Bear with me, this will only take a second: The market for super-chilled LNG is heating up.

There. It’s done. Out of my system. Ah, clichés. If necessity is the mother of invention (cliché), then clichés are the mothers of lame writing (not exactly a cliché but self-evident).

In this instance, though, reaching back for inspiration can be justified. The “heating up” line was deployed ad nauseum in coverage of LNG in 2014 (I should know, I used it enough), and it’s starting to look like 2023 is the new 2014.

Three major projects with total capacity of 5.1 Bcf/d are on track for final investment decisions this year, the most since 4.9 Bcf/d in 2014, Reuters has reported. They include Venture Global LNG’s Plaquemines facility in Louisiana (1.2 Bcf/d) and Sempra Energy’s facility in Port Arthur, Texas (1.8 Bcf/d). NextDecade’s Rio Grande project in Brownsville, Texas (2.1 Bcf/d) would be the third.

Then there are the deals signed to move that gas. INEOS Energy Trading will transport 1.4 million tonnes per annum of LNG from Sempra’s terminal to Germany’s Brunsbuttel regasification facility via two brand-spanking-new carriers built by MOL in South Korea. Cheniere locked in a 20-year agreement to sell about 1.8 mtpa to China’s ENN Natural Gas. Part of that deal is subject to an FID on the first train of Cheniere’s Sabine Pass Liquefaction Expansion Project and stems from China’s demand as it shifts away from coal.

Four scenarios

So, let’s blast “Happy” by Pharrell Williams and look at the numbers.

Everything hinges on price. If the price of natural gas isn’t high enough overseas, it’s not worth building the export terminals here. Clearly, the recent slew of deals reveals confidence that price won’t be a problem.

The Energy Information Administration (EIA) projects volumes of U.S. LNG on the global market to rise, eventually forcing international prices to drop. The opposite happens domestically—increased exports tighten the U.S. natural gas market and push up prices.

Eventually, the EIA says prices reach an equilibrium at which building new LNG capacity no longer makes economic sense because the spread will evaporate. That will limit LNG exports, which, if demand continues to rise, will push global prices…you get the picture.

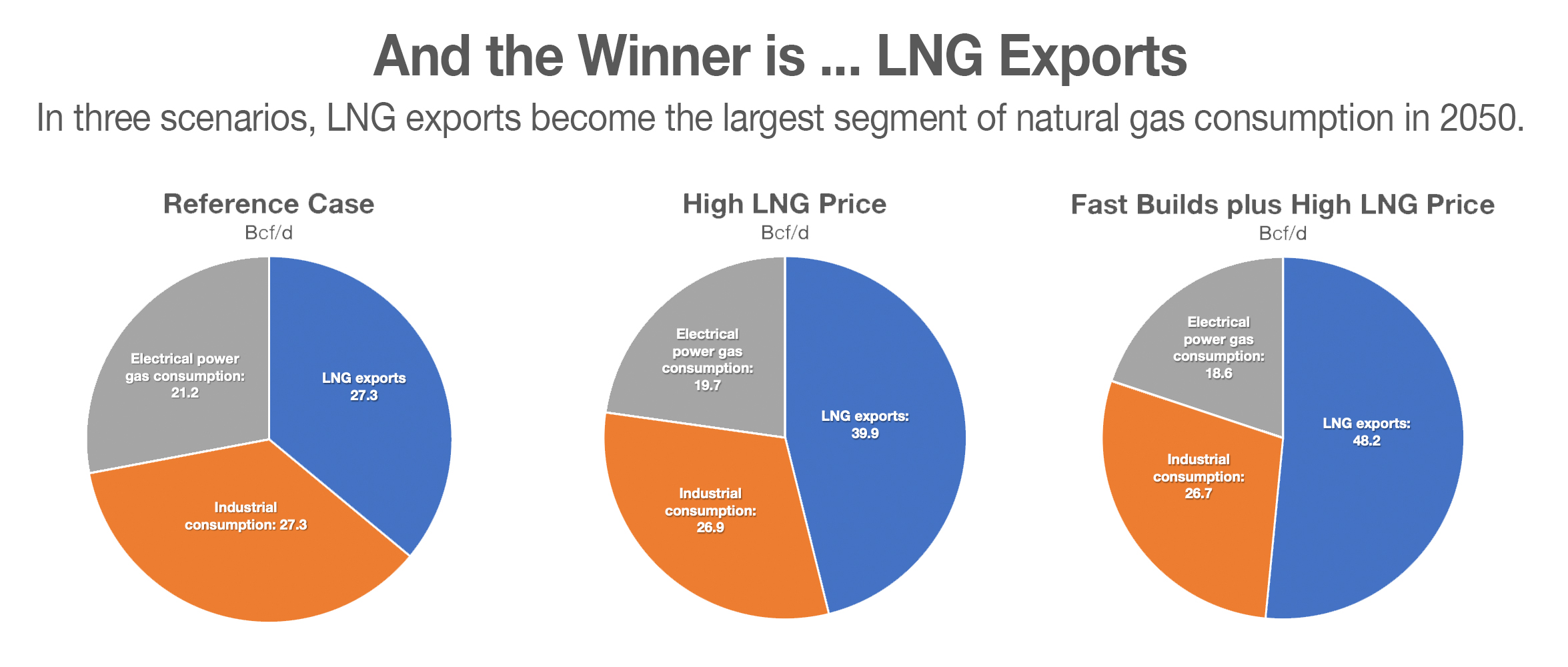

The EIA lays out four scenarios for the LNG market in 2050: the reference case from its Annual Energy Outlook; low international gas prices; higher international gas prices; and higher prices combined with faster development of export facilities.

What is interesting about the EIA analysis is that, while LNG exports affect U.S. natural gas prices, it’s not by much. Or, at least, not as much as it has been.

In the combination scenario of fast development and high international prices for LNG, exports will come in 77% higher than the base case in 2050. The Henry Hub price of $4.81/MMBtu, however, is only 28% higher.

And consumption will be flat across the board.

“In total, U.S. natural gas consumption changed only slightly across the cases because decreases in domestic consumption are largely offset by additional natural gas consumption required to support higher levels of LNG production and transmission,” the EIA says in its latest report in May.

The upshot in the EIA analysis is that, barring unexpectedly low international prices, LNG exports will become the largest segment of U.S. natural gas consumption beginning in the 2030s. And shipping it to those in Europe and Asia lacking in our bounty will not cause economic hardship domestically.

Makes ya want to dance like it’s 2014.

Recommended Reading

Spate of New Contracts Boosts TechnipFMC's Subsea Profits

2024-04-30 - TechnipFMC's operational profits are growing as the company heightened its focus on “quality” subsea orders, which earned $2.4 billion for the first quarter.

Message in a Bottle: Tracing Production from Zone to Wellhead

2024-04-30 - New tracers by RESMAN Energy Technology enable measurement while a well is still producing.

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.

Tech Trends: AI Increasing Data Center Demand for Energy

2024-04-16 - In this month’s Tech Trends, new technologies equipped with artificial intelligence take the forefront, as they assist with safety and seismic fault detection. Also, independent contractor Stena Drilling begins upgrades for their Evolution drillship.

AVEVA: Immersive Tech, Augmented Reality and What’s New in the Cloud

2024-04-15 - Rob McGreevy, AVEVA’s chief product officer, talks about technology advancements that give employees on the job training without any of the risks.