The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

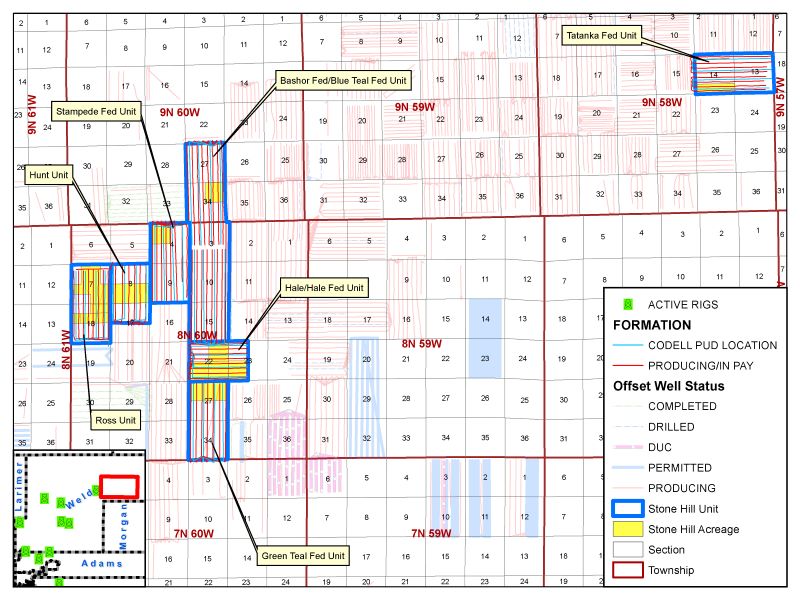

Stone Hill Minerals Holdings has retained EnergyNet for the sale of a D-J Basin 95 well package in Weld County, Colorado. The lot# 115339 package includes a six- month average free cash flow of $123,423 per month.

Opportunity highlights:

- Royalty Interest in 63 PDP/PDSI Wells

- 32 Additional Codell PUD Locations

- 6-Month Average Free Cash Flow: $123,423/Month

- 6-Month Average 8/8ths Production: 12,137 BOPD and 28,994 MCFPD

- 6-Month Average Net Production: 61 BOPD and 121 MCFPD

- Operators: Civitas Resources, Bison Oil/Gas, and Chevron U.S.A., Inc.

- 234 NMA/286 NRA

Bids are due March 5 at 4 p.m. CST. For complete due diligence, please visit energynet.com, or email Zachary Muroff, managing director, at Zachary.Muroff@energynet.com.

Recommended Reading

BKV CEO Chris Kalnin says ‘Forgotten’ Barnett Ripe for Refracs

2024-04-02 - The Barnett Shale is “ripe for fracs” and offers opportunities to boost natural gas production to historic levels, BKV Corp. CEO and Founder Chris Kalnin said at the DUG GAS+ Conference and Expo.