(Source: Shutterstock.com)

Mach Natural Resources LP has closed an $815 million acquisition of oil and gas assets in the Anadarko Basin, the company said on Dec. 29.

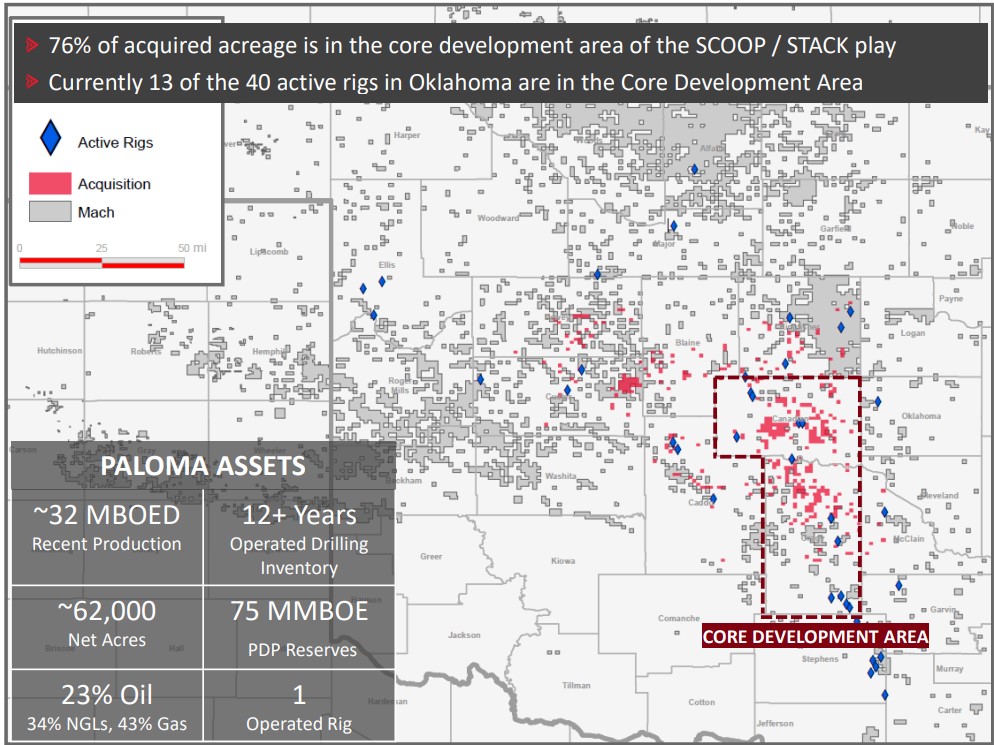

Mach said in November it would buy approximately 62,000 net acres in Oklahoma from EnCap-backed Paloma Partners IV, a privately-held Delaware limited liability company.

In conjunction with the closing of the acquisition, Mach entered into an $825 million term loan credit agreement to fund the purchase price via a group led by Chambers Energy Management and EOC Partners, as well as Mercuria Investments US Inc., funds managed by Farallon Capital Management LLC, Macquarie Group and Texas Capital Bank among others. Texas Capital Bank acted as the administrative agent.

Mach also entered into a $75 million super priority revolving credit facility led by MidFirst Bank. Mach used proceeds from the term loan facility and cash on hand to repay existing amounts outstanding under a previously outstanding revolving credit agreement.

Kirkland & Ellis served as legal adviser for Mach. Vinson & Elkins served as legal adviser and RBC Richardson Barr served as financial adviser for the sellers. Latham & Watkins served as legal adviser for the term loan arranger.

Recommended Reading

HighPeak Energy Authorizes First Share Buyback Since Founding

2024-02-06 - Along with a $75 million share repurchase program, Midland Basin operator HighPeak Energy’s board also increased its quarterly dividend.

Equinor Releases Overview of Share Buyback Program

2024-04-17 - Equinor said the maximum shares to be repurchased is 16.8 million, of which up to 7.4 million shares can be acquired until May 15 and up to 9.4 million shares until Jan. 15, 2025 — the program’s end date.

Northern Oil and Gas Ups Dividend 18%, Updates Hedging

2024-02-09 - Northern Oil and Gas, which recently closed acquisitions in the Utica Shale and Delaware Basin, announced a $0.40 per share dividend.

Magnolia Oil & Gas Hikes Quarterly Cash Dividend by 13%

2024-02-05 - Magnolia’s dividend will rise 13% to $0.13 per share, the company said.

Hess Midstream Increases Class A Distribution

2024-04-24 - Hess Midstream has increased its quarterly distribution per Class A share by approximately 45% since the first quarter of 2021.