Aerial view of the Permian Basin in West Texas. (Source: Shutterstock)

Matador Resources is seeing lower drilling costs—and encouraging results—from its first batch of “horseshoe” wells in West Texas.

Dallas-based Matador turned to sales its first two horseshoe wells in Loving County, Texas, this month, the company said in third-quarter earnings.

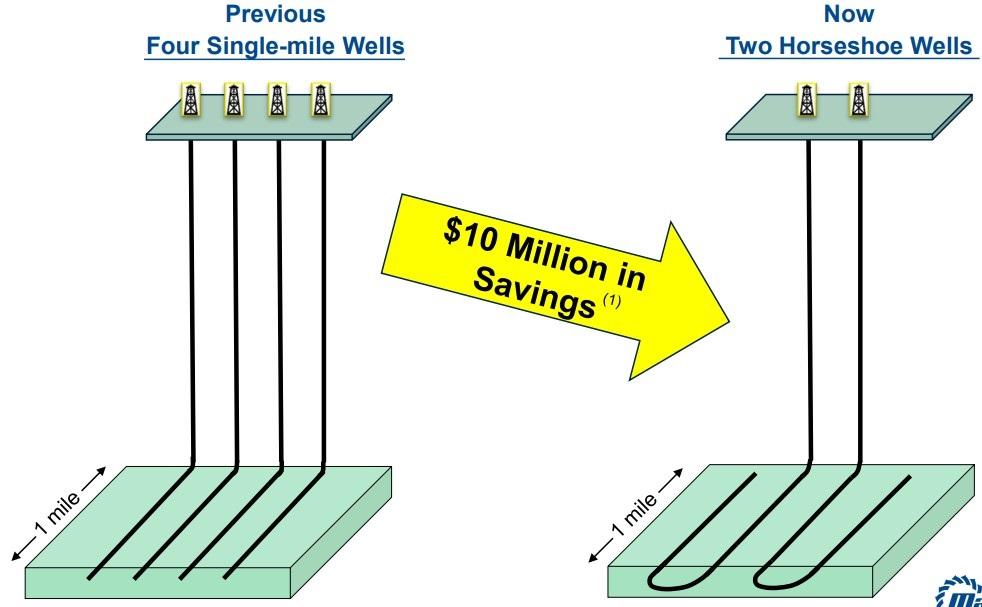

The company announced plans to test the U-shaped horseshoe wells in its Wolf asset area in the Permian’s Delaware Basin earlier this year. Instead of drilling four one-mile laterals, Matador opted to drill a pair of two-mile, U-shaped laterals—helping to bring down drilling and completion costs.

Joseph Wm. Foran, founder, chairman and CEO of Matador, said the Loving County horseshoe wells have 24-hour IP test results of 2,477 boe/d (51% oil) and 2,166 boe/d (53% oil), respectively.

“We are encouraged by the early initial production from the horseshoe wells, which is comparable to or better than traditional two-mile lateral wells drilled in the Wolf asset area,” Foran said in Matador’s third-quarter earnings release.

Matador estimates saving about $10 million in costs by drilling the two horseshoe wells versus drilling four one-mile lateral wells.

Chris Calvert, Matador executive vice president and co-COO, said the company is seeing comparable cycle times to a straight two-mile lateral for the horseshoe wells.

“Our previous record for drilling a two-mile Wolfcamp A in our Wolf asset area—one of these horseshoes actually beat that record by about 20% from spud to TD,” or total depth, Calvert said on Matador’s third-quarter earnings call with analysts.

Matador plans to bring online wells with 2.5-mile and 2.7-mile laterals in the next year, Calvert said.

RELATED: Matador Closes $1.6 Billion Delaware Basin Bolt-on

Record production

Matador Resources hit record oil and gas production in the third quarter—and spent less cash than expected to get there.

Matador’s total production averaged 135,096 boe/d during the third quarter—up 3% from the company’s previous quarterly output record of 130,683 boe/d seen during the second quarter.

Matador had guided for its third-quarter production to range between 129,500 boe/d to 131,500 boe/d.

The company also achieved record crude oil production of 77,529 bbl/d during the third quarter—a 2% sequential increase.

Matador’s third-quarter natural gas output of 345.4 MMcf/d also set a record.

The E&P’s record-setting quarter was enabled by better-than-expected production from Matador’s wells in Lea County, New Mexico; better-than-expected results from non-operated assets; closing certain land acquisitions during the quarter; and fewer shut-in wells.

And Matador spent less capital reaching record production levels than analysts had anticipated.

All-in capex—including drilling, completion and midstream spending—totaled $337.7 million during the quarter, beating analyst forecasts by Tudor, Pickering, Holt & Co., Truist Securities and Siebert Williams Shank & Co.

“We’ve got production up. Our costs are down. We think our inventory selection is better than ever, and debt is down $200 million,” Foran said. “We think we’re ready for the opportunities that will come along this year.”

Matador is currently operating seven drilling rigs. The company expects to add an eighth super-spec drilling rig during first-quarter 2024.

RELATED: Exclusive: Matador Deals Driven by Geology, Right Opportunity [WATCH]

Ground game

Matador’s record production and lower capex fueled quarterly adjusted free cash flow of $144.6 million in the third quarter.

A portion of the free cash flow was allocated toward lowering Matador’s debt, Foran said. Another portion was used to further the company’s brick-by-brick acquisition strategy in the Permian Basin.

Matador deployed approximately $65 million into oil and gas leasehold acquisitions during the third quarter.

Brian Willey, executive vice president and CFO at Matador, said the mix of a dozen or so deals included non-operated interests, boosting stakes in operated wells and new acreage.

“It’s a broad mix,” Willey said during the call.

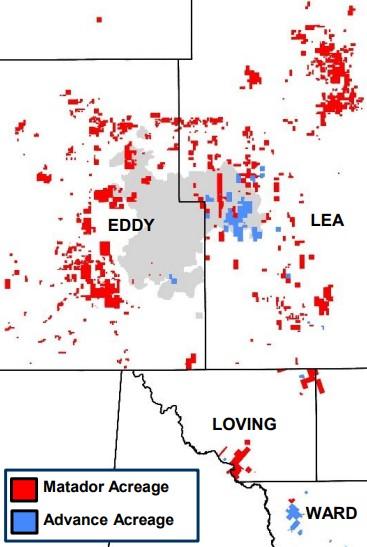

Matador has grown from around 7,500 net acres and six wells since going public in 2012 to around 150,800 net acres and 751 wells as of mid-2023.

Earlier this year, Matador closed its largest acquisition to date—a $1.6 billion deal to scoop up Advance Energy Partners’ Delaware portfolio from EnCap Investments LP.

The deal included 18,500 net acres in Lea County, New Mexico, and Ward County, Texas—near some of Matador’s best acreage within the core of the northern Delaware Basin.

Matador’s acquisition of Advance was special to Foran, he said during Hart Energy’s Strategies & Opportunities Conference in Dallas this month.

Foran and EnCap founder Gary Peterson are both natives of Amarillo, Texas, and the two have shared a decades-long friendship.

“Gary and his partners pioneered the oil and gas private equity business,” Foran said during the conference. “While I may be one of the last to favor and use the friend-and-family approach, Gary founded EnCap in 1988 to provide private equity capital to our industry and has done that.”

Recommended Reading

Analysts: Diamondback-Endeavor Deal Creates New Permian Super Independent

2024-02-12 - The tie-up between Diamondback Energy and Endeavor Energy—two of the Permian’s top oil producers—is expected to create a new “super-independent” E&P with a market value north of $50 billion.

Elk Range Royalties Makes Entry in Appalachia with Three-state Deal

2024-03-28 - NGP-backed Elk Range Royalties signed its first deal for mineral and royalty interests in Appalachia, including locations in Pennsylvania, Ohio and West Virginia.

Marketed: EnCore Permian Holdings 17 Asset Packages

2024-03-05 - EnCore Permian Holdings LP has retained EnergyNet for the sale of 17 asset packages available on EnergyNet's platform.

APA Closes $4.5B Callon Deal, Deepening Permian Roots

2024-04-01 - About two-thirds of Apache’s daily production will come from the Permian Basin after APA Corp. completed its $4.5 billion takeout of Callon Petroleum.

Is Double Eagle IV the Most Coveted PE-backed Permian E&P Left?

2024-04-22 - Double Eagle IV is quietly adding leases and drilling new oil wells in core parts of the Midland Basin. After a historic run of corporate consolidation, is it the most attractive private equity-backed E&P still standing in the Permian Basin?