The following information is provided by RedOaks Energy Advisors. All inquiries on the following listings should be directed to RedOaks Energy Advisors. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

A private seller retained RedOaks Energy Advisors for the sale of certain royalty properties in the D-J Basin. The package includes a robust NTM cash flow of $7.4 million.

Opportunity highlights:

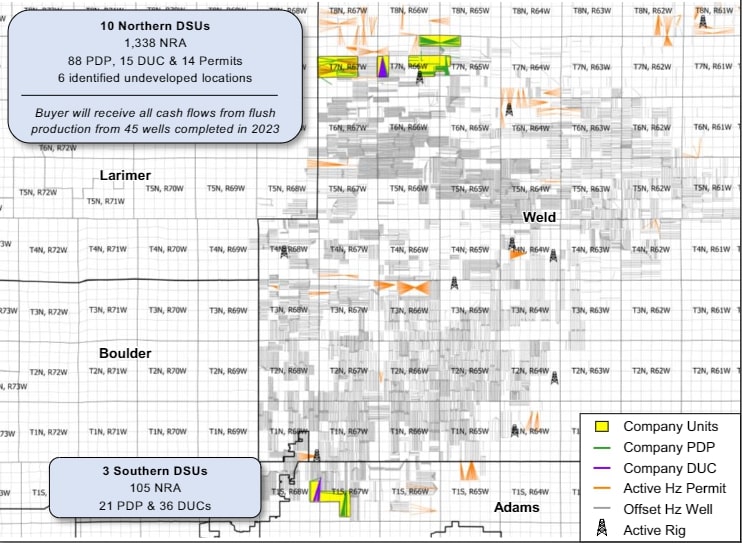

• Opportunity to acquire a high-yielding D-J Basin royalty portfolio

○ Concentrated footprint covering 1,443 NRA across 13 DSUs

• Robust NTM cash flow: $7.4 MM

○ Buyer will receive all cash flows from flush production from ~45 wells completed in 2023

• Highly active position (65 DUCs & Permits) controlled by marquee D-J Basin E&Ps: Chevron, Bayswater and Civitas

Bids are due Feb. 21 at noon CST. For complete due diligence, please visit redoaksenergyadvisors.com or email David Carter, partner, at david.carter@redoaksadvisors.com or Will McDonald, vice president, at will.mcdonald@redoaksadvisors.com.

Recommended Reading

Waha NatGas Prices Go Negative

2024-03-14 - An Enterprise Partners executive said conditions make for a strong LNG export market at an industry lunch on March 14.

Kinder Morgan Sees Need for Another Permian NatGas Pipeline

2024-04-18 - Negative prices, tight capacity and upcoming demand are driving natural gas leaders at Kinder Morgan to think about more takeaway capacity.

Kinder Morgan Exec: Don’t Count Out Midstream in M&A Frenzy

2024-04-02 - Kinder Morgan’s Allen Fore said 2024 should be an ‘interesting’ year in M&A during a discussion at DUG GAS+ Conference and Expo.

Summit Midstream Launches Double E Pipeline Open Season

2024-04-02 - The Double E pipeline is set to deliver gas to the Waha Hub before the Matterhorn Express pipeline provides sorely needed takeaway capacity, an analyst said.

For Sale? Trans Mountain Pipeline Tentatively on the Market

2024-04-22 - Politics and tariffs may delay ownership transfer of the Trans Mountain Pipeline, which the Canadian government spent CA$34 billion to build.