Goodrich Petroleum has grown its gas production from 70,000 Mcfe/d in 2018 to 140,000 Mcfe/d this year. (Source: Goodrich Petroleum)

[Editor's note: This introduction to the Operator Spotlight article first appeared in the November issue of E&P Plus. To view the full issue, click here. To subscribe to the digital publication, visit here.]

While the oil and gas industry might be hard-pressed to find many bright spots in 2020, the recovery of natural gas prices, and subsequently the role of gas producers, can be one of them. Among those that are riding the natural gas wave is Goodrich Petroleum. Goodrich, primarily focused on the Haynesville Shale, produces 138,000 Mcfe/d largely from its approximate 24,000 net Haynesville acres. Historically low service costs and stable Henry Hub price points are allowing Goodrich to set its goals on top-tier growth and the potential for free cash flow in 2021.

Goodrich President and COO Robert Turnham recently provided an exclusive interview with E&P Plus where he discussed in more detail the company’s plans for the remainder of the year and into 2021. He also touched on the company’s well completion strategy and how to position itself amid volatile times in the oil and gas industry.

Click below to read the full Q&A interview

in the November issue of E&P Plus.

Recommended Reading

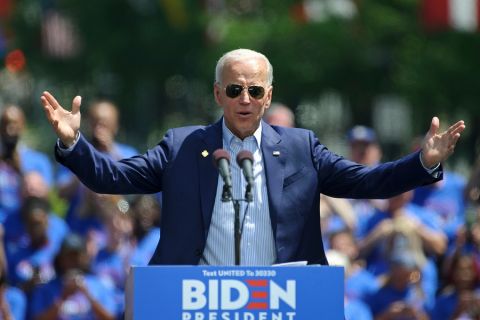

Exclusive: ‘Reality Has Hit,’ NatGas Not Just a Bridge Fuel, Landrieu Says

2024-04-11 - The Biden administration's LNG pause is "disappointing" and natural gas is a "solution to energy woes," co-chairs for Natural Allies for a Clean Energy Future Senator Mary Landrieu and Congressman Kendrick Meek told Hart Energy's Jordan Blum at CERAWeek by S&P Global.

Belcher: Our Leaders Should Embrace, Not Vilify, Certified Natural Gas

2024-03-18 - Recognition gained through gas certification verified by third-party auditors has led natural gas producers and midstream companies to voluntarily comply and often exceed compliance with regulatory requirements, including the EPA methane rule.

Hirs: LNG Plan is a Global Fail

2024-03-13 - Only by expanding U.S. LNG output can we provide the certainty that customers require to build new gas power plants, says Ed Hirs.

Pitts: Producers Ponder Ramifications of Biden’s LNG Strategy

2024-03-13 - While existing offtake agreements have been spared by the Biden administration's LNG permitting pause, the ramifications fall on supplying the Asian market post-2030, many analysts argue.

Wanted: National Gas Strategy for Utilities, LNG

2024-02-07 - Chesapeake CEO Nick Dell’Osso and Mercator Energy President John Harpole, speaking at NAPE, said some government decision-makers have yet to catch on to changes spreading across the natural gas market.