The company expects output to average a record 156,000 boe/d in full-year 2024—an 18% year over year increase from average production of 131,800 boe/d in full-year 2023. (Source: Shutterstock/ Matador Resources Co.)

Matador Resources Co. beefed up its Permian portfolio last quarter with additional interests from Advance Energy Partners.

Matador paid approximately $68 million to tack on additional Delaware Basin interests from Advance Energy Partners, the Dallas-based E&P reported in fourth-quarter earnings.

The transaction complemented the acreage interests that Matador picked up through a $1.6 billion acquisition from Advance last year, company executives said during Matador’s Feb. 20 earnings call.

Matador CFO Brian Willey said the fourth-quarter bolt-on was essentially treated as a continuation of the initial Advance transaction last year. The acquisition from private equity backer EnCap Investments LP closed in April 2023.

“They had this interest that they wanted to move out and called us,” said Van Singleton, Matador’s president of land acquisitions, “and we were able to make a deal.”

Matador Chairman and CEO Joe Foran said the deal primarily centered on mineral and overriding royalty interests that fit well into the E&P’s portfolio.

The additional Advance interests contributed around 1,000 boe/d of incremental output beyond Matador’s original expectations for the quarter.

The takeout of Advance Energy Partners last year was a big deal for Matador—in fact, it was the company’s biggest to date.

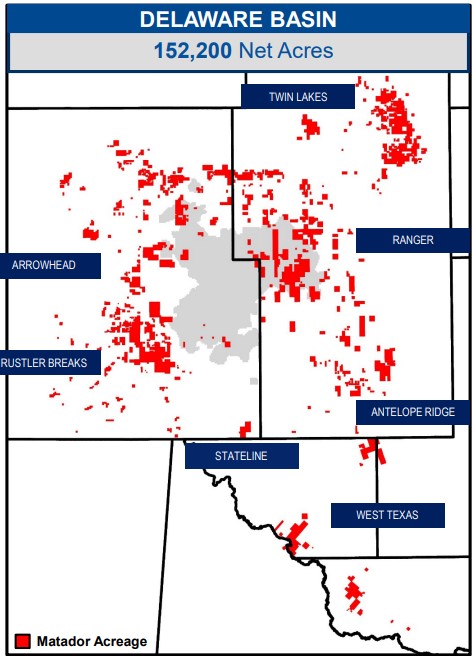

The transaction included 18,500 net acres in Lea County, New Mexico, and Ward County, Texas—near some of Matador’s best acreage within the core of the northern Delaware Basin.

But the Advance deal was one of more than 200 transactions completed by Matador’s land and business development group last year, Foran said.

RELATED

Matador ‘Encouraged’ as Delaware Horseshoe Wells Lower Drilling Costs

“Some of [the transactions] were very, very small. Some of them were a little larger,” Foran said. “But they’re out there—our land men, in particular—all the time making deals.”

Foran expects to see similar blocking-and-tackling work by Matador’s land acquisition team going forward this year.

“These are small transactions that don’t have that, by themselves, a big material impact,” Foran said. “But in the aggregate, they add up and they make your operations that much more efficient.”

Matador reached a record quarterly production average of 154,300 boe/d in the fourth quarter.

The company expects output to average a record 156,000 boe/d in full-year 2024—an 18% year over year increase from average production of 131,800 boe/d in full-year 2023.

RELATED

Exclusive: Matador Deals Driven by Geology, Right Opportunity [WATCH]

Recommended Reading

Global Partners Buys Four Liquid Energy Terminals from Gulf Oil

2024-04-10 - Global Partners initially set out to buy five terminals from Gulf Oil but the purchase of a terminal in Portland was abandoned after antitrust concerns were raised by the FTC and the Maine attorney general.

Making Bank: Top 10 Oil and Gas Dealmakers in North America

2024-02-29 - MergerLinks ranks the key dealmakers behind the U.S. biggest M&A transactions of 2023.

Enbridge Closes First Utility Transaction with Dominion for $6.6B

2024-03-07 - Enbridge’s purchase of The East Ohio Gas Co. from Dominion is part of $14 billion in M&A the companies announced in September.

ONEOK CEO: ‘Huge Competitive Advantage’ to Upping Permian NGL Capacity

2024-03-27 - ONEOK is getting deeper into refined products and adding new crude pipelines through an $18.8 billion acquisition of Magellan Midstream. But the Tulsa company aims to capitalize on NGL output growth with expansion projects in the Permian and Rockies.

Marketed: Anschutz Exploration Six Asset Package in Wyoming

2024-02-26 - Anschutz Exploration Corp. has retained EnergyNet for the sale of six AFE asset packages in Campbell County, Wyoming.