in the Utica Combo, what EOG is doing differently is “having a number of years of experience in all of our other basins that we can bring to bear here in the Utica,” Boedeker said.

That includes “understanding the phase, looking at that phase, not getting into the gas window and not getting too far into the black oil window.”

Also, it’s understanding how pressure varies in the acreage. Then, D&C execution.

“That all rolls into what I would call the geomechanics,” Boedeker said. “And when you roll all that together, it really gives us confidence in that area that we’ll be able to develop [it] with low finding cost and double premium returns.”

- EOG wouldn’t disclose its planned 2023 spend on the 20 wells. When moving to development, though, “you can use the $5 F&D and the 2- to 3-million-barrel [EUR] to get a reasonable estimate for well cost,” Boedeker said.

- As for takeaway, EOG plans to build the additional gathering needed and to use existing processing facilities “for the foreseeable future,” Boedeker added.

As for big pipe, Lance Terveen, senior vice president, marketing, said “there is significant available capacity that’s just adjacent to our play. And also, if you remember, it’s been built out for a long time.

“Much of it has been overbuilt, I would say, in the last 10 years.”

Compared with the Marcellus, he added, “when you get into this area, liquidity is very strong. So, we don’t see any issues at this time with sales on a go-forward basis.”

- EOG’s team in Oklahoma City led development of the play, with “a fresh look at the at the basin from a petroleum-system perspective,” Boedeker said. “We knew there was an oil rim with varying [GOR] present.”

Yacob said the Oklahoma City team brought its familiarity with the Woodford’s overpressured oil window. “That play really lended a lot of expertise to our understanding of mechanical stratigraphy—how the rocks actually break and interact with our completion strategy.”

RELATED:

Shale 2022: Changing Role of Gas Improves Prospects for Drillers

- What makes the play new? Yacob said, “It’s been a bit of a sleepy basin. Everyone knew that there was a liquids window there, obviously, and it hasn’t really been revisited in a number of years.”

EOG looked at it again, applying new understanding accumulated over the years, including how “the porosity manifests itself between the north and the south,” he added.

“We had better data to better define the GOR and the phase across this area, and we made a lot of progress modeling the overpressure across the play. When you combine that with technology on the operational side, that’s what gets us so excited about the opportunity here.”

Yacob added, “It’s really almost reminiscent of what we saw nearly a decade ago happening in the Delaware Basin where it was a bit of a sleepy basin with a lot of ‘show’ wells.

“It really required some industry and EOG technology and knowledge brought in from the outside to really make things work.”

Among new technologies to apply to the fairway this time is the advancements in precision targeting and stimulation, Boedeker said.

Recommended Reading

Defeating the ‘Four Horseman’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production — and keep the cash flowing.

Tech Trends: AI Increasing Data Center Demand for Energy

2024-04-16 - In this month’s Tech Trends, new technologies equipped with artificial intelligence take the forefront, as they assist with safety and seismic fault detection. Also, independent contractor Stena Drilling begins upgrades for their Evolution drillship.

AVEVA: Immersive Tech, Augmented Reality and What’s New in the Cloud

2024-04-15 - Rob McGreevy, AVEVA’s chief product officer, talks about technology advancements that give employees on the job training without any of the risks.

Lift-off: How AI is Boosting Field and Employee Productivity

2024-04-12 - From data extraction to well optimization, the oil and gas industry embraces AI.

AI Poised to Break Out of its Oilfield Niche

2024-04-11 - At the AI in Oil & Gas Conference in Houston, experts talked up the benefits artificial intelligence can provide to the downstream, midstream and upstream sectors, while assuring the audience humans will still run the show.