Some 600 miles of gathering lines spread across 24 counties in Ohio and West Virginia feed into Blue Racer’s Berne processing complex in Monroe County, Ohio. The first of three trains, each rated at 200 million cubic feet per day, went onstream in late 2014. All photos courtesy of Blue Racer Midstream LLC

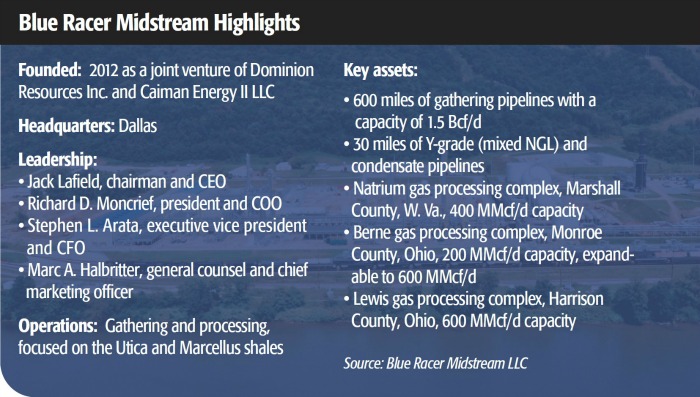

The rapidly developing Utica Shale has lacked midstream infrastructure. Two firms, Dominion Resources Inc. and Caiman Energy II LLC, formed a joint venture—Blue Racer Midstream—to create a “super system” serving producers throughout the play.

MIDSTREAM: What strengths did Caiman II and Dominion bring to the joint venture?

LAFIELD: The joint venture is a good combination of an existing company’s history along with a knowledgeable management team and the capital and the understanding of how to execute in the shale plays, which is quite important.

Dominion has a long history in the area as the gas utility. It’s a well-known name with a strong reputation and a local presence. Although their subsidiary, Dominion East Ohio, had never been in rich-gas gathering and gas processing, they did have facilities including an extensive pipeline network throughout eastern Ohio. When development of the Utica Shale began, Dominion East decided to take some idle and underutilized facilities and convert them to rich-gas gathering.

What Caiman brings to the joint venture is experience, the ability to execute new facilities and equity capital. Caiman has a long history of gathering and processing in the midstream space. Prior to the formation of Blue Racer, we developed significant infrastructure in the Marcellus Shale in the northern panhandle of West Virginia. My entire career—and the careers of a lot of our folks—has been spent building, owning and operating gas gathering, processing and fractionation facilities across the country, including multiple shale plays. Caiman also brought equity capital.

We sold Caiman I in April 2012, and formed Caiman II in July 2012 with $800 million in commitments from our private equity backers and management. We announced the formation of Blue Racer that December.

MIDSTREAM: What opportunities do you see in the Utica that may not be available elsewhere?

LAFIELD: Everyone has known where the shale plays are. It was technology that drove the industry to start focusing on them. The Marcellus Shale was one of the first. A lot of midstream infrastructure was required before the basin could be fully delineated and developed.

This is a relationship business. I like to tell the story of a friend who’s a big producer in the Marcellus and the Utica. He called in May 2009 and said, “Jack, if you want to focus on a place that could use your expertise, please come to the Marcellus.”

We took that leap of faith and followed the relationship to West Virginia, and that was our start. The Utica is a similar story. It’s a vast region of new development in an area that needs infrastructure.

What we enjoy—what I enjoy personally—is developing a network of systems, the entire infrastructure, to support the prolific growth of a basin. The Utica is probably the last of that type, in my opinion.

MIDSTREAM: The Northeast shale plays have been called a “game changer” in the oil and gas business. What is Blue Racer’s role in the new game?

LAFIELD: First, the Utica and the Marcellus combined make up the largest shale area in the U.S. They have changed the Northeast from a net importer of natural gas and natural gas liquids to an extensive exporter.

You could say that’s not all bad, because you just reverse the pipelines. But the infrastructure in the Northeast was not set up that way. It was set up to go in and distribute so there was no outbound infrastructure.

The real game changer is that by 2025 some 40% of the U.S. gas supply will be coming out of the Marcellus and Utica shales. That’s based on a 100 Bcf [billion cubic feet] a day market, so at least 40 Bcf a day will be coming out of a region that only three or four years ago analysts were estimating might produce a Bcf or two.

The real game changer is that by 2025 some 40% of the U.S. gas supply will be coming out of the Marcellus and Utica shales. That’s based on a 100 Bcf [billion cubic feet] a day market, so at least 40 Bcf a day will be coming out of a region that only three or four years ago analysts were estimating might produce a Bcf or two.

All the deck chairs need to be rearranged. The pipelines that used to take gas from the Southwest up to Chicago, Detroit, and the industries throughout that region, are now going to be served, in my opinion, by Northeast gas.

Blue Racer’s role is to build out the infrastructure that takes the gas from the wellhead to processing and then fractionation. We’re putting in a major hub system for natural gas supplies that will allow this gas to be able to move freely to multiple markets.

One of our goals with our Ohio system is to make sure our producers have access to all the new regions that the Northeast will serve—from Canada, to the upper Midwest, the Northeast, the Mid-Atlantic and even down into the Gulf Coast with the reversal of pipelines. Our goal is to make sure that our facilities have connectivity to optimize the market realization for our producer customers.

MIDSTREAM: What can Northeast midstream operators do to assure they are competitive with traditional gas and NGL suppliers elsewhere?

LAFIELD: I think the key is to educate ourselves and become very involved with projects that will increase connectivity. Ultimately we have to rethink the value of our customers’ products. This is one of the things we do well at Blue Racer. We are a fee-based business, a service business, so we don’t take title to the products. We believe that our obligation is to ensure that we have connectivity—that we support projects that will bring in new markets.

For example, we signed an agreement with a developing petrochemical facility that we hope will be built in West Virginia. We’re a go-between to help support these kinds of new markets, which again will make the region very competitive with areas that already have a market base.

MIDSTREAM: Blue Racer has a lot invested in its gathering and processing super system. What do you plan to add to that system in your 2015 capex?

LAFIELD: We call 2015 and 2014 our execution years. 2013 and 2014 were spent around commercial development—helping producers delineate their acreage and understand what they had, so we could design systems to help them develop their assets. In 2014, we built additional processing facilities. In 2015, we’ll focus on the needs of the super system.

In 2015, we will complete the expansion of the fractionator at our Natrium [West Virginia] facility, expand our Berne [Ohio] facility and bring our Lewis [Ohio] facility onstream. We plan to expand our interconnects with interstate pipelines to create new markets, to catch up with Sunoco on its Mariner East 2 project so we can start moving product to Marcus Hook at Philadelphia for export.

Really, it’s about continued execution of capital expenditures that we need to get this super system in the right order. We spent $750 million in capex in 2014, we'll probably spend another $750 million in 2015 to put the facilities into shape to allow producers to be able to execute on development programs.

MIDSTREAM: How have the commodity price declines of recent months impacted your business?

LAFIELD: Obviously, it has had an impact. I think you are going to see a lot of producers step back a little.

The good news for us is that for 2015 and the volumes that support our facilities, wells have already been drilled or are being drilled at this point. A drilling slowdown in the area in early 2015 is more likely to affect 2016 volumes. If this is a short-term pricing issue, I think the good news about shale plays like the Utica is that the industry can commercialize very quickly through drilling. You can make up for declines in a shale play on a fast track, and that’s not always possible in a conventional play.

We stay in tune with our producers. It’s something we focus on every day at Blue Racer. We are in very close contact with them on their drilling plans and where are they going to put rigs so we can manage our facilities to meet their needs.

The Natrium complex on the bank of the Ohio River in Marshall County, W.Va., was one of the first gas plants dedicated to Utica Shale production. Blue Racer acquired the facility from Dominion Resources Inc. in 2013.

MIDSTREAM: Capacity constraints have been an issue for the Utica and Marcellus. Are things improving?

LAFIELD: I think the answer to that question is not yet. But we’ll see some great connectivity in the next few years. The Utica Shale is probably less than 5% percent developed, so we have a lot of room to grow. We see close to 20 Bcf of new projects on the horizon. A lot of capacity will be onstream by 2017—all the way from a Canadian connection, to better connectivity to Midwest markets, expansive connectivity in the Northeast and brand-new pipelines. Dominion is building the Atlantic Coast Pipeline down into the Mid-Atlantic, an area that is rapidly developing gas-fired power generation.

MIDSTREAM: The first phase of Mariner East is scheduled be fully operational this year. How will that impact the region’s gas-liquids balance?

LAFIELD: I think the Sunoco projects are the best answer to NGL market needs in the Northeast. We have been supportive of export markets for ethane and other products from day one. I think Sunoco’s done a great job. I think we’re just seeing the tip of the iceberg in terms of the potential that the Marcus Hook-Philadelphia region could have in redeveloping petrochemicals and other industries that can utilize the products from this part of the country.

We are an anchor shipper, in the Mariner East 2 project, and we’ll have connectivity to Mariner East 1. But on Mariner East 2, we are very focused on being able to move product to the international market. We think there is tremendous opportunity for the U.S. economy to be able to utilize our resources to support international development. It’s a great market for the Northeast, and we’ re excited about it.

MIDSTREAM: Do you see a Northeast petrochemical industry developing that will use the plays’ abundant ethane production—as opposed to moving ethane to the Gulf Coast?

LAFIELD: In the five years that we’ve been working in the Northeast, the petrochemical industry’s thought process has gone from, ‘We can bring all this to the Gulf Coast’ to, ‘I don't think that’s going to work.’

We’ve never been a supporter of moving product to the Gulf Coast for a couple of reasons. The main reason is I’ve always felt that development in the other shale plays—Eagle Ford, West Texas and even up into Oklahoma—and the connectivity of those plays to existing infrastructure along the Gulf Coast would provide ample supply for the existing petrochemical industry on the Gulf Coast. We would always be the tail of the donkey and always receive lower pricing.

I’ve always believed that the Northeast needed to look closer to home. Caiman I was the first midstream company to enter into an agreement with NOVA Chemicals to move ethane through Mariner West up to Sarnia [Ontario] in Canada. We thought it was necessary to support the petrochemical industry at least that far away—but not all the way to the Gulf Coast.

Now we’re looking at Shell and we’re looking at Braskem. Both companies are focused on large, state-of-the-art petrochemical facilities. Hopefully one or both will be built. Some of our producers have signed agreements to supply them.

MIDSTREAM: Dominion has work underway on the Cove Point LNG export project. Will Cove Point have a direct impact on your business?

LAFIELD: We’re excited for Dominion. It’s a project they’ve been very focused on. It’s a key development asset in their portfolio. It’s one of many projects coming out of the Marcellus and Utica and it will be a little over 1 Bcf per day. Our connectivity with Dominion will offer the opportunity for our customers to tie in on a contractual basis. Though it may not be a direct impact, it will add to the growing portfolio of opportunities that our customers can benefit from.

MIDSTREAM: The energy industry has encountered opposition in developing the Appalachian plays. How can it do a better job of getting a good-neighbor message out?

LAFIELD: The industry has always encountered opposition. When I was at my prior employer, we were one of the initial midstream developers in the Barnett Shale. Here we were in Texas and we still got a lot of opposition.

The Appalachian area isn’t any different. I think the industry always needs to be very focused on being a good neighbor. I think we’re seeing a lot of that now. Maybe the difference in Texas, Louisiana, Oklahoma and the Appalachian area is that the industry was already well entrenched in the Southwest when the shale plays came along. The industry supported communities and oil and gas companies had employees that lived in the areas where they were working. So you had some deep, localized roots.

The communities in the Appalachians have a history of oil and gas but not at this level of development—not even close. It’s a huge change, and an issue early on was a lot of Southwest people moved up there to manage the early stages of development in the upstream as well as the midstream.

I think what you are finding today is local people are stepping in. There are employment opportunities and upstream and midstream companies like Blue Racer are very supportive of local charities and local training programs.

MIDSTREAM: Where does the Utica go from here? What changes do you see in the next five to 10 years?

LAFIELD: I think the Utica goes up and to the right. Again, I think only about 5% is developed so far. There’s a lot of technology that’s still being developed. I always say that all shales are the same in that they are all different—and that includes the Utica. It has its own characteristics and so it requires some different technology. We’re in the early phases of technology adjustments; we’re in the early phases of drilling; and we’re in the early phases of midstream buildout to support development. I see $10 billion to $20 billion of new upstream and midstream facilities being built in the next 10 years. I see easily 10 Bcf to 15 Bcf a day coming out of the Utica Shale over the next 10 years. Probably half of that will be rich gas and the other half lean gas. Very prolific wells are being developed on the lean side.

Blue Racer’s management team is focused on the long term. We’re making long-term plans for our facilities and our employees. Blue Racer is in the Northeast to stay. We will self-finance, grow and expand to be one of the major service providers in the Utica.

Paul Hart can be reached at pdhart@hartenergy.com or 713-260-6427.

Recommended Reading

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.

Chevron’s Tengiz Oil Field Operations Start Up in Kazakhstan

2024-04-25 - The final phase of Chevron’s project will produce about 260,000 bbl/d.

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.