Kimbell Royalty Partners purchase of Permian Basin and Midcontinent assets for $455 million cash is the largest transaction in the company’s history. (Source: Shutterstock)

Kimbell Royalty Partners LP closed a $455 million cash deal adding royalty interests in the Permian Basin and Midcontinent assets from a private, undisclosed seller.

The acreage is concentrated in the Delaware Basin (49%), Midland Basin (10%) and the Midcontinent (41%).

Kimbell, based in Fort Worth, Texas, estimated that as of June 1, 2023, the acquired assets produced approximately 4,840 boe/d (1,619 bbl/d of oil, 1,227 bbl/d of NGLs and 11,964 Mcf/d of natural gas).

For the full year 2024, Kimbell estimates the acquired assets will produce approximately 5,049 boe/d (1,682 bbl/d of oil, 1,312 bbl/d of NGLs and 12,327 Mcf/d of natural gas).

The acquisition, which was announced in early August, was funded through a $325 million private placement of 6% Series A Cumulative Convertible Preferred Units to funds managed by affiliates of Apollo and borrowings under the company's $400 million revolving credit facility.

The seller’s Permian acreage has 11 rigs actively drilling as of June 30, offering exposure to operators including EOG Resources, Occidental Petroleum and ConocoPhillips in the Delaware Basin and Pioneer Natural Resources, Endeavor Energy Resources and SM Energy in the Midland Basin.

Recommended Reading

The Jones Act: An Old Law on a Voyage to Nowhere

2024-04-12 - Keeping up with the Jones Act is a burden for the energy industry, but efforts to repeal the 104-year-old law may be dead in the water.

Energy Transition in Motion (Week of March 22, 2024)

2024-03-22 - Here is a look at some of this week’s renewable energy news, including a new modeling tool for superhot rock.

Laredo Oil Settles Lawsuit with A&S Minerals, Erehwon

2024-03-12 - Laredo Oil said a confidential settlement agreement resolves a title dispute with Erehwon Oil & Gas LLC and A&S Minerals Development Co. LLC regarding mineral rights in Valley County, Montana.

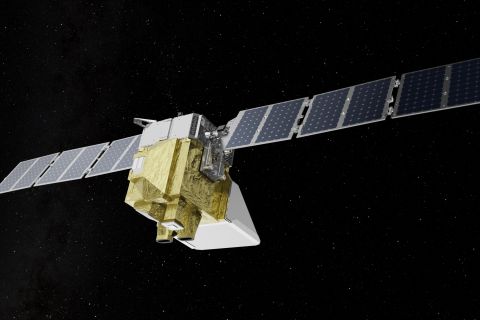

From Satellites to Regulators, Everyone is Snooping on Oil, Gas

2024-04-10 - From methane taxes to an environmental group’s satellite trained on oil and gas emissions, producers face intense scrutiny, even if the watchers aren’t necessarily interested in solving the problem.

Markman: Is MethaneSAT Watching You? Yes.

2024-04-05 - EDF’s MethaneSAT is the first satellite devoted exclusively to methane and it is targeting the oil and gas space.