The Haynesville Shale is in the spotlight as production in the gassy basin rises. (Source: Shutterstock.com)

With natural gas prices forecast to rise alongside exports of LNG, the outlook appears favorable for Haynesville Shale players.

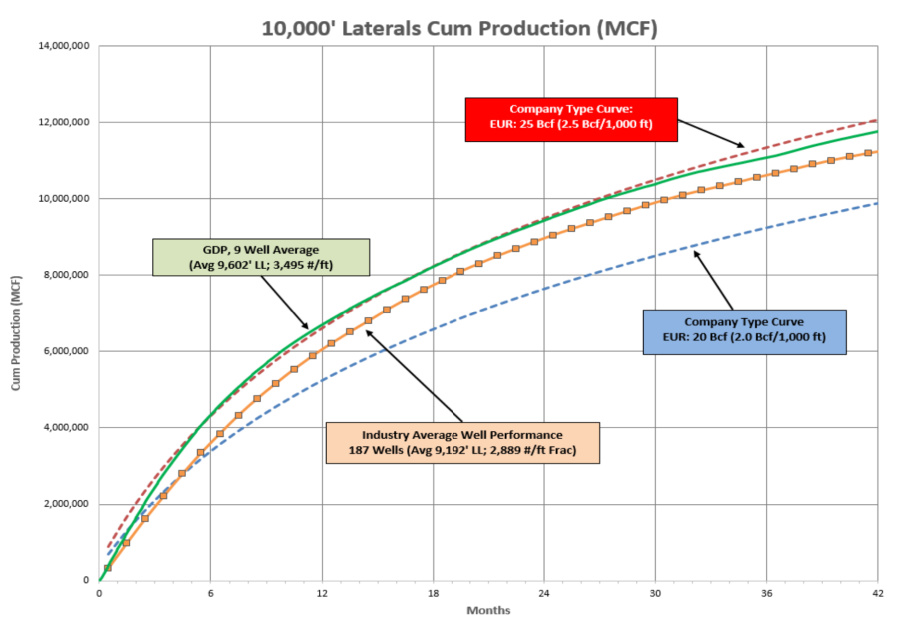

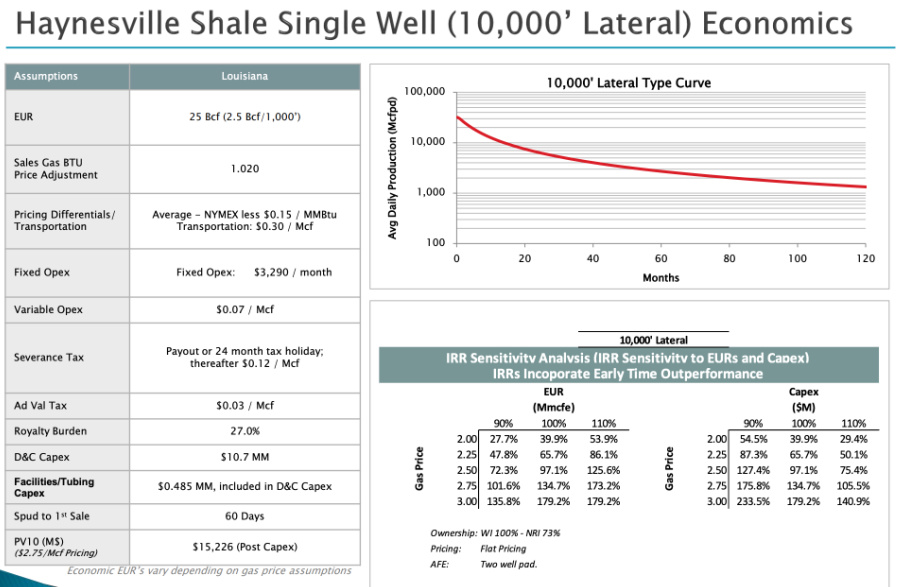

“The economics are really exceptional in this play. It’s driven by high volumes, very low lifting costs [about 5 cents per Mcfe],” said Rob Turnham, president and COO of Goodrich Petroleum Corp. “It’s 100% dry gas, very little formation water, if any, and therefore the operating expenses are extremely low. We’re getting about 2 1/2 Bcf per thousand feet of lateral.”

Speaking during the EnerCom Dallas conference this week, Turnham put its Haynesville assets in the spotlight as production in the gassy basin rises. Production is forecast by the U.S. Energy Information Administration (EIA) to grow by 119 MMcf/d to more than 12.1 Bcf/d in April, rebounding from the coronavirus-driven activity slowdown, as bullish drillers push forward.

The Houston-based independent E&P, which also has assets in the Tuscaloosa Marine Shale and South Texas Eagle Ford Shale, has a more than 26,000 net acre position in the Haynesville. Its sight is set on more bolt-on acquisitions, which could add to its more than 12 years’ worth of inventory. The company’s proved reserves have a 1.3 Tcf resource potential, he said.

Long laterals appear to be sweetening the economics.

“Short laterals typically come on at 15 to 20 million cubic feet per day,” Turnham said. “7,500s, anywhere from 20 to 25 million cubic feet per day, and then 10,000-foot laterals, anywhere from 25 to 35 million cubic feet per day. So, extremely productive.”

However, proppant loading is also making the play.

RELATED

PATH FORWARD: Goodrich Petroleum's Rob Turnham on the Haynesville Advantage

E&P Operator Spotlight: Goodrich Petroleum President, COO Details Company's Plans

Goodrich has moved from pumping about 2,500 lbs/ft of proppant to 5,000 but sees the best returns generated at 4,000 lbs/ft, Turnham added. That, combined with 100 to 125 ft per stage, have proven to be ideal for Goodrich. He pointed to the company’s type curve for 10,000-ft laterals, with an EUR of 20 Bcf (2 Bcf/1,000 ft).

That could bode well for the company, considering the EIA forecasts Henry Hub spot prices will rise to an average of $3.04/MMBtu this year, up from last year’s average of $2.03/MMBtu.

“Even at $2.50 gas on the short laterals, we’re generating 89% IRR. … When we complete a 7,500-foot lateral at $8.9 million, we’re generating 136% IRR at $2.50 gas,” Turnham said. “And again, because we’re only performing to the 2 1/2 Bcf curve, we’re generating 97% IRRs on the 10,000-foot laterals. We expect those returns to go up if we can prove that our completion recipe is working equally well on the 10,000-ft laterals, which we expect that to happen.”

Goodrich’s 2021 preliminary guidance includes plans for 17 wells (gross) with an average net lateral length of about 7,500 ft. The company is targeting production of between 58.4 Bcfe and 62.1 Bcfe, with the midpoint of average daily production at 165 MMcfe/d.

Budgeted capex is $75 million to $85 million.

Some analysts say prices could reach $3.25/MMBtu this summer and hit $3.50 by the end of the year, buoyed by rising LNG exports.

If that happens, watchful eyes will be on any capex adjustments by E&Ps.

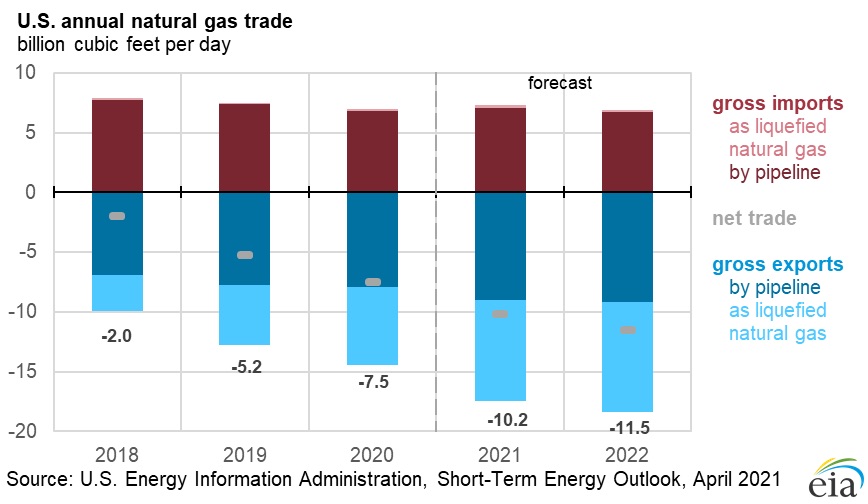

“We’ll just harvest the additional cash flow, pay down debt further, [and] build a war chest to take advantage of opportunities down the road,” Turnham said before turning to supply and demand. “What’s really been a positive is LNG export. … It’s far in excess of what most people were projecting at this point in time.”

Feed gas to LNG terminals was at about 11.5 Bcf/d with export capacity at 10.5 Bcf/d.

Exports to Mexico at about 6.5 Bcf/d is also a positive, he added.

The EIA forecasts LNG export growth will contribute to the average Henry Hub spot price increasing to $3.11/MMBtu in 2022.

Plus, “we’re exiting the storage withdrawal season at a very good number,” Turnham said.

The sector is in the “shoulder months,” for now, with comfortable outside temperatures. That will change moving into summer months when cooling demand rises. Add to the mix another expected active hurricane season.

Some people, he said, are concerned about whether there will be enough storage to comfortably go into the winter season.

“We hate watching weather. We hate relying everything on pricing, but I’ll tell you that it’s really a margin business,” Turnham said, speaking favorably about lower service costs. “To think that you can generate 100% IRRs at $2.50 gas is pretty, quite remarkable.”

However, $3.50 gas could prompt private E&Ps to ramp up activity and service costs could inch up, creating a scenario in which there are higher gas prices but lower margins, Turnham warned.

Maintaining efficiency is crucial.

Drilling multi-well pads, typically two-well pads for Goodrich, comes with built-in efficiencies given it’s one service facility with shared equipment and pipeline. Zipper fracking also has resulted in less time per stage, which saves on cost.

“What really drives your completed well costs, though, is your frac costs and as long as we have excess capacity in the market, we just don’t see a dramatic shift higher for our frac costs,” Turnham said. “That being said, if we’re in a bullish environment and commodity prices are higher, we’re bound to see a little bit of escalation on service costs.”

Goodrich expects to generate between $15 million and $30 million in free cash flow based on $2.50 to $3/Mcf gas.

Recommended Reading

Oil Broadly Steady After Surprise US Crude Stock Drop

2024-03-21 - Stockpiles unexpectedly declined by 2 MMbbl to 445 MMbbl in the week ended March 15, as exports rose and refiners continued to increase activity.

Oil Dips as Demand Outlook Remains Uncertain

2024-02-20 - Oil prices fell on Feb. 20 with an uncertain outlook for global demand knocking value off crude futures contracts.

What's Affecting Oil Prices This Week? (Feb. 5, 2024)

2024-02-05 - Stratas Advisors says the U.S.’ response (so far) to the recent attack on U.S. troops has been measured without direct confrontation of Iran, which reduces the possibility of oil flows being disrupted.

What's Affecting Oil Prices This Week? (Feb. 12, 2024)

2024-02-12 - With the increase last week, the price of Brent crude has reached its 200-day moving average.

What's Affecting Oil Prices This Week? (March 4, 2024)

2024-03-04 - For the upcoming week, Stratas Advisors expect the price of Brent will move sideways and will struggle to break through $85.